Whilst the AUD had a strong start to the week, an unexpected reduction in the Australian CPI result sent the pair plummeting. Additionally, weak PPI figures kept the Aussie dollar low as the session came to a close. The poor performance of last week is now challenging the integrity of the bullish channel which has been in place for some time. As a result, this could be signalling that the AUD is finally ready to begin following commodity prices lower.

In the beginning of the week, the AUD capitalised on the generally poor US indicator results and made some decent gains. However, the previous week’s tumble resumed with a vengeance in the wake of the Australian CPI figures which posted a 0.2% reduction q/q. Additionally, as the pair moved to correct itself it was slammed with a poor PPI result which came in at -0.2% q/q. As a result, the Aussie dollar was unable to utilise the negative USD sentiment that predominated throughout the week.

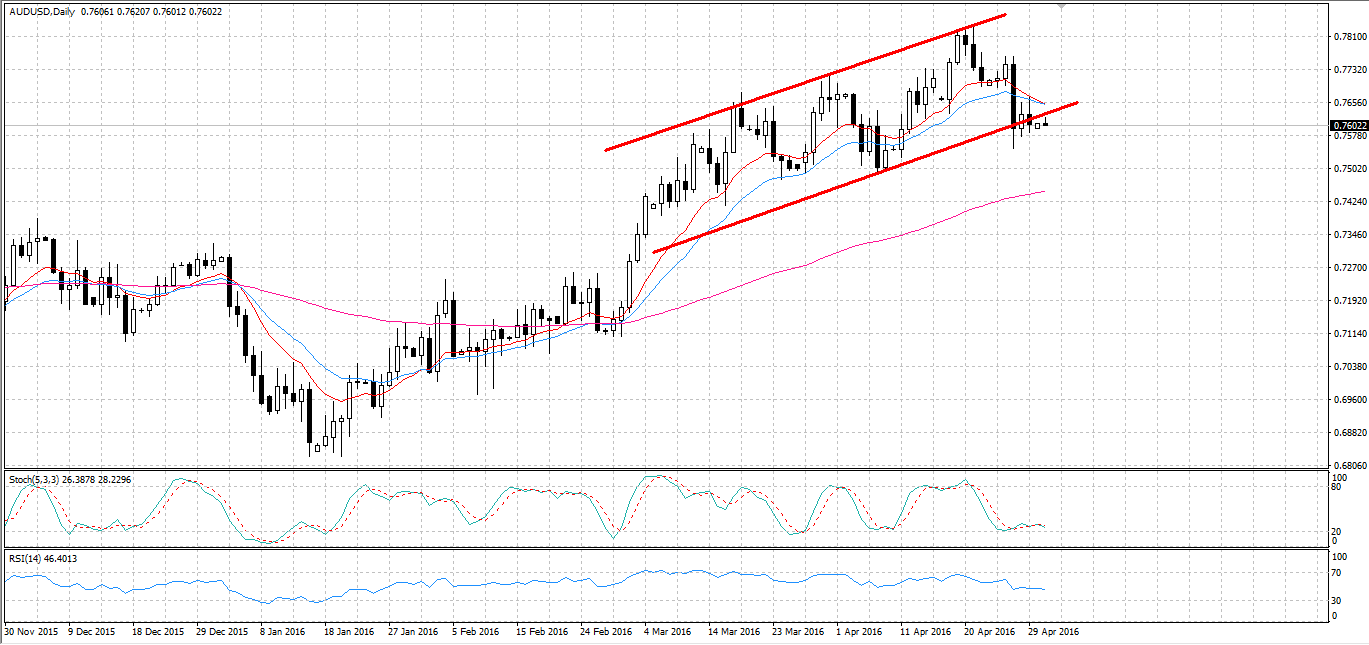

On the technical front, the AUD is still looking relatively bullish but the channel is beginning to deteriorate. Consequently, the pair may be set to enter a sideways trend if the Aussie dollar fails to close higher than the 0.7748 mark. Additionally, a relatively oversold reading on the stochastic oscillator should buoy the pair as the week begins. This being said, RSI is yet to reach the oversold point which might mean the pair could go lower still.

As for this week, the RBA Cash Rate decision will be watched closely but the rate is likely to remain unchanged. Whilst the AUD is still relatively high, the recent softening of the Aussie dollar is finally coming in line with RBA Governor Stevens’ expectations. As a result, the probability of a rate cut is looking relatively slim which should help to keep the pair buoyant. However, a predicted decrease of 2% m/m in Australian Building Approvals could prevent the pair climbing significantly. The combination of forces is then likely to send the Aussie dollar ranging in the near future.

Ultimately, the AUD’s divergence from commodity prices has been a source of worry for the RBA for some time. Consequently, the imminent downside breakout could be a sign that the currency has finally lost momentum. However, continued US economic weakness could prevent the pair from forming a downtrend and might instead see the Aussie dollar trending sideways.