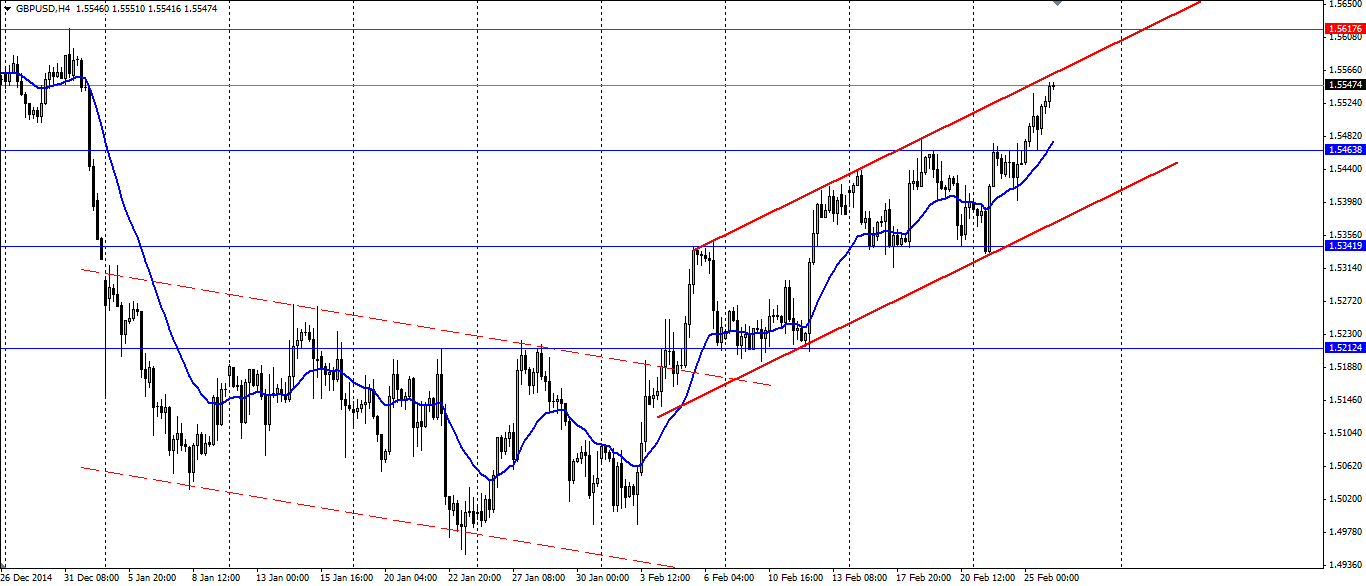

The cable has begun to turn bullish in recent weeks and the formation of a bullish channel could provide traders a technical setup to take advantage of it.

Source: Blackwell Trader

The cable, as the GBP/USD pair is known as, has turned a corner and is now following a bullish channel upwards. The Fundamentals haven’t changed too much, but the prospect of a cut in interest rates is very unlikely at this stage. Furthermore the Bank of England has remained committed to raising interest rates by early next year.

There is some news to watch out for tonight that could provide a bit of volatility for the cable. First preliminary UK GDP figures are due and are expected to hold steady at 0.5% q/q. I would not be surprised if we see it come in to the upside, given the low energy prices in the UK likely fuelling a bit of extra consumption. US CPI figures are due later on tonight with core CPI expected to tick up from 0.0% to 0.1% m/m. Anything higher would push the cable towards the bottom of the channel.

The channel on the above H4 charts is not too aggressive, suggesting it is more stable and could have a solid bit of momentum behind it. The price is close to the top and we could see a rejection off the top which could provide a short term short entry for anyone game enough.

A less risky trade would be to wait for a touch along the bottom of the channel and enter on the rejection. This could coincide with the resistance turned support at 1.5463 and would be a with-trend trade. Further support is found at 1.5341 and 1.5212. An upside continuation of the trend will look for resistance at 1.5617, 1.5749 and 1.5831.