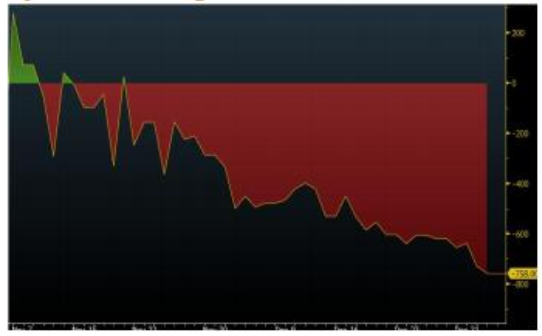

Bullion had a pretty ranged trading session yesterday at the MCX as almost all global markets remained shut due to New Year Holiday. In the Indian markets, Gold for most active February expiry contract at MCX was nearly unchanged at Rs 28422 per 10/Gms. However, adding on to our updation on the calendar spread side at the MCX, the move in Feb and Apr month contracts further diverged wherein the near month active contract was unchanged though April contract slipped by around 0.35%. Backwardation for the commodity increased to Rs 730 as of yesterday’s closing. While our initial target for the recommendation of buying the spread around Rs 500 has been achieved, we would advice to book partial profit and hold the rest for extended gains towards Rs 800-850 in the near term.

In the global markets today, we are seeing huge out performance in the bullion complex wherein both gold and silver are thumping higher. As per Bloomberg update today morning (IST), Gold for most active February expiry jumped near 2% to $1,223 an ounce on the Comex with trading volume standing nearly 106% above the 100-day average for this time.

Gold prices jumped after recording its worst fall in a year in more than three decades, while cruelty prices hover near a six-month low. Thai might have prompted short-covering; however we would actually wait for couple of session to confirm whether this is pure short-covering or a change in near-term bias towards positive. We have a ranged view in the commodity today.

Global Market Analysis: We are witnessing amazing movement during the first trading session of the year globally and particularly in Bullion. Gold commodity is trading up by 2% and silver by 4.50% at $1223 and $20.1650. We are not adept to cite any reasons for so much of movement in bullion while we could either anticipate it as a huge short covering or fresh buying by the investors. We recommend trading cautious for the day in the precious metals space.