Economic Laboratory Was Open Tuesday

Tuesday’s monthly labor report provided us with an excellent opportunity to monitor investors’ expectations about the important battle between economic forces that create inflation and those that create deflation. From Reuters:

U.S. employers added far fewer workers than expected in September, suggesting a loss of momentum in the economy that will likely add to the Federal Reserve’s caution in deciding when to trim its monthly bond purchases.

Inflation vs. Deflation

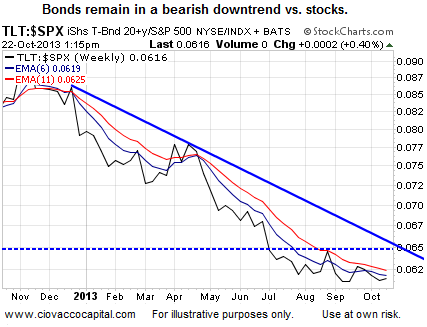

All things being equal, when investors are more concerned about deflation relative to inflation, it is a bearish sign for the economy, earnings, and stocks. Conversely, when inflation expectations are backed by more conviction than those backing deflation, it is a bullish sign for the economy, earnings, and stocks. In a deflationary environment, fixed income becomes attractive since it is easy to “stay ahead of inflation” from a purchasing power perspective. Therefore, if bonds benefit in a deflationary environment and stocks benefit during periods of inflation, we can monitor deflation vs. inflation expectations by tracking the demand for bonds (TLT) relative to stocks (SPY). The ratio continues to show a clear bias toward inflation and stocks.

Earnings Give Fed Reason To Pause

The Fed has been hoping the economy would strengthen enough to take the bullish baton hand off from QE. Thus far, the larger economic picture can still be classified as “tepid”. The outlook for earnings is another contributing factor to rising inflation/money printing expectations. From The Wall Street Journal:

A strong first half had initially signaled a good year for Wall Street, but recent political and market events will likely drive profitability and compensation lower, according to a report released by New York state Comptroller Thomas DiNapoli. Profits could total about $5 billion in the second half after generating an estimated $10 billion in the first half, the report said. “Washington’s inability to resolve budget and fiscal issues is bad for business,” Mr. DiNapoli said in a statement. “Failure to resolve the federal budget and debt ceiling impasse could disrupt the economy and hurt New York City and New York state.”

May 22 Taper Peak In Stocks vs. Employment Tuesday

When stocks gave back a good portion of their gains soon after the open Tuesday, the buzz on Twitter was that we were seeing a repeat of the May 22 high in the S&P 500. May 22 was the day the term taper was released to the Street. As the chart below shows, inflation expectations were much more bullish Tuesday than they were on May 22.

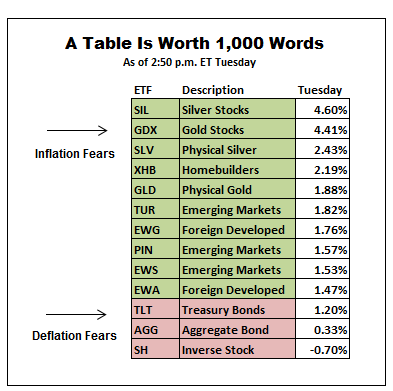

Investment Implications - Taper Later

One of the keys to success noted recently is monitoring the big picture. Monitoring relative demand provides insight into many things in the investing world, including confidence in the economy, earnings, innovation, and corporate leadership. The demand for economically-sensitive cyclical stocks relative to defensive assets provided us with the confidence to buy on October 10. After the weak employment numbers were released Tuesday, the performance of the ETFs below spoke volumes about the battle between inflation and deflation.

The recent Washington manufactured crisis has created even more uncertainty for the Federal Reserve, which adds to the “taper later” list. Even prior to the political embarrassment, the Fed was concerned about the labor markets. From Bloomberg:

“Conditions in the job market today are still far from what all of us would like to see,” Chairman Ben S. Bernanke said at a news conference following the Fed’s September meeting. While the labor market has shown improvement, the political debate over the shutdown and the debt limit may have been a source of concern for employers.

The reaction to Tuesday’s labor report, especially in the context of the Fed and inflation expectations, supports the stance we have taken since the October 9 low. The supply and demand balance on the ETF front continues to point to many of our holdings as being prudent risk-reward options: broad U.S. (VTI), technology (QQQ), small cap (IJR), foreign developed (EFA), financials (XLF) and emerging markets (EEM). We will hold our current positions until the observable evidence shifts in a meaningful way.