Last year, the slowdown in China and the subsequent crash in commodity prices had left miners in a lurch. Miners saw millions being wiped out and, in the wake of falling demand, the only key to stay afloat was to control costs. Saddled with debt, they had to sell off underperforming assets.

This year, the mining industry seems to be on a better footing, having staged a comeback. A weakening greenback, slowdown in China, volatile equity markets and introduction of negative interest rates by several of the world’s central banks (including Japan) have spurred safe-haven demand for precious metals like gold and silver. The uncertainty, both before and after Brexit, has fuelled the prices. Overall, the bullion has gained 23% in the first half of the year while silver has clocked an enviable 34% gain over the same time frame. Both are currently trading at 2-year highs.

Iron ore prices have also been on an upward trajectory, touching $70 a ton in April, its highest since Jan 2015. The surge was triggered by the “big three” producers - BHP Billiton (LON:BLT) Ltd. (NYSE:BHP) , Rio Tinto (LON:RIO) plc (NYSE:RIO) , and Vale S.A. (NYSE:VALE) trimming their full-year iron production guidance. In addition, fresh stimulus measures introduced by the Chinese government to boost steel production, which implies a revival in the country’s property construction sector, led to the upswing.

Through the first half of this year, copper prices have also gained 5%. Copper prices gained in March and again in May on the back of huge jump in imports in China, the top consumer. Lately, Brexit fears also helped support prices.

What Does the Crystal Ball Forecast?

Gold prices will be supported by seasonal retail demand in the latter part of the year, from India and China. Moreover, pent-up demand due to the shutdown of jewelry stores in India in the first quarter will likely be a catalyst this year. Silver will also gain from increased demand in industrial applications as well as in jewelry. With rising safe-haven demand and dwindling supplies, gold and silver prices are set for further gains.

Demand for copper will remain strong, supported by its widespread use in transportation, manufacturing and construction, limited supplies from existing mines, and the absence of new significant development projects.

In the U.S., an improving job market and a strong housing sector will lead to 3.2% growth in steel demand this year. Thus, iron ore prices will ride on the back of increased demand. While much hope is pinned on India as the next growth engine, a recovery in the Chinese economy will help revive the overall industry.

A recent report revealed that the U.S. economy expanded a meager 1.1%, one of the weakest performances in the past several years. Further, the imbroglio over Brexit will likely keep the Federal Reserve off the interest-rate trigger for now. This in turn is a boon for precious metals.

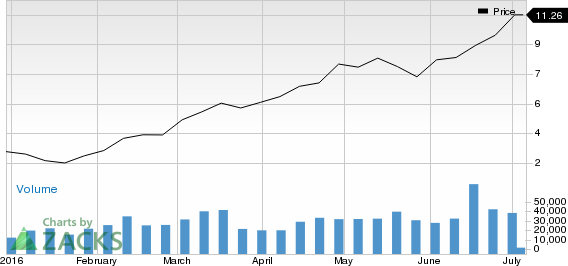

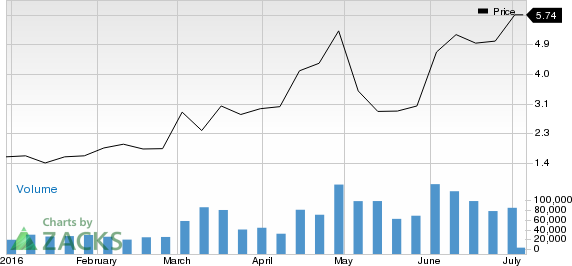

Thus, a collusion of factors has prepared the ground for mining stocks to win back the favor of investors after disappointing last year. It would be a prudent move to zero in on some stocks that have fared well this year and exhibit all signs of healthy prospects.

5 Mining Stocks on a Rally

We have selected five stocks with a Zacks Rank #1 (Strong Buy) or #2 (Buy). These stocks have rallied considerably in 2016 so far. Further, these stocks have undergone positive estimate revisions, reflecting strong growth prospects. With their safe-haven appeal, it would be prudent to add these stocks to your portfolio now.

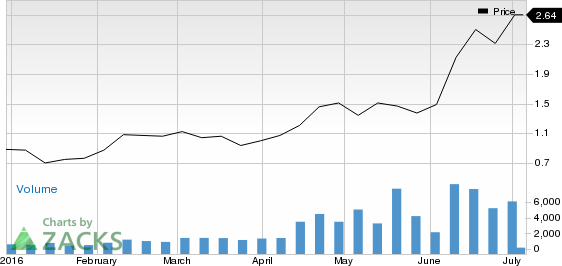

Avino Silver & Gold Mines Ltd. (NYSE:ASM)

Vancouver, Canada-based Avino Silver & Gold Mines Ltd. engages in the production and sale of silver, gold, and copper bulk concentrates; and the exploration, evaluation, and acquisition of mineral properties. The company owns 42 mineral claims and leases 4 mineral claims in the state of Durango, Mexico.

AVINO SILVER&GD Price

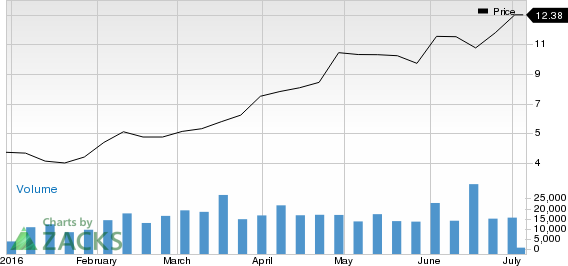

Compania de Minas Buenaventura S.A.A. (NYSE:BVN)

Headquartered in Lima, Peru, Compañía de Minas Buenaventura engages in the exploration, mining, and processing of gold, silver, lead, zinc, and copper metals in Peru.

BUENAVENTUR-ADR Price

VALE SA (VALE): Free Stock Analysis Report

BHP BILLITN LTD (BHP): Free Stock Analysis Report

BUENAVENTUR-ADR (BVN): Free Stock Analysis Report

COEUR MINING (CDE): Free Stock Analysis Report

RIO TINTO-ADR (RIO): Free Stock Analysis Report

AVINO SILVER&GD (ASM): Free Stock Analysis Report

MAG SILVER CORP (MAG): Free Stock Analysis Report

Original post

Zacks Investment Research