After a hectic week, the bulls rescue the Dow Jones Industrial Average on Friday.

The Dow Jones Industrial Average (DIA) rallied 198 points, 1.26%, on Friday to close out the week on a high note.

The SP500 (SPY) jumped 1.1%, the Nasdaq (QQQ) added 0.76% and the Russell 2000 (IWM) gained 0.79%.

For the week, the SP500 (SPY) declined 0.1%, the Dow Jones Industrial Average (DIA) dropped 0.4% and the Nasdaq (QQQ) posted a fractional gain.

Good news was good on Friday as the rally was largely credited to the better than expected Non Farm Payrolls and unemployment reports which helped stock market bulls break a five day losing run for major U.S.. indexes.

On My Stock Market Radar

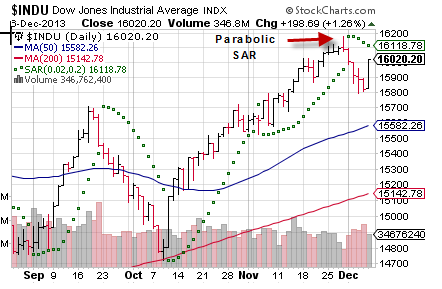

In the chart of the Dow Jones Industrial Average (DIA) below, we can see how the index is still in a bullish configuration, above both its 50 and 200 day moving averages and with its price in a general uptrend stretching back to October. However, Parabolic SAR, a price based trading system, also known as “stop and reverse,” shows the index to be on a short term “sell” signal in response to recent negative price action and trend.

Last week’s fundamentals were mostly positive, particularly on Friday, as the Non Farms Payrolls report showed that the economy added 203,000 new jobs in November and that overall unemployment fell to 7%.

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector's Disclaimer, Terms of Use, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bulls Rescue Dow Jones Industrial Average

Published 12/08/2013, 02:28 PM

Bulls Rescue Dow Jones Industrial Average

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.