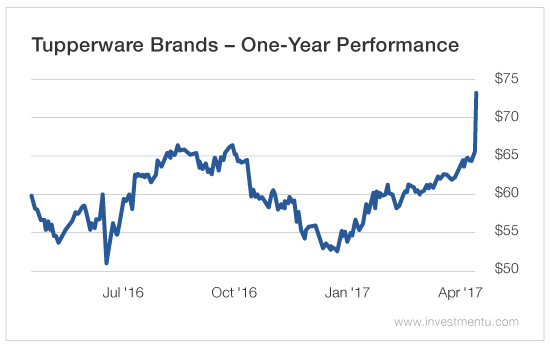

Tupperware Brands (NYSE:TUP) is a midcap company that operates within the household durables industry. Its market cap is $4 billion today and the total one-year return is 31.76% for shareholders.

Tupperware Brands stock is beating the market, but does that make it a good buy today? To answer this question we've turned to the Investment U Stock Grader. Our research team built this system to diagnose the financial health of a company.

Our system looks at six key metrics...

(EPS) Growth: Tupperware Brands reported a recent EPS growth rate of 9.3%. That's below the household durables industry average of 82.43%. That's not a good sign. We like to see companies that have higher earnings growth.

Price-to-Earnings (P/E): The average price-to-earnings ratio of the household durables industry is 44.04. And Tupperware Brands’ ratio comes in at 17.49. It's trading at a better value than many of its competitors.

Debt-to-Equity : The debt-to-equity ratio for Tupperware Brands stock is 334.54. That's above the household durables industry average of 46.4. That's not a good sign. Tupperware Brands’ debt levels should be lower.

Free Cash Flow per Share Growth : Tupperware Brands’ FCF has been higher than its competitors over the last year. That's good for investors. In general, if a company is growing its FCF, it will be able to pay down debt, buy back stock, pay out more in dividends and/or invest money back into the business to help boost growth. It's one of our most important fundamental factors.

Profit Margins

Profit Margins

Profit margin is another metric that is very useful when comparing companies in the same industry. Profit margin is calculated by taking net income and dividing it by sales (revenue). While EPS is a crucial metric, it doesn’t cover the whole picture. That’s why we also like to look at profit margins. Sure, EPS could be growing, but profit margins could be decreasing. For example, sales could be up, but costs could have increased at a higher rate. This means costs need to be controlled better by management.

The profit margin of Tupperware Brands comes in at 8.54% today. And generally, the higher, the better. We also like to see this margin above that of its competitors. Tupperware Brands’ profit margin is below the household durables average of 8.86%. So that's a negative indicator for investors.

Return on Equity : Return on equity tells us how much profit a company produces with the money shareholders invest. The ROE for Tupperware Brands is 119.64%, and that's above its industry average ROE of 18.06%.

Tupperware Brands stock passes three of our six key metrics today. That's why our Investment U Stock Grader rates it as a hold.