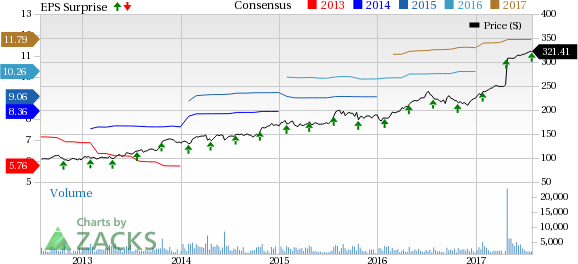

Murray Hill, NJ-based C.R. Bard Inc. (NYSE:BCR) reported adjusted earnings of $2.92 in the second quarter of 2017, exceeding the Zacks Consensus Estimate of $2.84. Adjusted earnings also improved from $2.56 in the year-ago period.

Net sales during the second quarter increased from $931.5 million on a year-over-year basis to $979.7 million. The figure was also better than the Zacks Consensus Estimate of $977.0 million. Excluding the impact of foreign exchange, net sales improved 6% on a year-over-year basis.

C.R. Bard to Get Acquired

On Apr 23, Becton, Dickinson and Company (BDX), a leading global medical technology company, announced that it will acquire C.R. Bard for $24 billion ($317 per C.R. Bard’s common share in cash and stock). The agreement is expected to close in the fourth quarter of 2017.

We believe that the development will provide benefits of medication management and infection prevention to C.R. Bard customers and bolster its foothold in the global medical devices market. In this regard, C.R. Bard registered more than 500 products internationally in full-year 2016.

Quarter Highlights

U.S. net sales rose 4% year over year to $660.2 million. International sales increased 7% to $319.5 million.

Without foreign exchange headwinds, second-quarter 2017 net sales outside the U.S. rose 11% on a year-over-year basis.

Segment Details

Vascular product: Sales at this segment increased 9% year over year (up 10% at cc) to $277.6 million.

Urology: Sales increased 1% on a year-over-year basis (up 2% at cc) to $241.3 million in the urology segment.

Oncology: Sales at this segment were up 6% (up 7% at cc) year over year to $266.5 million.

Surgical Specialties: Sales were up 6% (up 7% at cc) year over year to $169.7 million.

Sales from other product lines increased 6% on a year-over-year basis at cc to almost $24.6 million.

Guidance

For fiscal 2017, adjusted earnings per share (after adjusting for amortization of intangibles) are projected between $11.70 and $11.90. This represents year over year growth in the range of 14% to 16%.

C.R. Bard expects net sales growth of 5% to 6% on a reported basis. Excluding the impact of foreign exchange, net sales are projected to increase between 6% and 7% from the prior year.

Key Picks

Currently, C.R. Bard carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical sector are Edwards Lifesciences Corporation (NYSE:EW) , CryoLife, Inc. (NYSE:CRY) and Fresenius Medical Care Corporation (NYSE:FMS) . Notably, Fresenius Medical Care sports a Zacks Rank #1 (Strong Buy), while Edwards Lifesciences and CryoLife have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Fresenius Medical Care represents an impressive return of 4.3% over the last one year. The company delivered a solid earnings surprise of 20.5% in the last reported quarter.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. Notably, the stock has a one-year return of 2.3%.

CryoLife yielded a strong return of 35.8% over the last one year. The stock delivered a positive earnings surprise of 20% in the last-reported quarter.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Fresenius Medical Care Corporation (FMS): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

CryoLife, Inc. (CRY): Free Stock Analysis Report

C.R. Bard, Inc. (BCR): Free Stock Analysis Report

Original post