The news that Chinese banks are now expected to close the accounts of any individual or entity involved with cryptocurrency sent the markets crashing on Monday.

Key Takeaways

- More than $1 billion was liquidated on major exchanges on Monday as Bitcoin continued its bad weekly performance and Ethereum revisited sub-$2,000 levels.

- Bad news from China sent ripples through the already-weakened markets as only one cryptocurrency out of the top 100 has had a positive 24 hours.

- The crypto market just saw its worst monthly performance since 2011.

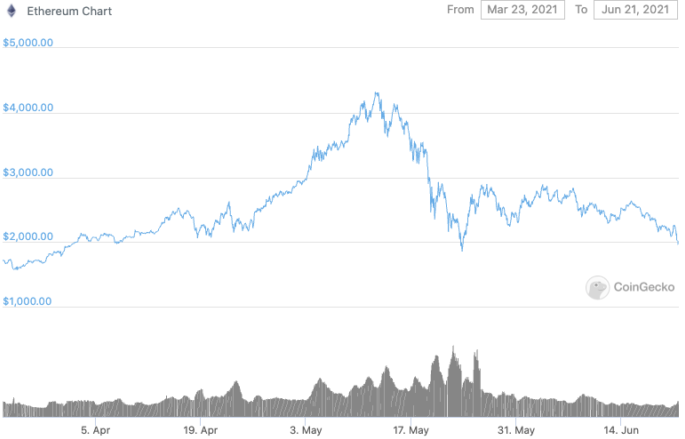

More bad news from China confirms the current bearish tendency of the market. While Bitcoin falls more than 15% in the last seven days, Ethereum comes back below $2,000 for the first time since March.

Week Opens In The Red

Renewed legal challenges against Bitcoin in China have led the market into one more round of panic. Over the last 24 hours, more than $1 billion was liquidated as the total cryptocurrency market cap suffered a painful correction of 5%. While Bitcoin lost 4% market cap, Ethereum went back below $2,000, a key psychological level.

The key level around $2,000 was passed at the beginning of April, before the price more than doubled in May to reach an all-time high of $4,356. Since then, except for a few brief moments during the crash of May 23, the second cryptocurrency by market cap had experienced a comparatively better rebound compared to Bitcoin.

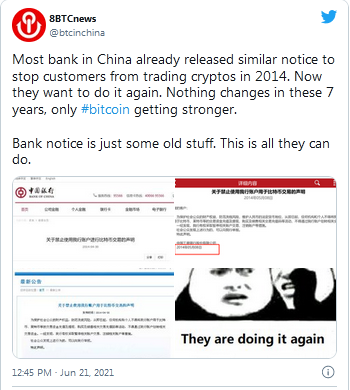

The catalyst for this further leg down seems to be linked to renewed anti-crypto guidelines for Chinese banks. As Crypto Briefing reported, the People’s Bank of China is looking to discontinue services to account holders and entities involved in crypto trading.

China has multiplied regulatory threats against Bitcoin in the last few weeks as it seeks to boost adoption for its digital yuan, adding 3,000 ATMs in Beijing alone. The notice sent by the Chinese government to all the banks in the country is nothing new though as the rules remain the same as those announced back in 2014.

Nevertheless, the fragile state of the market after Bitcoin saw its worst monthly performance in a decade couldn’t handle the renewed policy from China.