What a summer its been.

I’ve taken many weekends off and booked it out of town to enjoy it while it’s here.

Stocks ended last week on a strong note and are looking to move higher anytime at all now while metals tested and held support areas and are now turning higher.

Mining stocks are really turning up quickly and should continue to be strong for a few years as we remain in the very early stages of this metals bull market.

Buy the dips!

Gold gained only 0.06% this past week but is starting to move higher nicely again now.

The wide box between $1,310 and $1,375 is still in play and this pattern is good for higher prices into years end.

Metals tend to be strong in the last quarter when they are in a bull market.

Silver gained 3.31% on the week and is also turning nicely higher.

A move above the $19.50 level can be a buy point with $20 then $20.50 resistance to watch above.

All in all, silver continues to act fine.

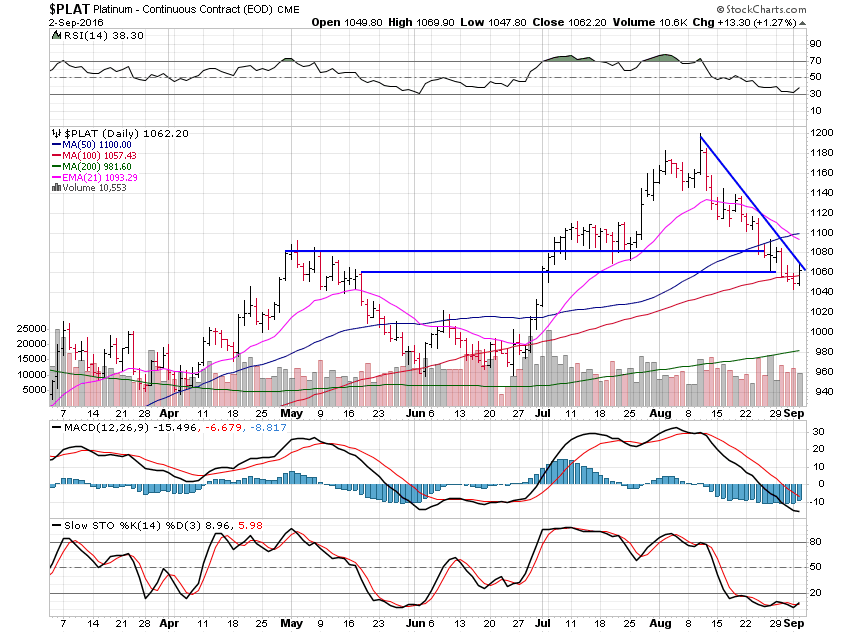

Platinum lost 1.44% but held the 100 day moving average and is now turning up well.

After a massive move from $980 to $1,200 some retracement and rest is certainly due and that looks to be now over for platinum.

I’d look at the $1,080 level as a buy point now.

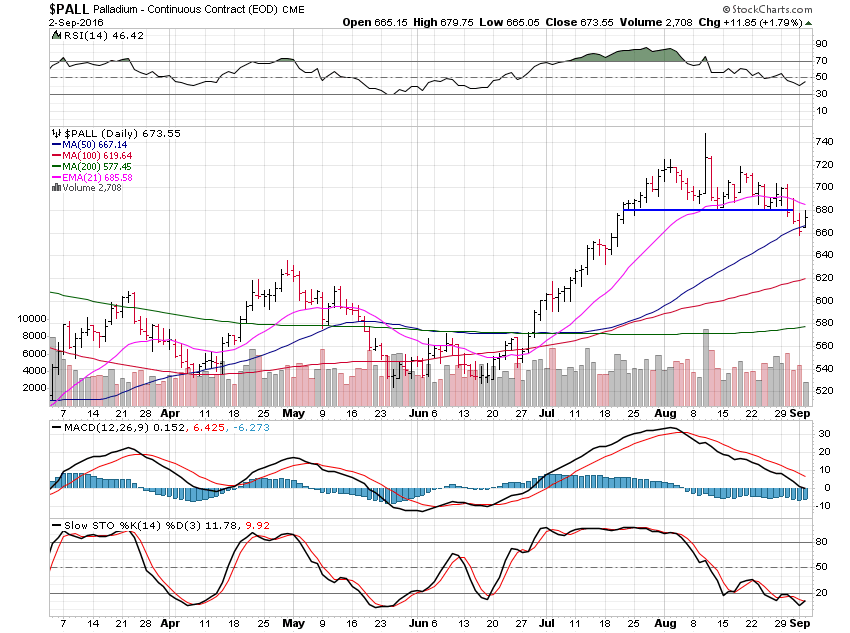

Palladium fell 2.91% over the last week but held the 50 day moving average and is now turning higher.

The $680 level is now the buy area to watch.