Greetings from the CalTrain station in bucolic Palo Alto, California. I thought I’d have a change of venue to type up my end-of-day post, and although a video would have been a lot easier, I’m going to not to be lazy this time.

There’s not a whole hell of a lot to say about a market that goes up every single day. There are only so many instances of, “wow, this market is sure going up a lot lately” that one can utter. One item I’m rather impatiently watching is the EUR/USD, which is configured for a nice tumble, but so far refuses to do so.

One thing is clear, however. Whatever speech Bernanke has prepared for 10:00 EST tomorrow is going to be a market-mover, and an instantaneous one. There’s not much point in watching any quotes between now and then, because what comes out of those beard-shrouded lips is going to make or break things. EUR/USD" title="EUR/USD" width="568" height="635">

EUR/USD" title="EUR/USD" width="568" height="635">

If you want evidence as to how insane this market has become, think back to the old maxim about how, in the final stages of a bull run, even horrible shit floats to the top. Fannie Mae, the poster child of the financial crisis, offers a superb example of this. Just amazing:

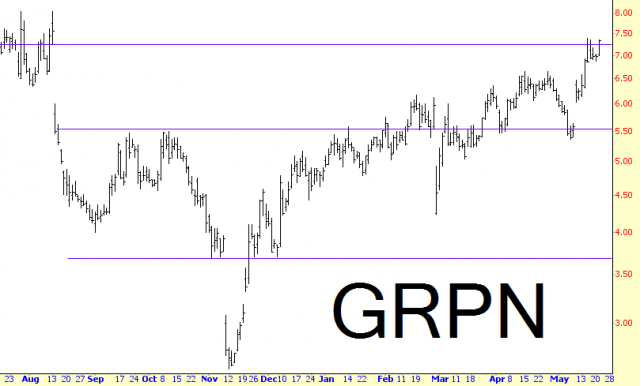

Of course, there are still good buying opportunities. I am about to choke on my tongue to offer this one, but honestly, Groupon looks like a really clean breakout pattern on the long side.

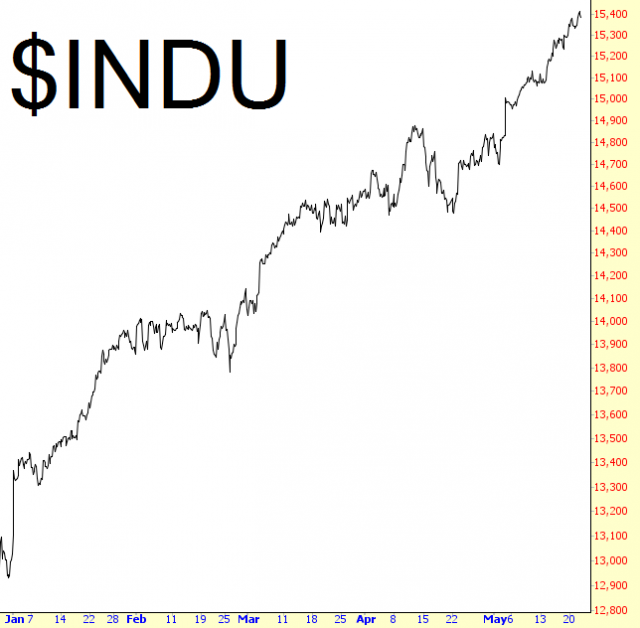

This upward-run has reminded me of the old tale of the frog being boiled to death slowly in a pot of water; the heat goes up just a tiny little bit every day, but one by one, the bears have been boiled to death without feeling the pain instantly or acutely. The Dow 30 captures this nicely, with a three-freaking-thousand point increase in a mere six months. Disgusting.

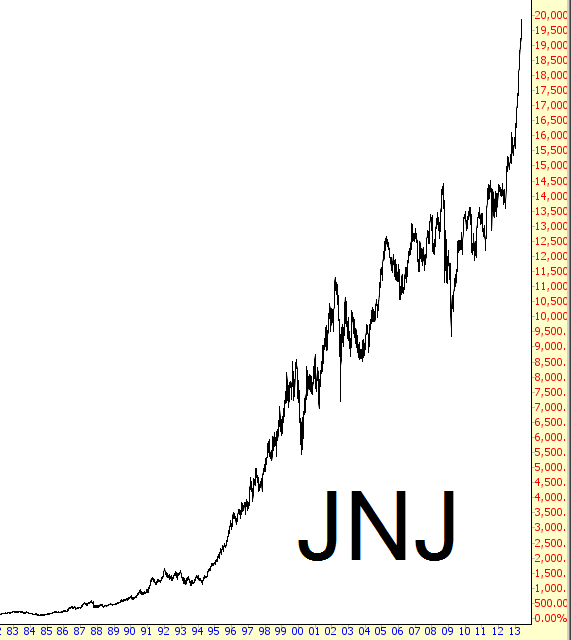

And, just to drive the nausea home, take a good at red-hot Internet startup Johnson & Johnson, which is making huge breakthroughs in 3-D printing, social blogging technologies, solar panels, electric-powered sports cars, and Martian colony infrastructure. Oh, wait, sorry, that’s not right. They make fucking baby shampoo. And they’re up twenty THOUSAND percent.

Do I sound bitter? Yeah, I probably do. Anyway…

Just about the only index that hasn’t had its trendlines gang-raped is the Russell 2000, on which I am short by way of the IWM. It has crossed into quadruple-digit territory, and, ironically, Bernanke is pretty much our only hope of reversing this beast (which, if he does so, may well be accentuated by the Fed Minutes, also coming out Wednesday).

I will bid you a fond farewell at this point as I turn my energy to other matters. Good night, and thank you, as always, for being part of Slope!

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Buying Opportunities In An Upwards Market

Published 05/22/2013, 12:42 AM

Updated 07/09/2023, 06:31 AM

Buying Opportunities In An Upwards Market

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.