Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Dow stocks Cisco Systems, Inc. (NASDAQ:NASDAQ:CSCO) and Microsoft Corporation (NASDAQ:NASDAQ:MSFT) have enjoyed steady climbs up the charts in 2018. However, the ride could be far from over, with both stocks recently flashing potential "buy" signals.

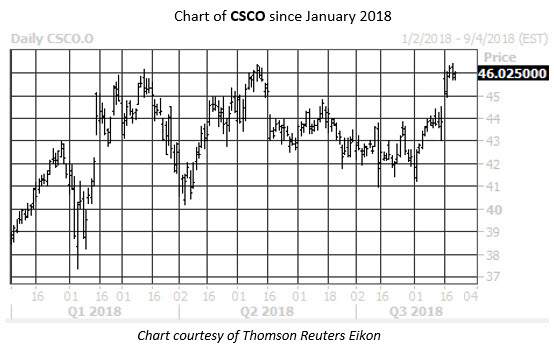

Cisco Stock Poised To Extend Weekly Winning Streak

At last check, Cisco stock is up 0.4% today at $46.02, and just yesterday nabbed an 17-year high of $46.43. Overall, the equity added 20% in 2018, and is on track for its sixth straight weekly win.

In addition, CSCO's Schaeffer's Volatility Index (SVI) -- a measure of front-month, at-the-money implied volatility (ATM IV) -- currently stands at just 16%. This SVI arrives in the 8th percentile of its annual range, indicating that speculative players have priced in lower volatility expectations just 8% of the time in the past year.

This combination of a high stock price and low IV has had bullish implications for CSCO in the past, according to Schaeffer's Senior Quantitative Analyst Rocky White. Since 2008, there have been five occasions where CSCO has been trading within 2% of its annual high while at the same time its SVI was in the 20th annual percentile or lower. Following those signals, the security was up 4.1% one month later, on average, and was higher all five times.

What's more, the equity has consistently rewarded premium buyers over the past year. This is per the stock's Schaeffer's Volatility Scorecard (SVS), which is currently docked at an elevated 87 out of 100. This suggests that Cisco stock has regularly made larger-than-expected moves on the charts, compared to what its options were pricing in.

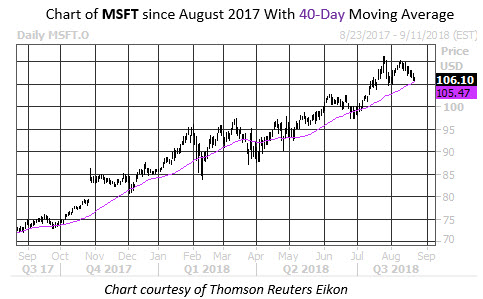

MSFT Skid Could Have Bullish Implications

Looking at Microsoft, the stock is up 0.1% today at $106.10, on track to snap a five-day skid. That losing streak put MSFT shares within one standard deviation of their 40-day moving average, a trendline with bullish implications in the past. Specifically, after the last 14 similar pullbacks, Microsoft stock went on to rally an average of 3.37% in the subsequent month, per data from White, and was positive 79% of the time. A move of similar proportions would have MSFT closing in on its late-July record high of $111.15.

In the options pits, puts have become more popular recently. Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows MSFT with a 10-day put/call volume ratio of 0.60, which ranks in the elevated 80th percentile of its annual range. This means that although calls have outnumbered puts on an absolute basis, the lofty percentile rank indicates puts have been purchased relative to calls at a faster-than-usual clip during the past two weeks -- though some of this could be the result of shareholders initiating an options hedge.

Whatever the motive, it's a prime time to purchase premium on Microsoft options. The equity's SVI of 17% ranks in the 13th percentile of its annual range, indicating low volatility expectations are being priced into its short-term options.