Overnight the Bank of England voted 1-0-8 (increase-decrease-hold) as expected and kept interest rates on hold at 0.5%.

Taking a wait-and--see approach was the preferred option as the bank lowered its estimate for the UK’s economic growth in the third quarter of this year from 0.7% down to 0.6%.

Of the Monetary Policy Committee, once again only Ian McCafferty voted for an increase in rates with some key quotes from the Monetary Policy Statement below:

Global developments do not as yet appear sufficient to alter materially the central outlook described in the August Report, but the greater downside risks to the global environment merit close monitoring for any impact on domestic economic activity.”

“All members agree that, given the likely persistence of the headwinds weighing on the economy, when Bank Rate does begin to rise, it is expected to do so more gradually and to a lower level than in recent cycles.

It looks as though the Bank of England is still on track o raise rates but they are still in no rush to do so. Like many other central banks who are taking this approach, a September hike would have been nice to get their own balls rolling but nobody is holding their breath.

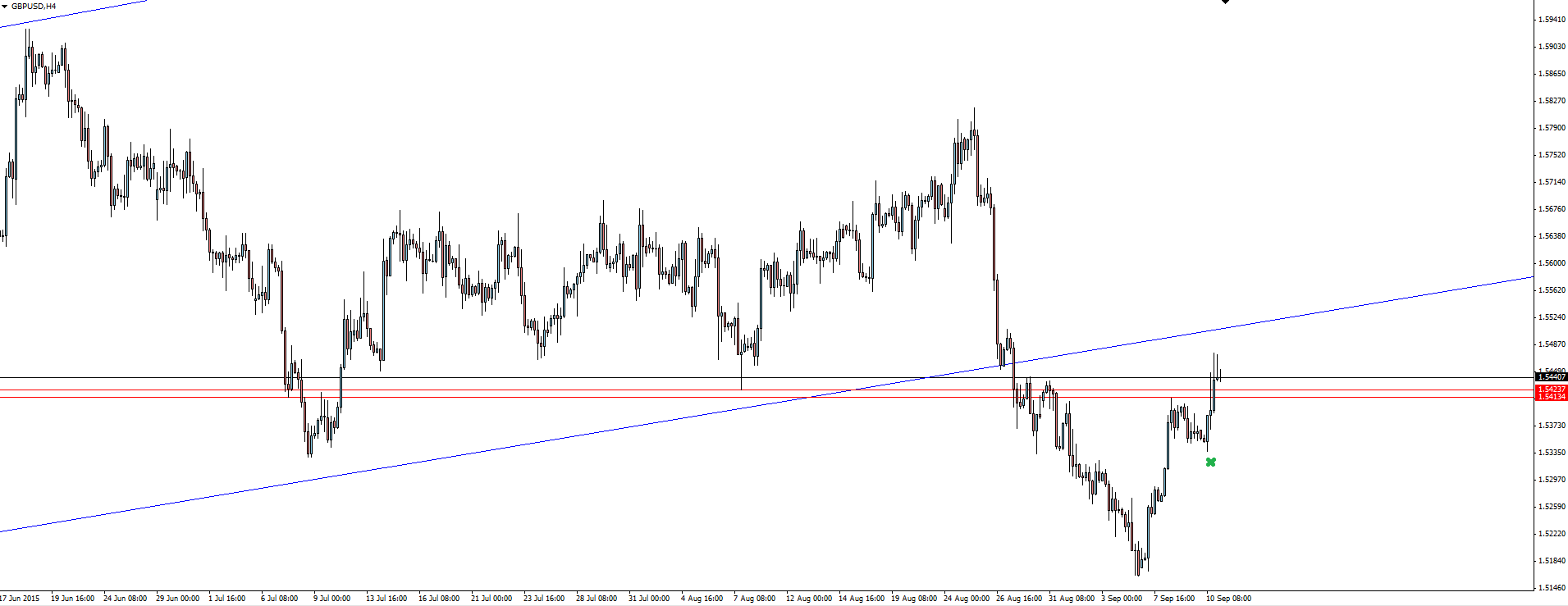

Cable got a nice pop out of the BoE vote, pushing through the short term resistance level we spoke about yesterday.

It’s a tough one, because the statement was as dovish as expected and price will need momentum to clear the remaining upcoming resistance levels that now come into play. I still see less risk in playing from the short side.

On the Calendar Friday:

USD PPI m/m

USD Prelim UoM Consumer Sentiment

Chart of the Day:

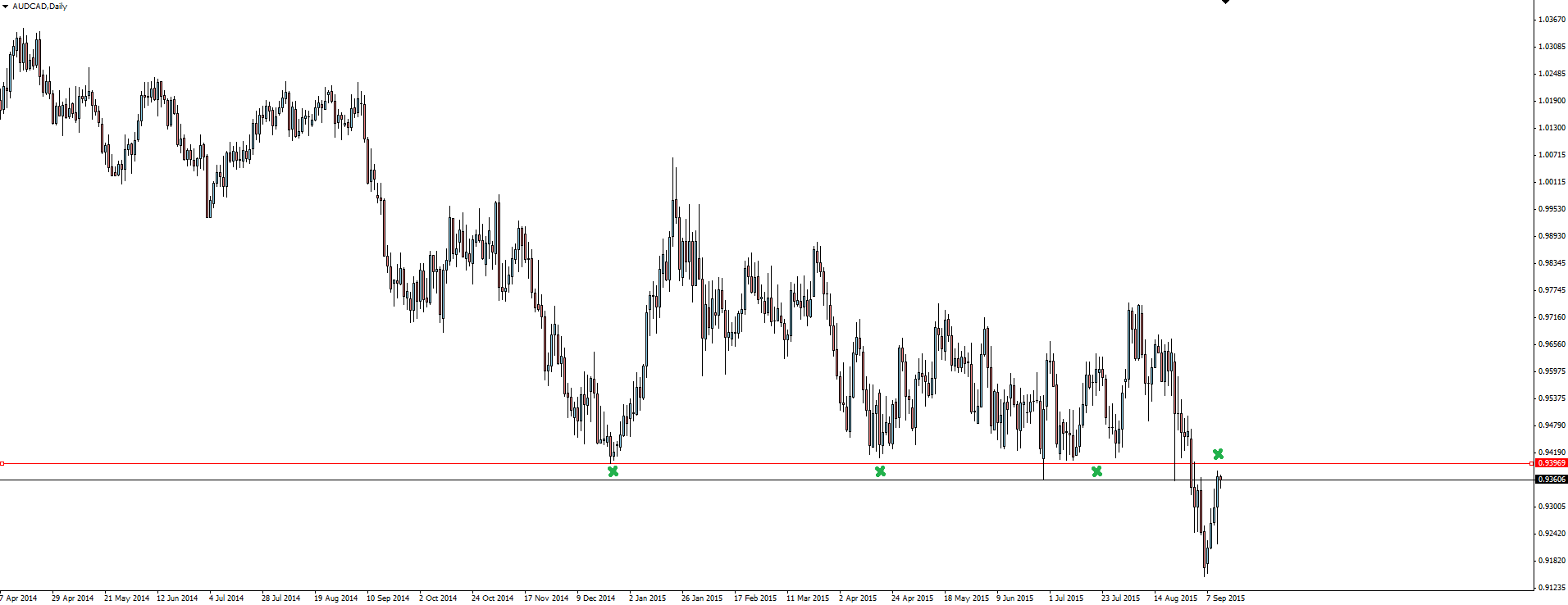

On the back of yesterday’s better than expected Australian employment print, AUD/CAD sits in an interesting position.

“AUD Employment Change (17.4K v 5.2K expected).”

I’ve highlighted a daily break of support as price gradually stepped down longer term. However, on the back of the better than expected Australian unemployment data yesterday, the pair has found some buyers and price has pushed back to re-test the previously broken support level as possible resistance.

The price action in the crosses are a bit of a double edged sword. On one hand you get big moves out of them, but on the other, the technicals are never as clean as the more liquid majors.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our Forex trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this Australian Forex broker report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.