Another choppy day for the dollar saw yo-yo price action for the USD% index with overall strength not from the great Unemployment Claims number (they still have counting problems in California so the number is meaningless) or from the GDP numbers and pending homes sales (they both came in poorer than expected), but possibly from rumours of an imminent deal regarding the debt ceiling. Whatever the reason, the breakout was quite weak so a continuation of dollar strength is sought. JPY was a significant recipient of the dollar move, as was the Pound.

The debt ceiling is likely to be the focus for traders now that we have run out of risk events to fret about so anything relating to a deal being struck will be dollar positive, and any delays, stumbling blocks or insolvencies, being obviously bearish USD. It also seems there is a resurrection of the rumour mills, with plenty of dubious “market talk” which needs careful consideration regarding it’s validity before acting on it.

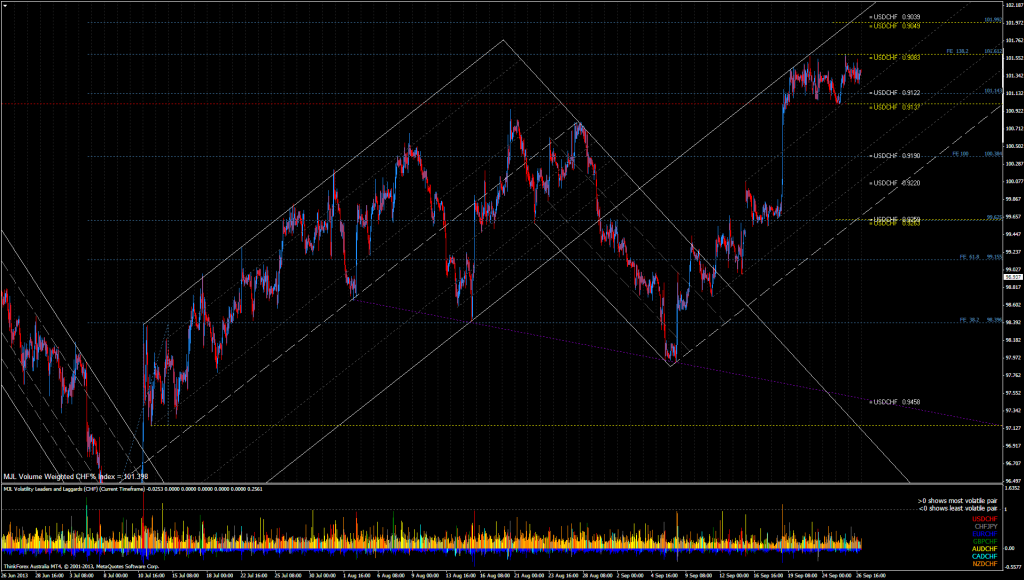

USD% Index

The USD% index had numerous attempts and false breaks of a key bearish trend line resistance before finally pushing through and holding, managing a rally up to the previous high before running out of puff. The price action was abysmal though with a serious lack of conviction from the market which meant that trend lines were sloppily rejected from with a lot of overshoot. Never the less we are in a bullish breakout for the dollar so I remain bullish USD

USD% Index Resistance (EURUSD support): EURUSD 1.3443, 1.3400

USD% Index Support (EURUSD support): EURUSD 1.3512, 1.3531, 1.3577

EUR% Index

The Euro erased most of the gains from the previous day and is consolidating currently following the big move higher after the FOMC disappointment. The dollar breakout suggests lower for the EUR% index although we seem to be forming a bullish flag so the picture is not clear cut. The failure of the Euro to maintain a rally with bullish news of this magnitude however suggests that the recent move higher is overblown and needs to consolidate significantly or drop lower to move the dollar further away from such oversold conditions before a continuation higher for the EUR% index. EURGBP printed numerous bullish pin bars today and still ended the day lower which just highlights how frustrating the price action is currently. EUR% trend is still bullish, although a drop lower in the short term is preferable

EUR% Index Resistance: EUR/USD 1.3529, 1.3547

EUR% Index Support: EUR/USD 1.3453, 1.3400

EUR/GBP Trade Positioning

I am short from 0.84389 and set to break even having taken 50% profit already.

EUR/USD Trade Positioning

I am short from 1.3495 with stops above 1.3556

JPY% Index

Further chop for the JPY% index as it continued to bounce between two trend lines again, allowing for some easy scalps if quick. We ended the day lower though with the Nikkei looking strong all day and keeping USDJPY well bid. With the trend lines expanding currently, as does the range, which means that we may continue to move sideways with less pressure on either end of the trade until the major bearish channel resistance is met again. I am neutral JPY

JPY% Index Resistance (USDJPY Support): USD/JPY 98.41, 98.00

JPY% Index Support (USDJPY Resistance): USD/JPY 99.14, 99.74

GBP% Index

A down day for the GBP% index following poor data this morning, which pushed the index temporarily though support. Cracks are starting to appear again in the shiny new over-performance of the UK relative to expectations, which hints that the large rally recently may be quite overblown and in need of a correction lower. The pound was on the receiving end of a fair amount of the available dollar pressure during dollar rallies which is something that we haven’t seen for a while and indicates the start of weakness, however we failed to make a new low today and have technically printed a fresh high so confused consolidation seems the most likely outcome with few major risk events now to decide medium term direction I maintain a short term bearish GBP outlook within an overall bullish trend

GBP% Index Resistance: GBP/USD 1.6100, 1.6166

GBP% Index Support: GBP/USD 1.6020, 1.5941, 1.5885

GBPUSD Trade Positioning

Short from 1.6046 stops at 1.6111.

AUD% Index

A further fall for the AUD% index today however there was reasonable demand for Australian Dollars before the low volumes allowed the dollar rally to bully the Aussie back lower to meet the major bullish trend line mentioned in my previous analysis as a potential long entry position. As such we are poised for a trend continuation higher I am bullish AUD

AUD% Index Resistance: AUD/USD 0.9400, 0.9450

AUD% Index Support: AUD/USD 0.9350, 0.9327

AUD/USD Trade Positioning

Long from 0.9249 with stops at 0.9253.

CHF% Index

Tightly constricted, directionless chop today from the CHF index which is now stuck between two strong levels and without a major catalyst to decide it’s fate. This does now look like a flag continuation pattern which suggests that upside could be possible, however if the dollar breakout continues this may prevent this scenario. We’ll have to see if this dollar rally has legs. Trend remains bullish although downside for the short term seems possible

CHF% Index Resistance (USDCHF support): USD/CHF 0.9083, 0.9050

CHF% Index Support (USDCHF resistance): USD/CHF 0.9122, 0.9137

CAD% Index

A strong rejection last week from the top of a bearish channel has shown that the CAD index has the potential to drop lower over the next few weeks, as downward pressure gathers momentum. The yellow trend line which had been acting like a magnet has now been broken to the downside and a retest of this trend line allowed for a nice short entry which was reversed back up to the trend line again. The downside is extending though which may see the index break free from it’s magnetic trend line soon. I am bearish CAD

CAD% Index Resistance (USDAD support): USD/CAD 1.0300, 1.0262

CAD% Index Support (USDCAD resistance): USD/CAD 1.0357, 1.0436, 1.0481, 1.0500

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bullish USD Index Breakout Vs. European Bullish Flag Patterns

Published 09/27/2013, 05:24 AM

Updated 07/09/2023, 06:31 AM

Bullish USD Index Breakout Vs. European Bullish Flag Patterns

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.