Interest rates were predictably held at 0.5% once again by the Bank of England last week. The economic data was mixed with some weak manufacturing production figures, but a lift in the GDP estimate will give the BoE confidence. The result however, is the cable pushing lower out of the wedge which could see a bear trend form.

Manufacturing Production was the big miss of the week as it came in well short of the 0.1% the market was expecting at -0.6% m/m. This was followed shortly by the NIESR GDP Estimate that returned a solid 0.7% q/q, up from last month's 0.6% but it was not enough to halt the slide in the cable as it slipped out of the rising wedge.

Interest rates were once again held at 0.5% which came as no surprise with inflation remaining low. The BoE is in the enviable position of having relatively strong growth with low inflation meaning there is no pressure on them to raise rates. They bank did warn that inflation is expected to pick up towards the end of the year so we could see talk of rate hikes then.

Looking ahead and this week will be one the BoE pays close attention to with inflation figures due on Tuesday. CPI is expected to remain at 0.1%, but any uptick will benefit the pound. Unemployment figures due this week will give the market more clarity on the state of the economy and could shape interest rate expectations.

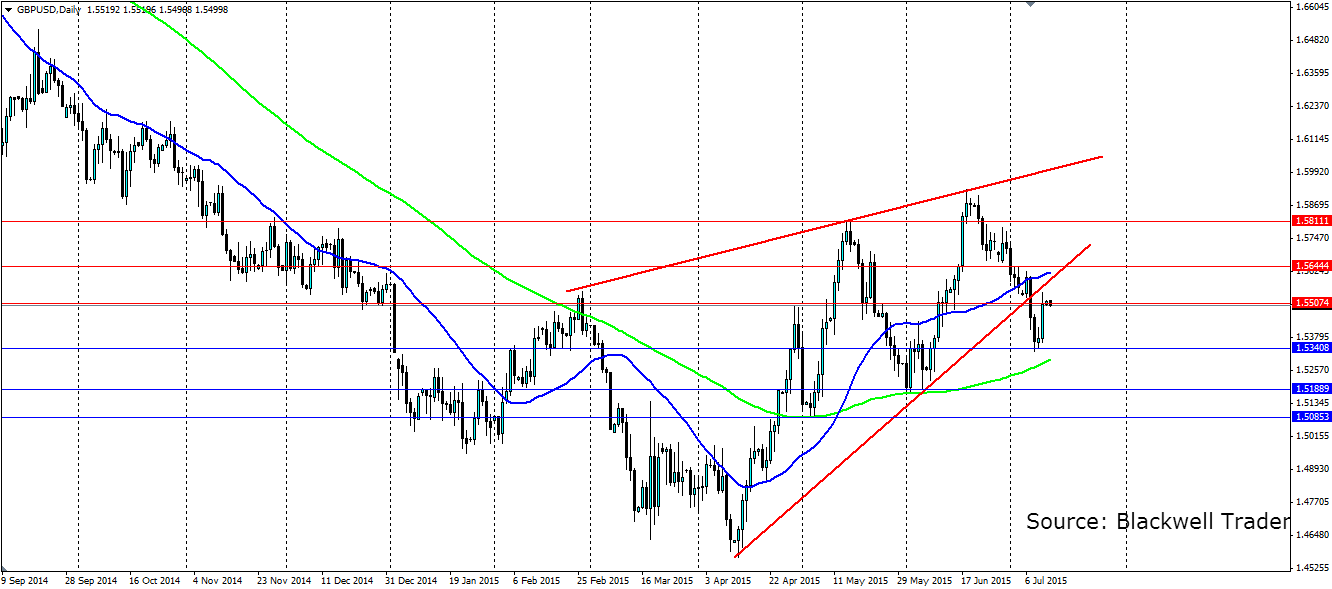

The cable has broken out lower of the rising wedge which is likely to see a continuation of the bearish trend line for earlier this year. The bottom of the shape has already acted as resistance so we are likely to see a strong bearish leg form this week.

Static resistance is found at 1.5507, 1.5644 and 1.5811 while support is found at 1.5340, 1.5188 and 1.5085. Be wary of the dynamic support the 100 day MA will provide which may coincide with the most recent swing low.