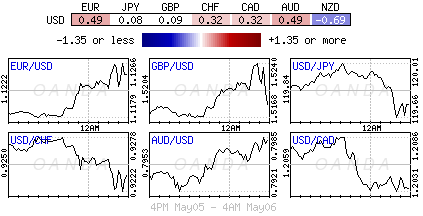

Currently, there are a lot of moving parts in capital markets that are keeping investors on their toes. If it’s not exploding sovereign bond yields or new yearly high crude prices, then it’s the dollar that’s causing dealers and investors most of the pain. Speculators are trying to pick tops and bottoms pre-NFP, but most of their newly minted positions have become quickly over stretched and only compounding some of the market price moves.

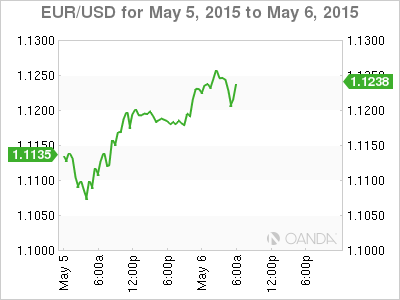

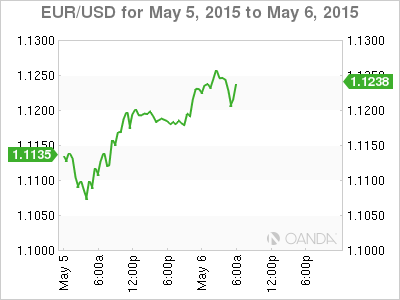

The EUR (€1.1219) is being led by moves in longer dated bonds. The German Bund continues to sell off rapidly. The 10-Year yield is currently at +0.58% – it’s highest since before the ECB in January announced its intention to launch QE. Two-week’s ago German 10’s hit an all time low of +0.05%, spurring predictions of zero or even negative yields on Europe’s benchmark bond. The market call for the “greatest short of a lifetime” ignited the spike in bond yields, and a massive bear steepening of the German curve.

No Relief in Spreads

The back up in Bunds has caused the 10-year US/Bund spread to tighten -19bps to +165bps over the past week. Currently, the market is technically straddling its March low print and a momentum break through +160bp should spur only more EUR/USD buying, exposing the vulnerable short EUR positions in front of the psychological €1.1300 print. The EUR bear will be hoping that German 10’s yielding +0.58% will hold, otherwise much more significant losses can be expected to the +0.70% region or even +0.81% on cash.

This morning’s euro data is also providing the single unit some support. Major European Services PMI are improving (54.1 – Spain, Italy, France and euro zone all beat expectations and remain in growth territory; while Germany missed but stays in growth territory). The region seems to be finally emerging from its long period of near stagnation, aided by lower oil prices, a weakening EUR and strengthened confidence following the ECB launch of its QE program in March.

U.S Fundamentals producing mixed results

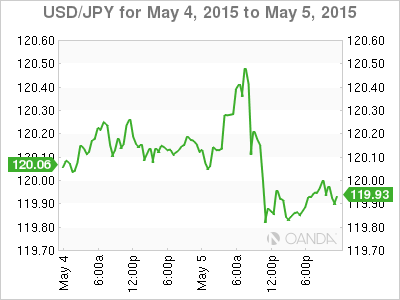

The U.S Treasury bond selloff really reignited yesterday and this despite disappointing U.S trade data. The headline print was distorted by the west coast ports strike. The trade deficit rose +43% y/y to +$51.5B in March (a six-month high), reflecting a surge of imports that followed the settlement of the port dispute. Exports edged up +0.9% to $187.8B, but imports leaped a record +7.7% to $239.2B. Nevertheless, the dollar has taken the bulk of the pain, trading under pressure against G7 currencies, as the trade numbers were viewed as being less favorable than those used to calculate advance U.S Q1 GDP. The market now expects Q1 GDP to be revised down, even a potential drop into negative territory. This is allowing the market to bet on a Fed lower for longer, which is undercutting the long USD trade premise.

The ISM service reading (57.8) was unmistakably positive, with strong showings in the new orders and employment components. Maybe this morning U.S ADP nonfarm employment change (+199k e) will give the dollar a lift? If not, Friday’s highly anticipated NFP report is sure to cause some one way or another. A strong report (+223k and +5.4%) will satisfy dollar bulls and have fixed income traders repricing the Fed’s first-rate hike. A similar print to last months disappointing headline (+126k +5.5%) and dollar naysayers will have control.

U.K economy: ‘Eggs all in one basket’

U.K’s Prime Minister Cameron is getting very few breaks. Just one day ahead of the U.K’s general election, the Conservatives continue to champion economic growth as a key achievement of their government. Data this morning confirms that the story of the U.K recovery continues to be limited to services (80% of the economy). Today’s services PMI print (59.5) recorded an eight-month high in activity, soundly beating manufacturing and construction. April’s GDP figures suggested that the U.K economy continues to remain overreliant on services sector for economic growth.

Even before today’s PMI print the pound (£1.5180) has been struggling to attract friends ahead of tomorrows opening polls. Sterling’s price action this morning is putting support at £1.5120 at risk that guards Tuesday’s bear trap low at £1.5091. The GBP bear’s believe that a breach of this week’s low will open the doors to a new downside risk to £1.4840 very quickly. On the EUR/GBP cross a new ten-week high has been already been achieved 0.7416.

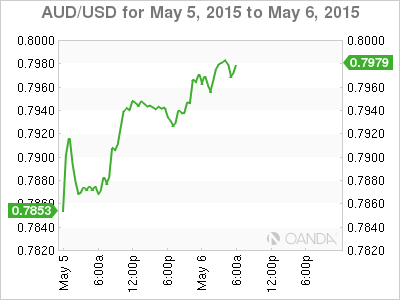

Commodity currencies supported by crude

Aussie, loonie and NOK continue to be supported by the recent surge in crude prices. WTI crude is up nearly +$2.50 since yesterday, and trades north of $60 p.b. (+$61.81), while Brent is trading firmly above $68 – prices last seen in December. The ‘black stuff’ is being supported by reports of Yemen rebel activity and OPEC’s officials stating yesterday that improved pricing over recent months means the cartel will most likely maintain its production quotas at the June 5th OPEC meeting. A weaker USD is again a problem, and the market does not seem too surprised to see further upside from here. Obviously that will depend on yields and how this week’s job reports will shape the dollar’s next move.