Key Points:

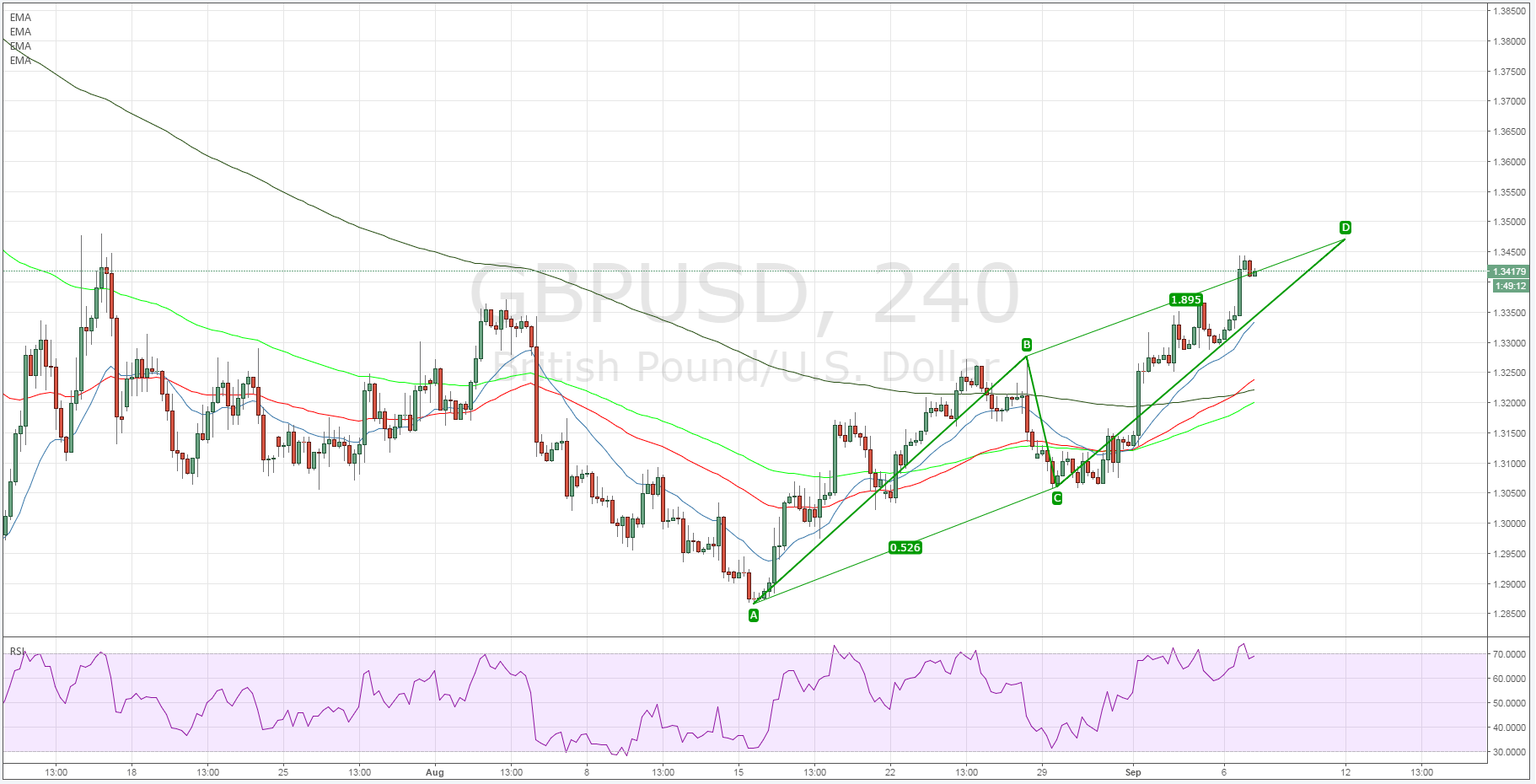

- ABCD pattern nearing completion.

- Downside risks remain in place.

- Cable likely to reverse around 1.3468

The cable has been relatively buoyant over the past 24 hours as currency markets have reacted to the surprisingly weak US ISM Non-Manufacturing PMI figures. Subsequently, the pair’s price action has risen steadily above the 1.34 handle but the pending completion of an ABCD pattern is likely to dominate proceedings over the coming days.

Taking a look at the 4-hour chart shows the ABCD pattern relatively clearly with the “A” leg having commenced in the middle of August. If the pattern is true to form then the completion of the final leg would take prices to around the 1.3468 mark which is a relatively strong reversal zone given the placement of highs from early July. Additionally, the RSI Oscillator is also nearing overbought territory, on the 4-hour time frame, and lends further credence to the idea that the cable requires a corrective move lower.

However, price action will still need to reach the key price reversal zone around the 1.3468 mark to complete the “D” leg before the pair starts to move concertedly to the downside. In fact, price action is still bullishly above the 100MA whilst all of the other moving average time frames also trend higher. Subsequently, traders should expect the cable to continue moving higher until it nears the PRZ.

From a fundamental perspective, the US dollar has experienced a broadly negative sentiment swing over the past week that has clearly benefitted the cable. However, Friday is likely to bring some fundamental reversals as US Federal Reserve member Kaplan is due to speak.

It’s almost a given that he will attempt to reset the markets expectations of a rate hike and this could have a very real impact on the cable’s near term trend. Subsequently, don’t be surprised if you see the USD resurging in strength late in the week as various Fed members attempt to jawbone the market.

Ultimately, any failure to breach resistance around the reversal zone is likely to lead to a sharp retracement as price action seeks to move back towards the 1.32 handle. Subsequently, keep a close watch on the shorter timeframes as we near this level, as when the move comes it will be relatively swift indeed.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.