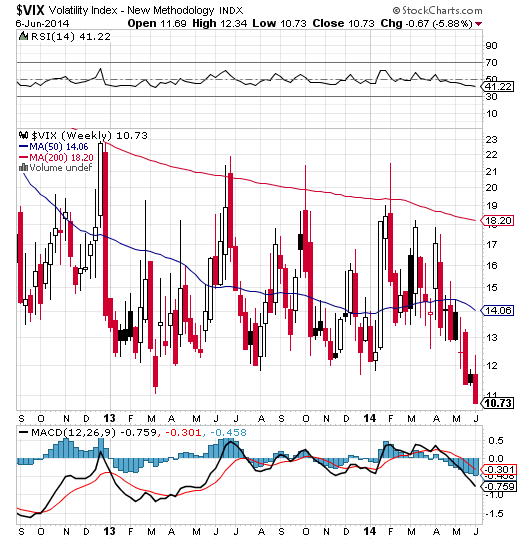

The Volatility Index (VIX), also known as the panic index or fear gauge, is at its lowest level in quite some time -- 10.73 to be precise, as of this writing. Back in January 2007 it was around these levels -- more than 7 years ago. In fact, I don't remember it even dipping below 10. In any case it looks very interesting to me. This is mainly due to the fact that this level strikes me as insane. Civil war in Syria, unrest in the Middle East, Europe not being able to keep its currency under control and tensions in Asia, yet the volatility index is at it lowest level (ever?). I think any range in the 10 'zone' is a reason to look at this index and be optimistic.

How to play?

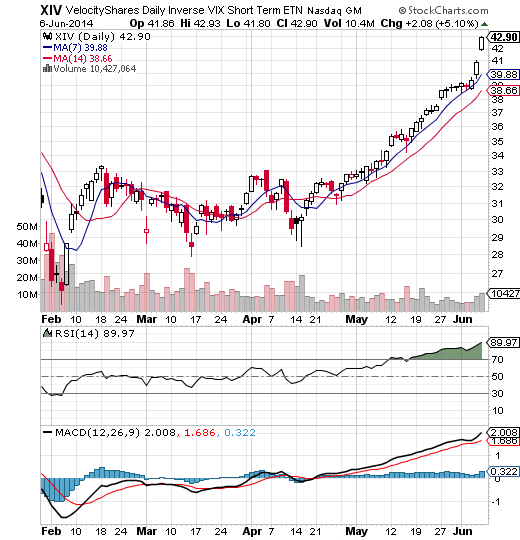

But how do we play this trade? I personally like the XIV (VelocityShares' Daily Inverse VIX Short-Term ETN). This ETN trades like a stock, and goes up when the VIX goes down. The XIV is a short-term, exchange-traded note, which means less risk than the (ARCA:VXX) -- mid term, not inverse so keep in mind that if the VIX goes up, the VXX goes up as well. The XIV doesn't have options, unlike the VXX that does allow you to trade options contracts.

Anyway, short XIV at almost $43.

I'll be very surprised if the VIX continues to drop this week. In fact I think it's highly unlikely. My SL is at $44.50, however, and my Target? At least $40.