Key Points:

- Bank of England likely to cut between 25bps.

- Shock to consumer confidence evident.

- Corrective structure calling for rally but watch for fundamentals.

Last week was positive for the cable as it managed to finish the week above the 1.32 handle but still largely remained in a sideways consolidation phase. Initially, the pair received a boost from a rise in the UK Advance GDP to 0.6% q/q, however, the GfK Consumer Sentiment figures spoiled the party coming in below estimates at -12.0.

Ultimately, this was largely offset by the disappointing US GDP figures and the pair finished the week on a positive note. Looking ahead, monitor the UK Services PMI and the BoE’s rate decision as there is a likelihood of volatility.

Reviewing the pair’s performance from the past week, the cable had a fairly quiet week as its sideways consolidation pattern continued to dominate proceedings. Despite the consolidation pattern, the pair managed to amble its way higher to close the week around 80 pips higher as the weaker greenback sentiment buoyed the currency.

However, the rise was not without some shocks as the UK Gfk Consumer Sentiment data proved dire, coming in at -12.0 (-1.0 prev). This result largely offset the surprising uptick in the UK Advance GDP to 0.6% q/q (0.5% exp).

The week ahead is likely to see plenty of volatility for the pair as both the UK Services PMI and Bank of England’s decision on interest rates fall due. In particular, the Bank of England meeting is likely to provide plenty of interesting fodder for traders as they are largely expected to cut the bank rate 25bps to 0.25%.

In fact, given the sharp drop in consumer sentiment, an expansionary cut to rates is all but assured as the central bank is likely to want to get out in front of any deteriorating conditions. Subsequently, there is a sharp likelihood of volatility and we could see some fairly strong swings from a fundamental perspective.

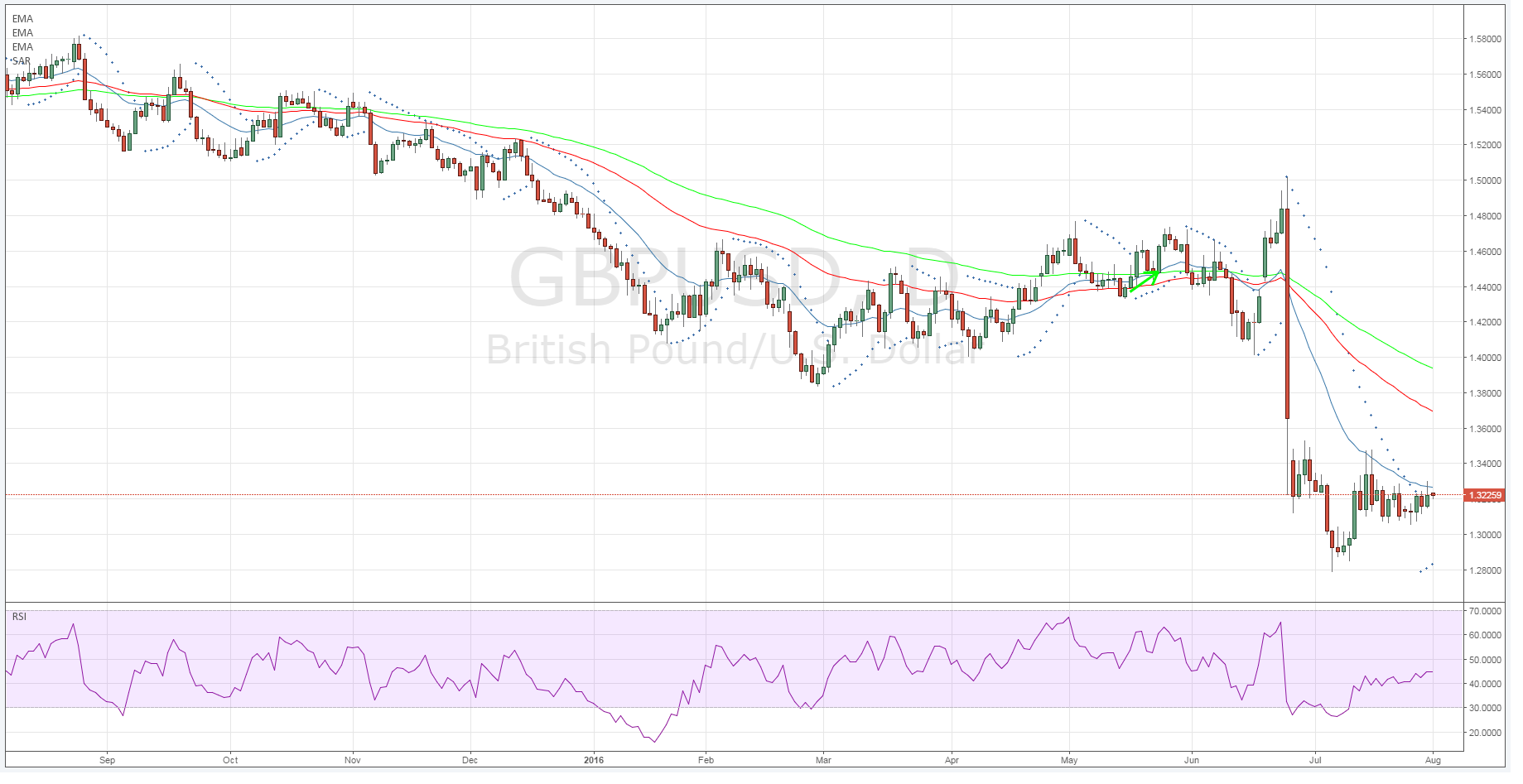

From a technical perspective, the pair’s consolidation and recovery over the past week has predisposed it to the upside and made it clear that the corrective recovery from the 1.28 handle is ongoing.

However, the upside is likely to be limited above 1.3480 and there is also the risk of some sharp fundamental moves following the BoE’s decision on interest rates. Subsequently, given the uncertainty, our bias remains neutral for the week ahead. Support is currently in place for the pair at 1.3047, and 1.2794. Resistance exists on the upside at 1.3480.

Ultimately, monetary policy is likely to drive the currency in the coming days given the strong likelihood of a decisive rate cut from the Bank of England. Subsequently, be very careful taking a long technical view on the pair given the risk of a rate cut causing a sharp depreciation to below the 1.32 handle.