I never like it when someone purports to be “the devil’s advocate,” because I figure I’m about to hear something I don’t want to hear. In spite of that, I’ll take on this role and point out a potential area of bullish support (which, God willing, will shatter and crush the spirits of evil bulls the world over).

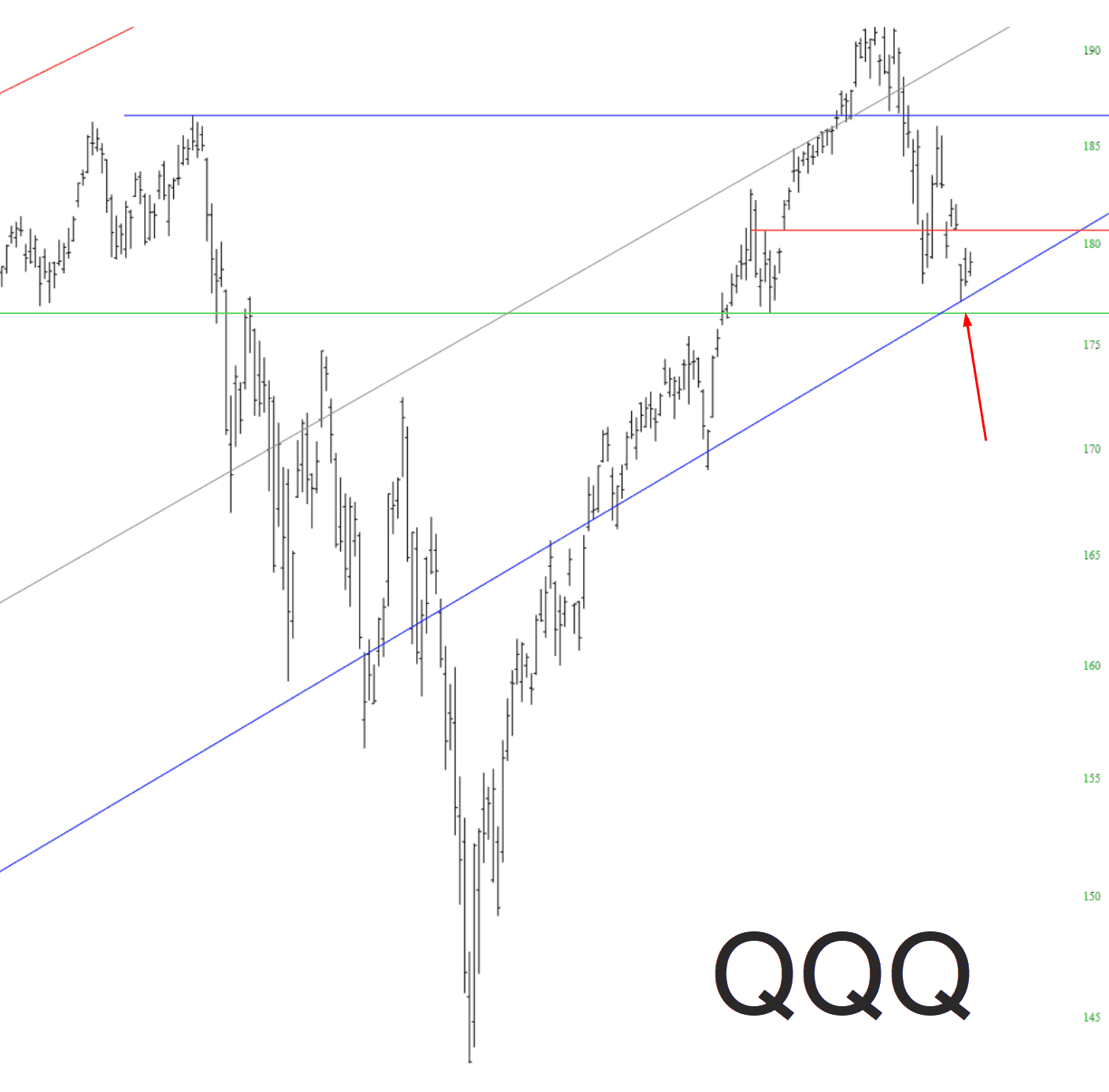

Take note of where things are with the Nasdaq:

Prices are tightly hemmed-in within a small but important range. The bottom of the range is that green horizontal line. The top is the red line, anchored to the price gap from a few trading days ago. The principal bullish formation failed ages ago, so I’m not worried about that. A push above the red line, however, might stir up some buying since people will argue prices are – groan – “cheap”.

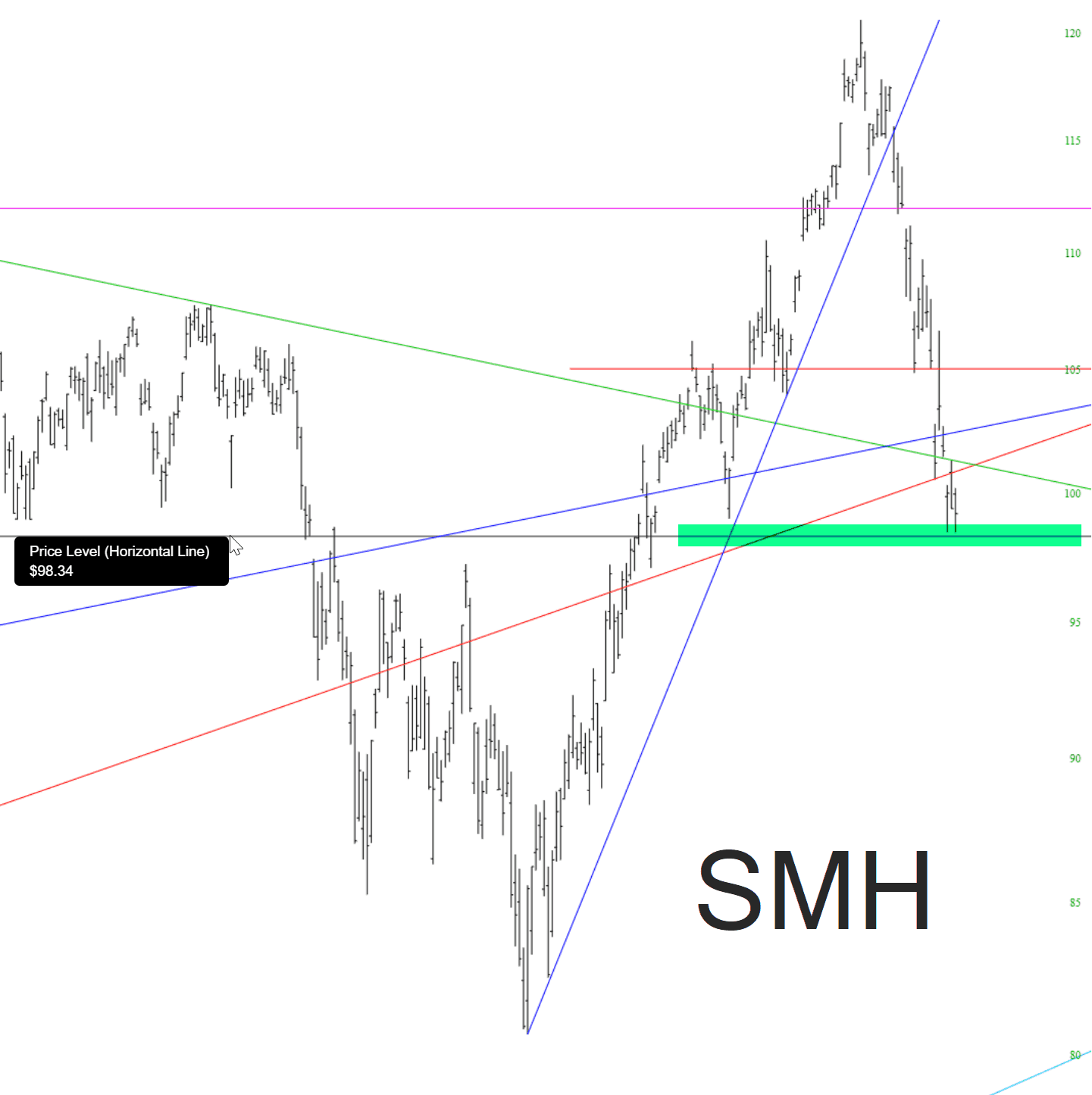

An important element to this is the semiconductor sector itself, whose demise has been a weighty anchor on tech in general. It, too, has crucial support that I’ve tinted not-too-subtly below. Until and unless we break this, it will continue to be a slug-fest.

SMH