It was another week of falling prices for soft commodities, as oversupply issues continue to dominate across all the major markets. This is clearly evident from the weekly charts.

As the largest exporter, it is the US which sets the price for world markets, with the US Midwest corn belt set to produce a record harvest for a second year. soybeans too are expected to generate the largest crop ever on record.

This picture of bumper harvests is also mirrored in Canada, and even events in the Ukraine and Russia have had little impact on prices. China too, is increasingly adding storage facilities to cope with its own booming harvest and imports, with corn and rice now in plentiful supply. With Europe also forecasting record crops, it’s little wonder that grain markets are falling, and falling fast. In addition, a resurgent US dollar is also helping to propel commodities lower, with the CRB index closing lower once again at 279.17. All of this is in sharp contrast to the shortages which were the catalyst for a surge in prices in 2007, which in turn sparked riots in many countries around the globe.

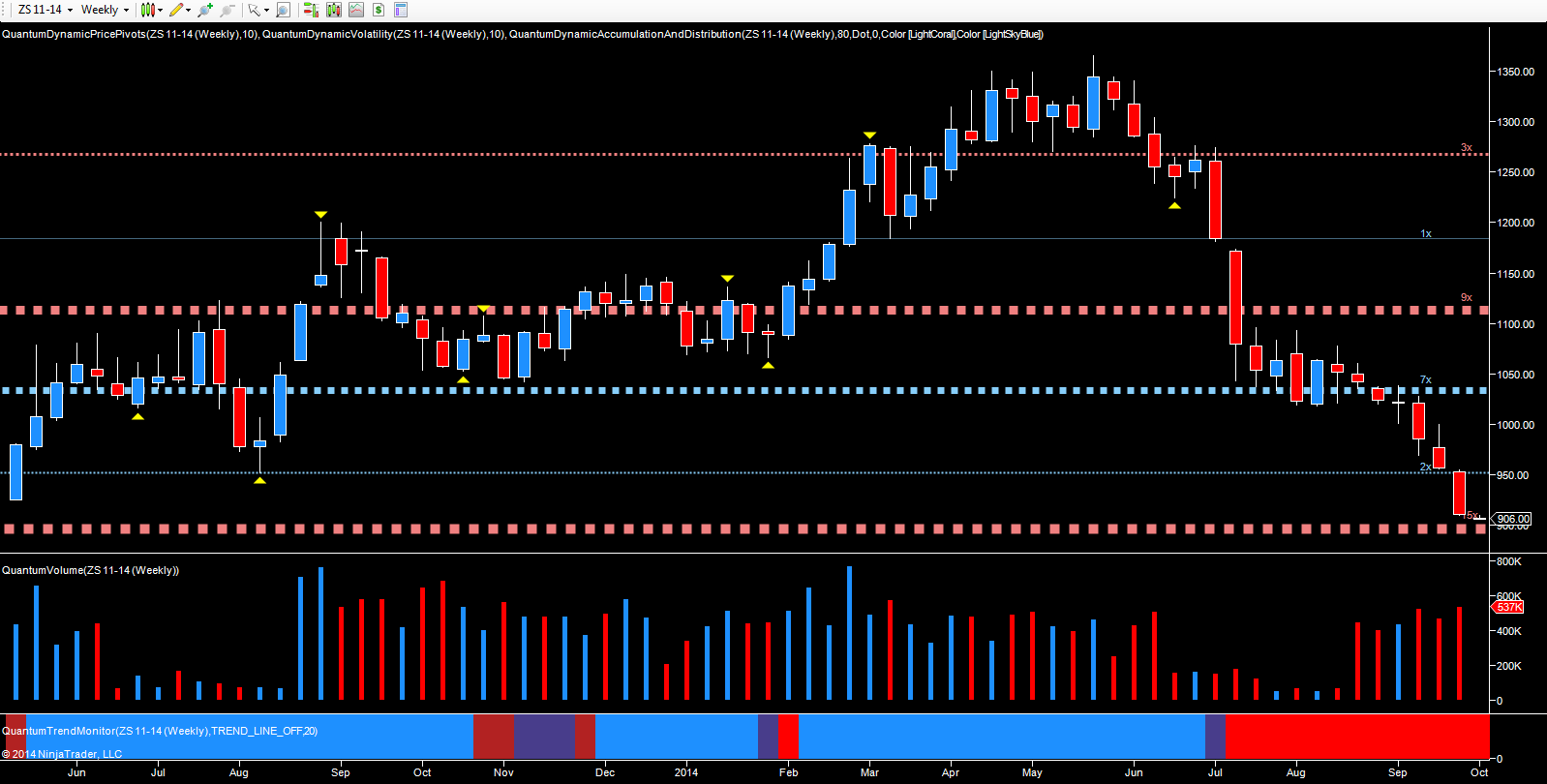

If we start with soybeans, the key price action here was the breach of potential support in the 1030 per bushel region early in September which failed to hold. The market duly broke lower on high volume, with last week’s price action closing on a wide spread down candle and high volumes, ending at 910.25 per bushel. Soybean prices are now approaching a second and perhaps even more significant area of potential support in the 900 per bushel region. If this is breached, we can expect to see the commodity move through this level and lower still, perhaps to test the 840 per bushel region in the longer term. In overnight trading on Globex, soybean prices have fallen once more with the November contract trading at 906.00 per bushel.

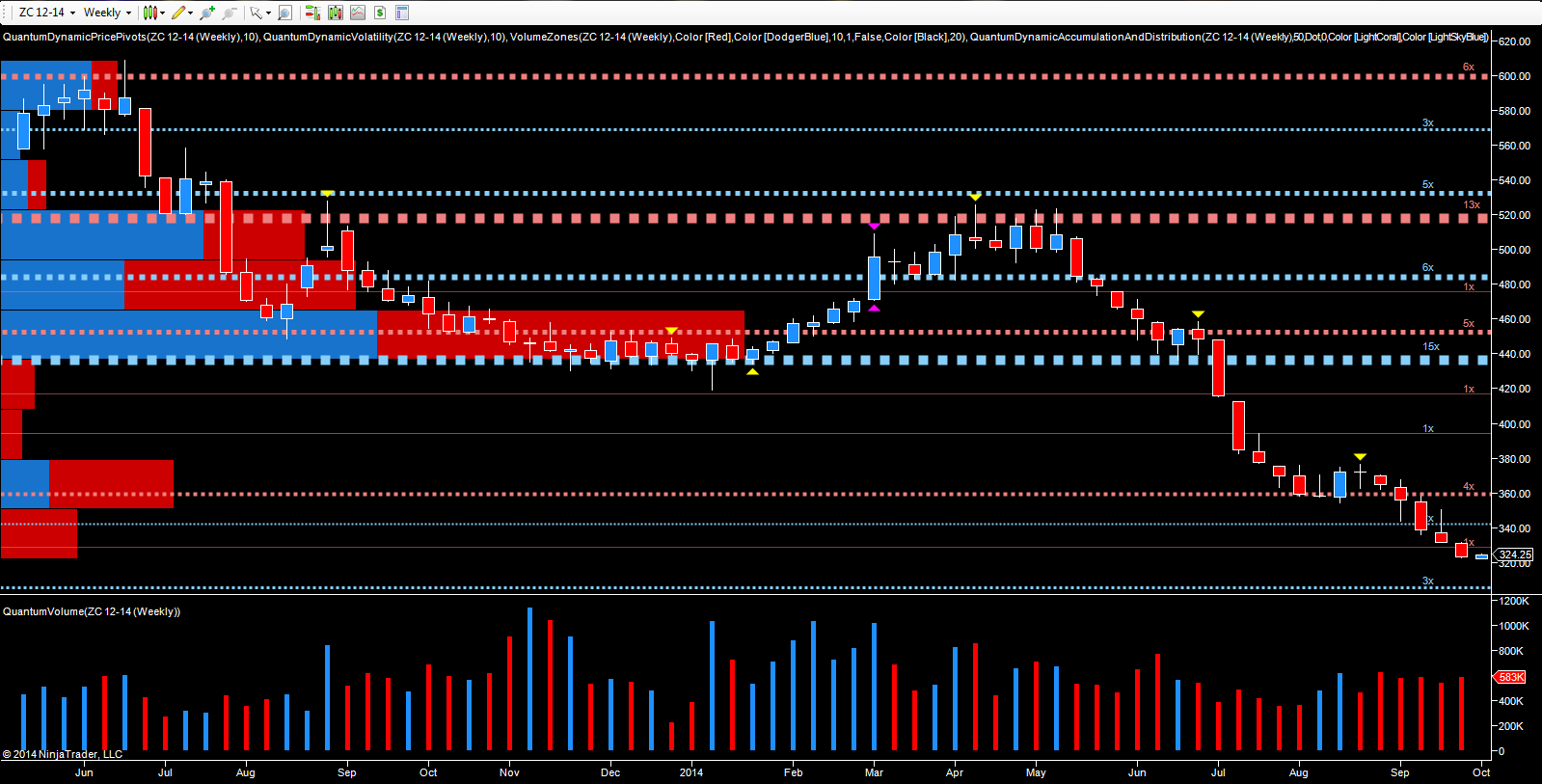

Moving to corn, the picture here is much the same as for soybeans, although perhaps at a slightly more measured pace. Here the decline in prices has been less pronounced over the last three weeks, but nevertheless the bearish picture remains dominant as corn, like soybeans and wheat, is largely being driven lower by the supply equation.

Last week’s price action was accompanied by above average volume, following the weakness signaled in the previous week with the deep upper wick to the candle. The key level here is in the 300 per bushel region, where a minor support region awaits. If this is broken, then 260 per bushel becomes the next logical region for a pause, where a deep area of price congestion may finally bring the current bearish trend to an end. This was the level back in May 2010, which saw prices surge from 270 per bushel up to 630 per bushel. The December contract closed last week at 323 per bushel and overnight on Globex has climbed marginally to trade at 324.50 per bushel at time of writing.

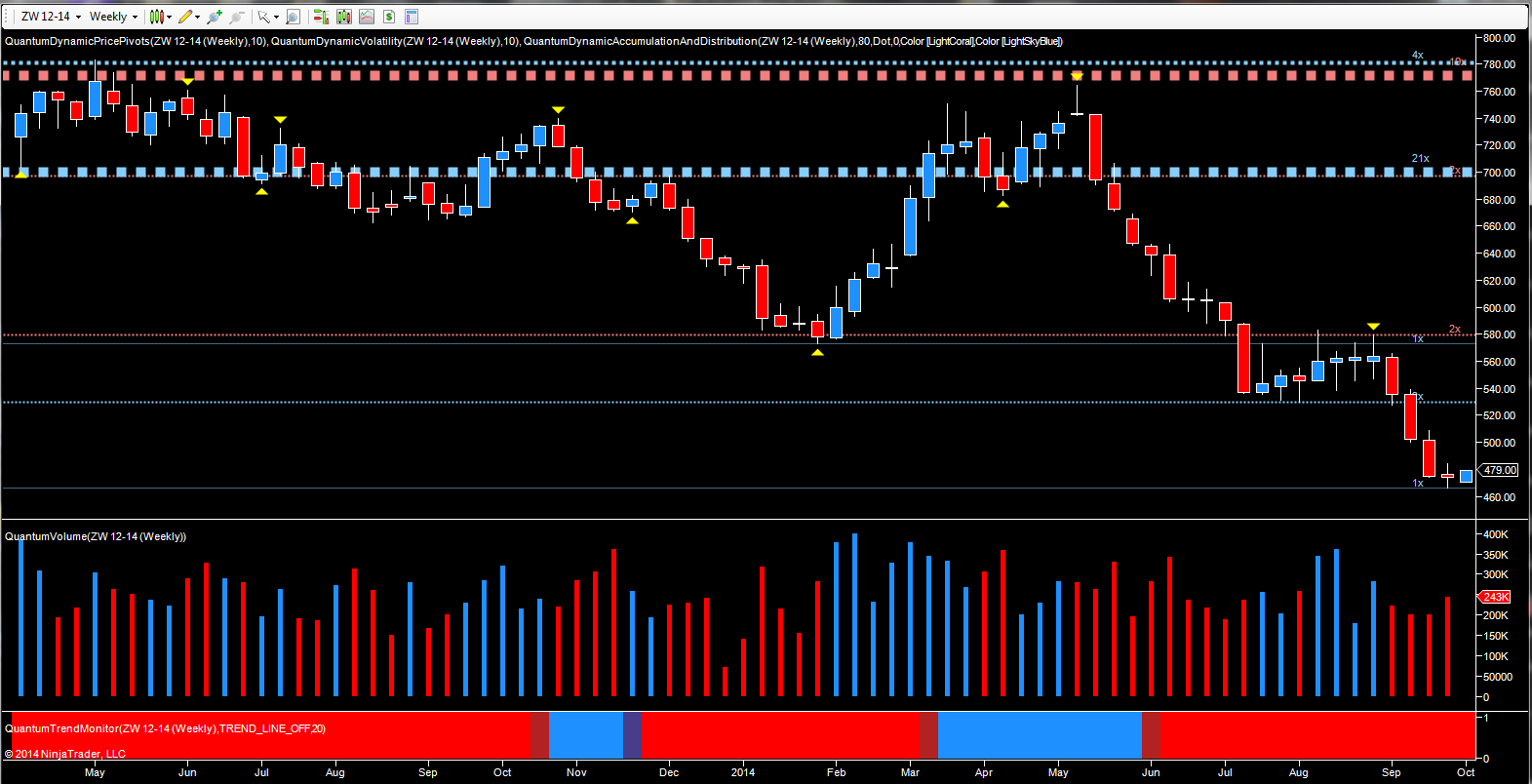

Finally to wheat, and here perhaps we are starting to see the first signs of a pause point, following the sharp declines of the previous three weeks with last week’s candle closing as a small doji candle, but on high volume. This is an obvious anomaly for volume price analysis traders, clearly signalling buyers moving into the market at this level, and the first signs of stopping volume in the downward trend.

As always, I must stress, markets rarely reverse a trend on one candle, but nevertheless, this is the first sign that perhaps soft commodity prices, and wheat in particular, are just starting to find a bottom. Indeed, in overnight trading on Globex the December contract is currently trading at 478.50 per bushel, moving off last week’s close of 474.25. Whilst one swallow does not make a summer, it will be interesting to see any reaction in the associated markets, particularly, of course, for corn. The probability will be that this is simply a pause point, before a further move lower. However, for commodity traders in wheat it may be a case of trade what you see and not what you think in the coming week.