Well, folks, since the NASDAQ Invesco QQQ Trust (NASDAQ:QQQ) moved about one-tenth of a single percentage point, the amount of stuff there is to talk about isn’t much greater than it was on, let’s say, Sunday.

Things barely moved at all yesterday (grateful as I am that it was red across the board, albeit barely). So I’ll just share some key ETFs and a few thoughts on each.

Starting with the iShares MSCI EAFE ETF (NYSE:EFA) (worldwide equities, except for North America) we see a picture-perfect gap fill and a price push precisely to the underside of a broken major trendline. This is super clean!

iShares MSCI Brazil ETF (NYSE:EWZ) seems to have warn itself out, and any further weakness in oil stocks is sure to get this thing falling fast.

It finally sunk in a few weeks ago that gold and related instruments is just a drag to trade, so I stopped bothering. Good thing, too. All the overhead supply and messy price action have led, once again, to a total sputtering out of the miners.

On Monday, I did a post of all the high-yield debt funds that had zoomed higher. It looks like the unwind has begun, as we see here with the high yield ETF—iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG).

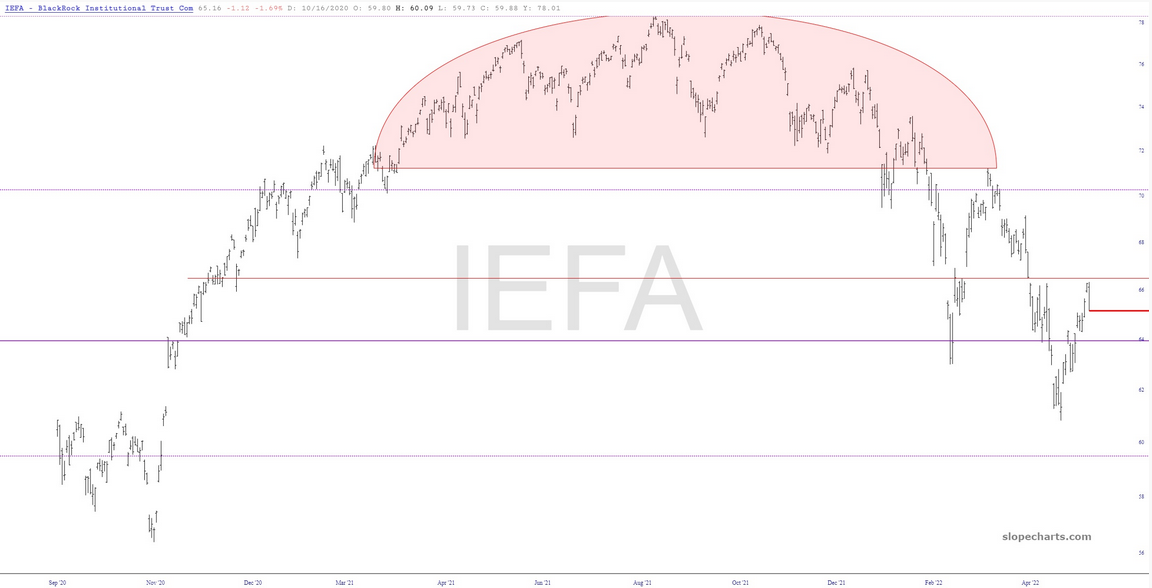

Harkening back to the EFA example at the top, here is iShares Core MSCI EAFE ETF (NYSE:IEFA) which is sporting a very clean stop and a steady series of lower lows and lower highs.

Our own favorite real estate fund—iShares U.S. Real Estate ETF (NYSE:IYR)—is just as pretty as can be. The analog is still intact, and the topping pattern we’ve got right now is vastly better-looking than the one which preceded the COVID crash.

The tech stocks, by way of the QQQ, likewise have a gorgeous topping pattern.

Finally, energy was quite interesting on Tuesday. It started off strong (like it’s been for YEARS at this point), notching yet another lifetime high on Energy Select Sector SPDR® Fund (NYSE:XLE) and a multi-year high on SPDR® S&P Oil & Gas Exploration & Production ETF (NYSE:XOP).

It then starting wheezing when oil gave up most of its daily gains, and both XLE and XOP ended the day down relatively hard. XOP is extremely precariously positioned vis-à-vis its wedge.

I am presently at 34 bearish positions. I am still far from comfortable with the market, even after yesterday’s negative close, but all the retracements remain solidly intact for a prospective hard down-move.