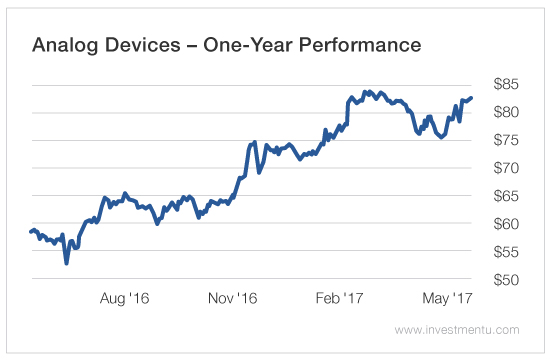

Analog Devices (NASDAQ:ADI) is a large cap company that operates within the semiconductor industry. Its market cap is $31 billion today, and the total one-year return is 43.97% for shareholders.

Analog Devices stock is beating the market, and it reports earnings next week. But does that make it a good buy today? To answer this question, we've turned to the Investment U Stock Grader. Our Research Team built this system to diagnose the financial health of a company.

✗ Earnings-per-Share (EPS) Growth: Analog Devices reported a recent EPS growth rate of 32.08%. That's below the semiconductor industry average of 56.31%. That's not a good sign. We like to see companies with higher earnings growth.

✓ Price-to-Earnings (P/E): The average price-to-earnings ratio of the semiconductor industry is 47.44. And Analog Devices' ratio comes in at 24.8. It's trading at a better value than many of its competitors.

✗ Debt-to-Equity : The debt-to-equity ratio for Analog Devices stock is 71.71%. That's above the semiconductor industry average of 54%. That's not a good sign. Analog Devices' debt levels should be lower.

✗ Free Cash Flow per Share Growth : Analog Devices' FCF has been lower than that of its competitors over the last year. That's not good for investors. In general, if a company is growing its FCF, it will be able to pay down debt, buy back stock, pay out more in dividends and/or invest money back into the business to help boost growth. It's one of our most important fundamental factors.

✓ Profit Margins : The profit margin of Analog Devices comes in at 22.06% today. And generally, the higher, the better. We also like to see this margin above that of its competitors. Analog Devices' profit margin is above the semiconductor average of 11.43%. So that's a positive indicator for investors.

✓ Return on Equity : Return on equity tells us how much profit a company produces with the money shareholders invest. The ROE for Analog Devices is 17.75%, and that's above its industry average ROE of 13.71%.

Analog Devices stock passes three of our six key metrics today. That's why our Investment U Stock Grader rates it as a Hold.