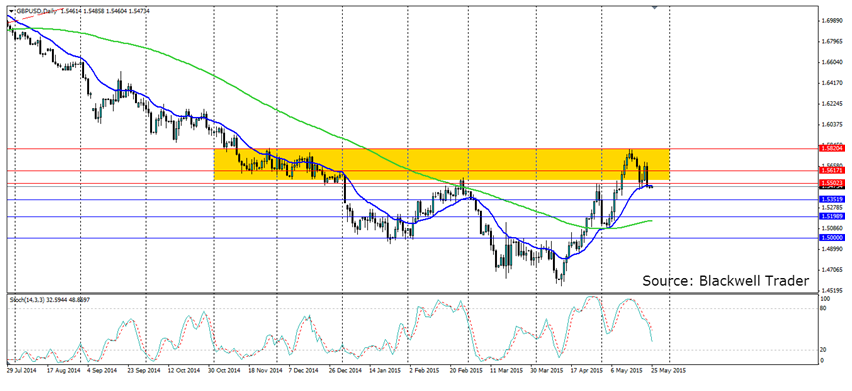

The GBP/USD was extremely volatile last week thanks to some mixed data out of the UK, combined with bullish US dollar sentiment. 200+ pip swings were the norm as UK CPI disappointed, but Retail Sales surged ahead two days later. The liquidity zone certainly played its hand in leading the pound lower, and that could continue thanks to some failed support.

The cable was much more volatile than many had expected with the dollar bullish bias of the market making any moves higher a tough ask. UK CPI dipped to -0.1% y/y which led to the first aggressive swing lower, but that was halted as Core Retail Sales jumped up by 1.2% m/m.

The US Core CPI ticking higher led to the second aggressive swing downwards as the market was gagging for anything dollar bullish. Fed Chair Janet Yellen added to the dollar's resurgence by saying the Fed remains committed to raising interest rates this year.

The calendar for the week ahead is not exactly brimming with events on the UK side. CBI Realised Sales, Consumer Confidence and Preliminary GDP are the standout items. The US side is certainly busier and will likely provide direction.

Technicals point to a bearish week ahead for the Cable with a lower high meaning the bears are winning as they push the pair out of the liquidity zone. The pair has broken under support levels and the 20 EMA which puts the 100 day MA is sight.

The Stochastic Oscillator is looking extremely bearish and the markets insatiable appetite for dollar buying will likely dominate. Resistance is found at 1.5502, 1.5617 and 1.5820 while support is found at 1.5351, 1.5198 and 1.5000.