Stocks continued to show nice strength as we get deeper into earnings season.

They just look, and act great!

We have a healthy sized group of top callers everyday which is what we need.

It’s when everybody says we will go higher that I’ll get worried.

As for the metals, the pre-Chinese New Year buying has dried up and we are seeing weakness set in now.

I’m not saying we will crash, but a nice couple month of building a bottom would be fine.

Gold lost just 1.37% this week but it’s pretty apparent that the pre-Chinese New Year buying is now done.

Support sits at $1,180, $1,160 and $1,120.

Silver rose 0.61% on the week thanks to Friday’s impressive and counter-gold movement.

I don’t think silver will move higher here even with Fridays strength, doubly so if gold continues to act poorly.

Platinum gained a pathetic 0.75% in the face of weakness this past week.

Looks to me like platinum is going nowhere fast for the time being.

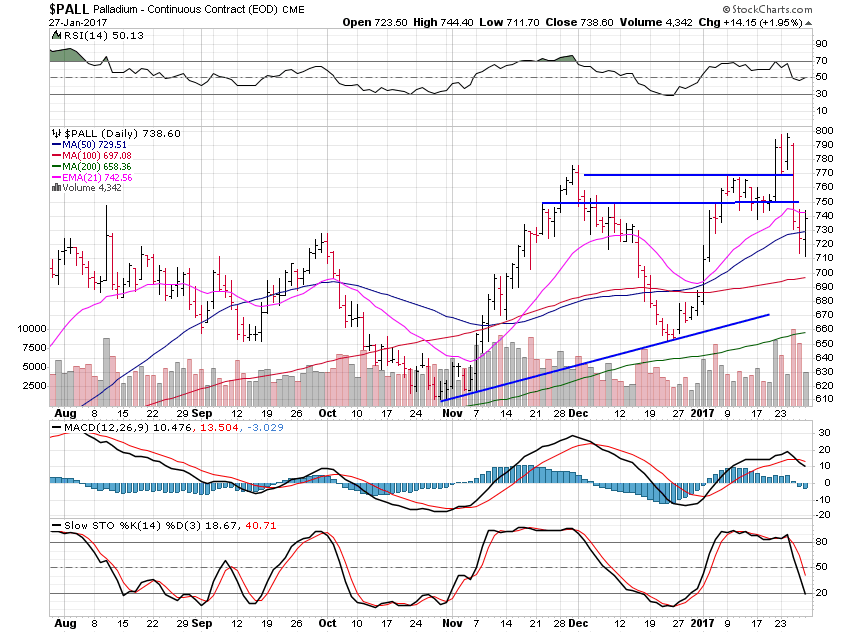

Palladium lost a hefty 6.32% this past week, but did have a strong Friday.

The action is wide, loose and sloppy on this chart and that is not the type of action I like to trade.

That’s it for this very short letter as my laptop is about to die, I forgot my charger, and the ski slopes are calling!