Southwest Airlines (NYSE:LUV) stock returned about 29% in the past 52 weeks and 6% year-to-date. LUV shares hit a 52-week high of $64.75 in mid-April. But since then, they have lost close to 25% of their value.

By comparison, the Dow Jones US Airlines Index is up 37% in the past year and 6% so far in 2021. It saw a multi-year high in mid-March. Since then, however, the index has also lost about 23%.

LUV stock's 52-week range has been $35.82 - $64.75. Yesterday it closed at $49.15.

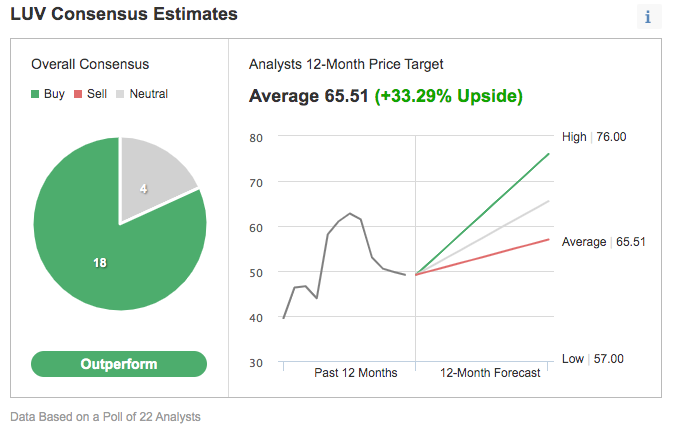

Despite the recent decline in price, Wall Street is still bullish on the airline in the long run. According to 22 analysts polled by Investing.com, the 12-month median price forecast is $65.51, implying a return of well over 30%.

Chart: Investing.com

So today, we look at how bullish investors might consider selling cash-secured put options on LUV stock. Such a trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own Southwest Airlines shares for less than their current market price of $49.15.

We previously discussed the detailed mechanics of cash-secured put selling using Exxon Mobil stock. Readers who are new to put selling may want to consider reviewing that article.

Selling Cash-Secured Puts On LUV Stock

Investors who write cash-secured puts are typically bullish on a stock during the timeframe that extends to the option expiry date. They generally want one of two things—either to:

- Generate income (through the premium received by selling the put); or

- Own a particular stock, in spite of finding the current market price per share (i.e., $49.15 for LUV now) higher than what they would like to pay.

A put option contract on Southwest Airlines stock is the option to sell 100 shares. Cash-secured means the investor has enough money in their brokerage account to purchase the security if the stock price falls and the option is assigned. This cash reserve must remain in the account until the option position is closed, expires or the option is assigned, which means ownership has been transferred.

Let's assume an investor wants to buy LUV stock, but does not want to pay the full price of $49.15 per share. Instead, the investor would prefer buying the shares at a discount within the next several months.

One possibility would be to wait for Southwest Airlines stock to fall further, which it might or might not do. The other possibility is to sell one contract of a cash-secured LUV put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's assume the trader is putting in this trade until the option expiry date of Dec. 17. As the stock was $49.43 at the time of writing, an OTM put option would have a strike of 47.50. So the seller would have to buy 100 shares of Southwest Airlines at the strike at $47.50 if the option buyer were to exercise the option to assign it to the seller.

The LUV Dec. 17, 2021, 47.50-strike put option is currently offered at a price (or premium) of $2.54.

An option buyer would have to pay $2.54 X 100, or $254, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. This put option will stop trading on Friday, Dec. 17.

Risk/Reward Profile For Unmonitored Cash-Secured Put Selling

Assuming a trader would enter this cash-secured put option trade at $49.43, at expiration on Dec. 17, the maximum return for the seller would be $254, excluding trading commissions and costs.

The seller's maximum gain is this premium amount if LUV stock closes above the strike price of $47.50. Should that happen, the option expires worthless.

If the put option is in the money (meaning the market price of Southwest Airlines stock is lower than the strike price of $47.50) any time before or at expiration on Dec. 17, this put option can be assigned. The seller would then be obligated to buy 100 shares of LUV stock at the put option's strike price of $47.50 (i.e., at a total of $4,750).

The break-even point for our example is the strike price ($47.50) less the option premium received ($2.54), i.e., $44.96. This is the price at which the seller would start to incur a loss.

On a final note, the calculation of the maximum loss assumes the put seller was assigned the option and purchased 100 shares of Southwest Airlines at the strike price of $47.50. Then, in theory, the stock could fall to zero.

If the put seller gets assigned the option, the maximum risk is similar to that of stock ownership but partially offset by the premium (of $254) received.

Bottom Line

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This strategy can be a way to capitalize on the choppiness in LUV stock in the coming weeks.

Investors who end up owning Southwest Airlines shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares.

In other words, selling cash-secured puts could be regarded as the first step in stock ownership.