GBP/USD: Cable edges lower from highs; Overall bullish structure remains

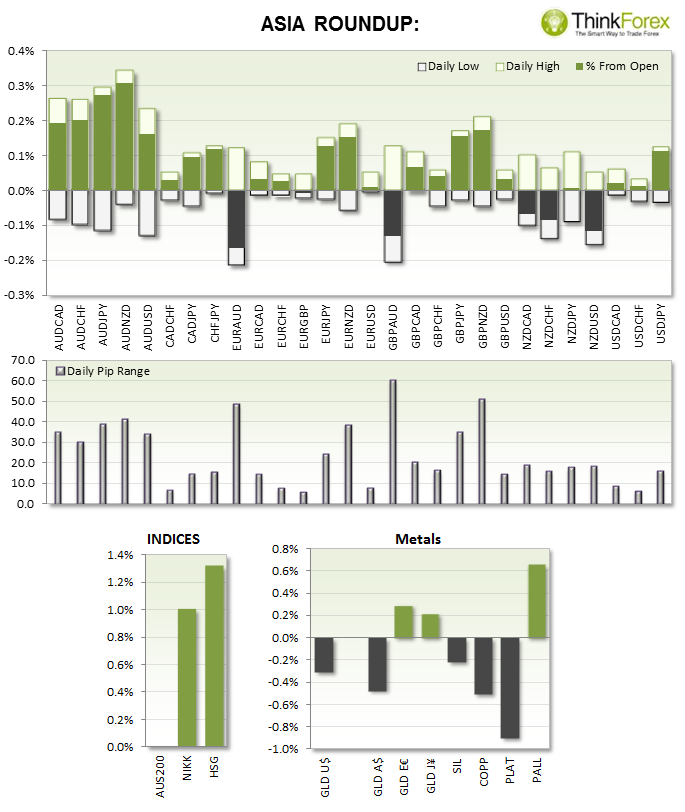

- JPY government sees FY14 economic growth of 1.2%, down from 1.4% projected earlier.

- CNY leading Index m/m is nearly double the previous month, at +1.3% vs +0.7% in June, making it the highest anticipated rate of growth this year.

- RBA Glenn Stevens said in a speech today it is impossible to judge if QE was worked. AUDUSD gained due to the lack of jawboning, spiking up to 0.9394

- Russian Ambassador tells Malaysia that Rebels are not behind the downing of flight M17; It is too soon to tell who was responsible for the crash; Rebels do not possess any defence air systems capable of hitting on elevation at 10,000m; Ukrainians do possess these kind of systems

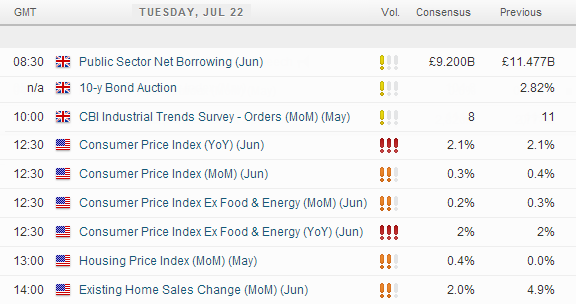

UP NEXT:

The US provides headline figures tonight with CPI y/y. Positive numbers should see the greenback (DXY) remain above 80.50 support and bring downward pressure on AUD/USD, GBP/USD and EUR/USD. However with USD remaining above 1.07 it may provide decent long opportunities up towards 1.080 resistance

TECHNICAL ANALYSIS:

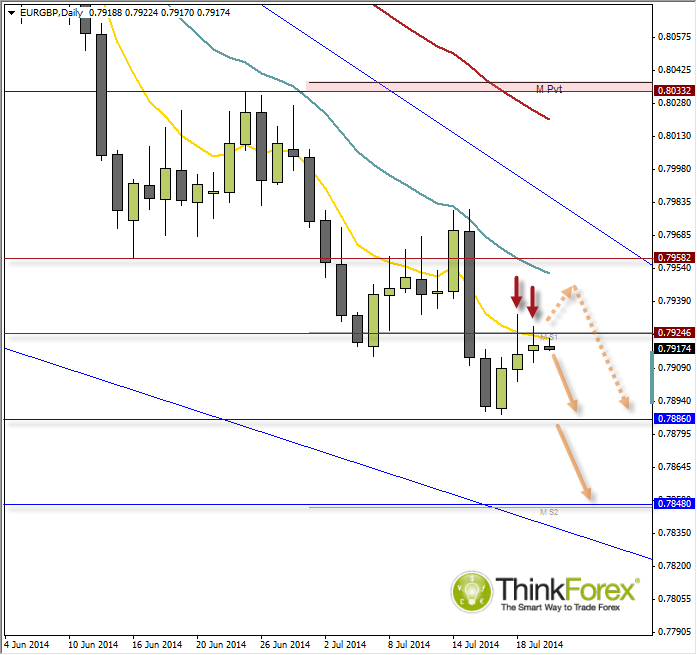

EUR/GBP: Setting up for a swing trade short?

To continue from yesterday's analysis we have now produced an 'inside' candle which is also a spinning top, below resistance. The fact it has respected resistance and failed to take out the high of the Shooting Star adds extra confidence we may be aligning up for anther leg down.

GBP/CHF: Seeking buy setups above 1.53

There is potential for a double bottom to form and target the 1.54 swing highs. I have highlighted 2 key candles which have respected support levels on relatively high volume, to suggest buyers propping up price above support.

The more significant clue of the two is the 2nd candle, as it is the highest volume candle since price rejected 1.53 and the open and close are at the same level (bullish pinbar) to suggest a 'change in hands' during the decline.

We may see a retracement back within the green buy zone, but overall the bullish bias remains as long as we remain above 1.53.

With Swiss Trade balance tonight, a poor number should help GBPCHF bullish bias along the way.