Key Points:

- Cable remains under a bearish cloud.

- UK GDP result likely to be closely watched.

- Failure of 1.25 handle could signal further bearishness ahead.

The Cable initially started last week on a positive note following a list in the UK’s CPI to 1.2% y/y. However, this sentiment was quickly reversed as volatility ahead of the FOMC’s decision to hike rates proved pervasive. Subsequently, the Cable trended steadily lower throughout most of last week in response to the US rate hike and the stronger US labour data to close around the 1.2480 mark. The week ahead will likely focus on the UK GDP and Current Account figures, which are due out on Thursday.

Last week was fairly busy for the Cable as the pair faced rate hike decisions from both the Bank of England and the US Federal Reserve. The pair initially started the week on a positive note when the UK CPI figures exceeded expectations and rose to 1.2% y/y.

However, the positive sentiment quickly turned around ahead of the Fed’s decision to hike rates 25bps to 0.50%. This sent the pair reeling and overshadowed some stronger UK macroeconomic data as well as the BOE’s decision to keep rates steady at 0.25%. Subsequently, the Cable never really had an opportunity to rally and closed the week well down around the 1.2480 mark.

Looking ahead, it’s likely to be a relatively busy week for the Cable, given that the UK GDP and Current Account figures are due for release on Thursday. The Final GDP figures are forecast to remain around the 0.5% q/q mark but watch for any variability in their release. Additionally, the US Core Durable Goods Orders and Unemployment Claims data could also have an impact on price action if they exceed their forecasts of 0.2%, and 258k, respectively. Ultimately, the market will be relying upon the UK GDP results to provide the pair with a much needed fundamental boost.

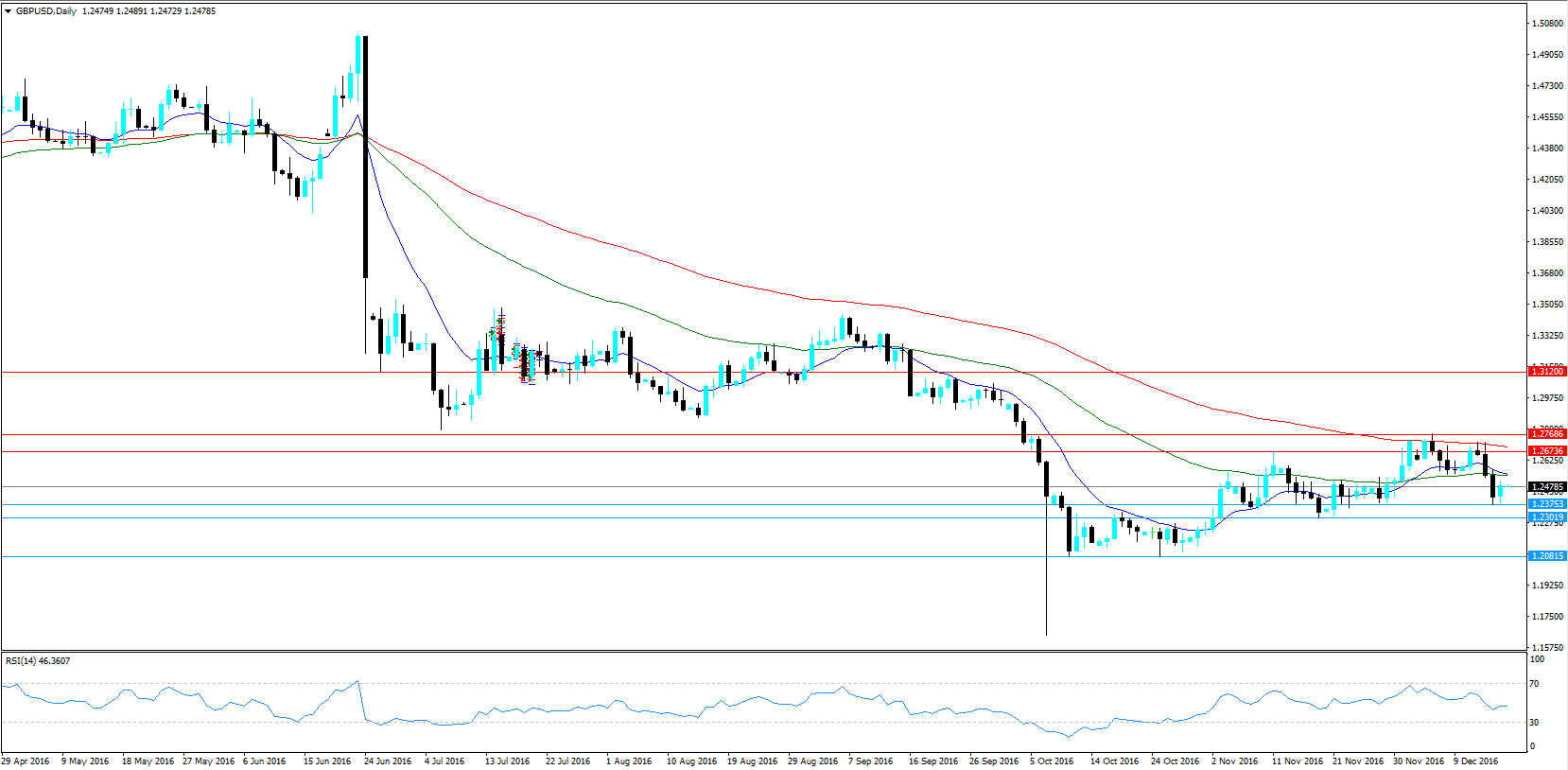

From a technical perspective, the pair’s outlook remains relatively bearish given that the key 1.25 handle was recently lost. In addition, price action has declined strongly below the 12 and 50 EMA’s which suggests that the downside play towards support at 1.2301 remains intact. Subsequently, we expect the selling to continue in the week ahead, whilst the RSI Oscillator remains above oversold. Support is currently in place for the pair at 1.2375, 1.2301, and 1.2081. Resistance exists on the upside at 1.2673, 1.2768, and 1.3120.

Ultimately, Friday’s intra-day rally may have provided some relief for the bulls but the reality is that the bearish bias remains. The coming week will therefore be relatively critical for the pair, given the thin liquidity environment in the lead up to Christmas holidays. Subsequently, watch for the pair to continue falling below the 1.24 handle as this could signal a fairly rapid decline prior to the holiday period.