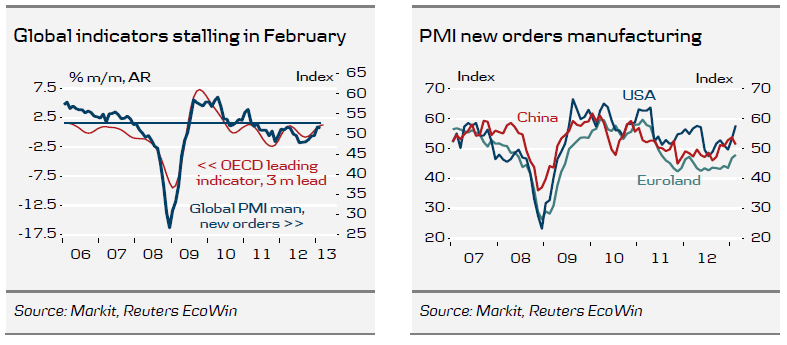

Global PMI

new orders fell slightly from January to February from 51.8 to 51.5. We expect global new orders to remain at this level for some time.

In the US, Manufacturing ISM did better than expected, as it increased for the third month in a row to the highest level since June 2011. It indicates that the US manufacturing sector got off to a good start in 2013 as worries about fiscal uncertainty declined and inventories were low going into the new year. Capex orders rose strongly in January.

Manufacturing new orders PMI in the Euro Area climbed a bit higher again to 47.9. While still at recession level, this suggests the recession is easing a bit. Germany was the main driver of the rise, as PMI new orders rose significantly. Also, the ifo and ZEW expectations both climbed to higher levels. Scandinavian data continue to be relatively soft and the outlook does not point to any substantial changes. However, Sweden is the exception, as PMI continued to rise in February.

In China, PMI fell but the Chinese New Year, which occurred in February seems to be the main explanation for the fall. The Japanese rebound goes on, as production grows and inventories are on their way down. In CEE, PMI new orders increased for all countries expect Hungary.

To Read the Entire Report Please Click on the pdf File Below.