The fundamentals have not been as kind to the cable at the end of last week as many had hoped and that led to a big fall. The technicals show a large consolidating pennant shape that could see a strong breakout.

The pound opened last week on the front foot as the bullish sentiment continued from the previous week on comments from the Bank of England hinting as a possible rate rise. That sentiment was reversed when retail sales missed estimates of 0.4% to come in at -0.2%. The BoE is unlikely to raise rates while consumption is in a weakening cycle.

GDP is the standout feature of the economic calendar for the pound in the coming week. The market is forecasting a solid 0.7% q/q which would be a strong result and could see last week's losses regained. The US FOMC will likely add volatility to the market, especially if they talk up a rate rise in September. Also keep an eye on US Durable Goods and Consumer Confidence figures as they could shift the cable.

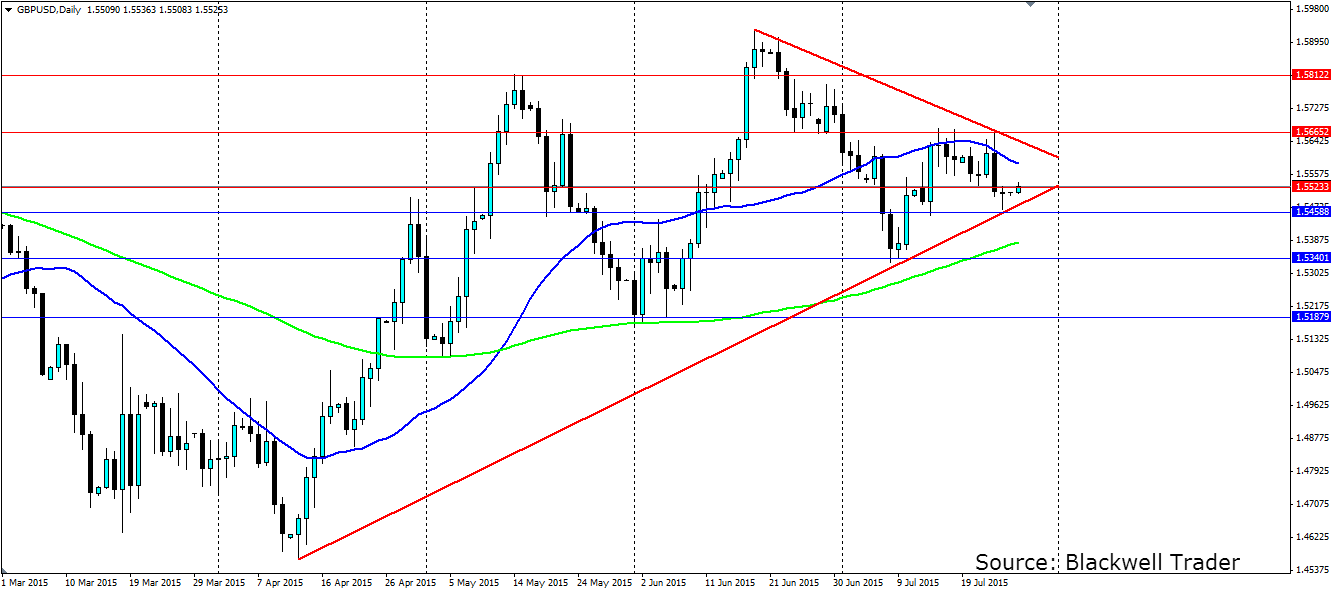

On the charts the cable has been consolidating in a pennant flag pattern that is likely to continue for the next few days. A bearish trend line formed from the lower high, and a bullish trend line formed from several higher swing lows are converging on each other with the pound stuck in between. Interestingly the two MAs (20 and 100 day) on the chart are also adding to the consolidation pressure which will keep the cable in check before a large breakout shifts the pair.

If we see a bullish breakout, which is the likely scenario given the overall bullish sentiment, we could very well see the recent highs near the 1.6000 handle tested. Conversely, a bearish break will likely seek out the 1.5187 lows as a target. Either way a breakout is set to be a large one given the size of the structure. Support is found at 1.5458, 1.5340 and 1.5187 with the bullish trend line also providing dynamic support. Resistance is found at 1.5523, 1.5665 and 1.5812 with the bearish trend acting as dynamic resistance.