In mid-November, last year, we wrote an article titled, Is the Bond Market a Bull Trap? Our thesis was that the Treasury bond carry trade had played itself out. Yields were dropping, cutting the profit margins on this so-called “risk free” investment. Granted, the asset values in Treasuries increased, offsetting the loss of income. However, each marginal unit of new investment produced lower yields and smaller increases in asset value.

Bond volatility was also on the rise.

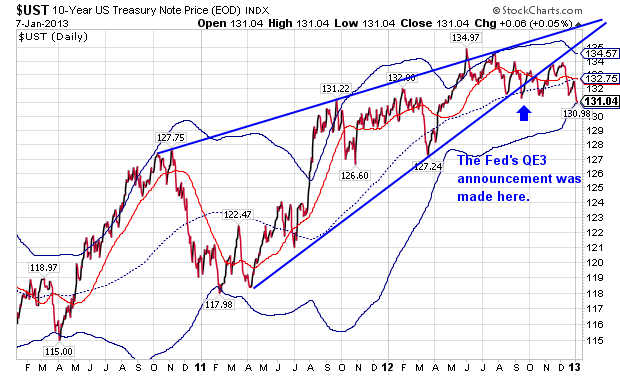

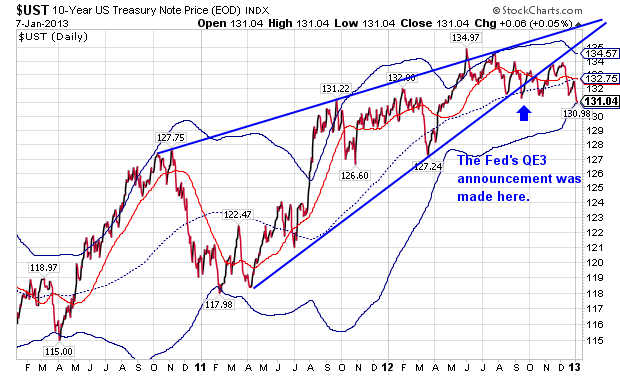

In early September 2012, the 10-Year U.S. Treasury Note broke the lower trendline of a Bearish Wedge, signaling the end of the uptrend in notes and bonds. On September 13, the Fed announced QE3, which gave speculators the courage to attempt to front-run the Fed. That is exactly what happened. The speculative long positions in the bond futures market more than doubled, giving the commercial banks the ability to exit their bond carry trades. T-Notes made their final peak on December 7 and have been selling off since then. Just a week later, Treasury Notes crossed below their 50-day moving average, and have been beneath that average since then.

We also warned that “any downgrade of the Federal debt would also have grave consequences for bond and note holders. Recently Standard & Poor's announced that the U.S. credit rating is on hold until an agreement on the debt ceiling is reached at the end of February. S&P issued a reminder on Wednesday to say that nothing had changed. Resolution of the so-called “fiscal cliff” delays the automatic discretionary spending cuts and does nothing to remedy the structural imbalances created by Medicare and Social Security. Standard and Poor's further says that this "doesn't affect our view of the country's credit outlook, given that we believe yesterday's agreement does little to place the U.S.' medium-term public finances on a more sustainable footing."

Technical Breakdown

While the Congress and Senate did not appear to pay any attention to the Standard & Poors’ announcement, the bond market did -- finally breaking down through the September 14, 2012 low of 131.32 and suffering a technical breakdown. The consequences may be severe, since a breakdown from a Bearish Wedge formation implies a full retracement to the beginning of the formation, near 115.00.

Quick Retracement

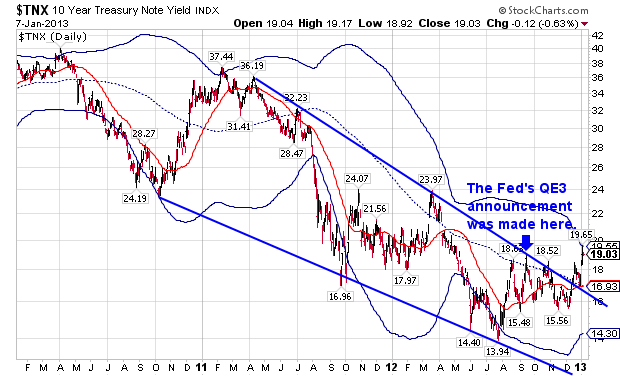

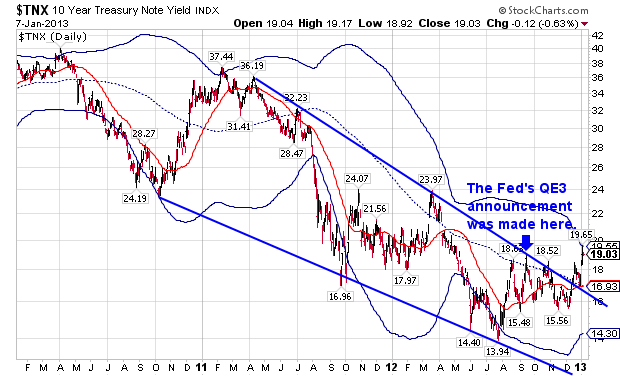

Likewise, a breakout above a Bullish Wedge formation, as seen in the 10-Year U.S. Treasury Note Yield Index, implies a full retracement to the top of this formation at 40.00, more than doubling the yield on the 10-year note. While it took nearly three years for the 10-Year Treasury Note Yield to reach its low in July, the retracement may be rather quick by comparison.

This has implications, not only for investors and speculators, but also for the Federal Reserve and the national debt. For investors and speculators, the Treasury bond market is no longer a safe haven.

For the Fed, quantitative easing may end sooner than expected. An excerpt from the December FOMC minutes reveals a split in the ranks (emphasis ours):

In considering the outlook for the labor market and the broader economy, a few members expressed the view that ongoing asset purchases would likely be warranted until about the end of 2013, while a few others emphasized the need for considerable policy accommodation but did not state a specific time frame or total for purchases. Several others thought that it would probably be appropriate to slow or to stop purchases well before the end of 2013, citing concerns about financial stability or the size of the balance sheet. One member viewed any additional purchases as unwarranted.

About That Debt

The national debt would also be affected. Using the CBO baseline calculations at a blended 2%, the 2022 national debt will have grown to $31.4 trillion. A simple reversion to the mean historical interest rate of 5% would grow the national debt to $40 trillion by 2022, assuming that spending is frozen at current levels. Moreover, after submitting their baseline projections, the CBO admitted to “finding” an additional $600 billion deficits from the Obama tax cuts.

In summary, investors may be entering a new era of risk in the Treasury markets. The Fed may find itself slowing the QE process and looking for an exit sooner than planned. Finally, our lawmakers may find that low interest rates that enabled them to kick the can down the road are no longer available. Rising interest rates will either force fiscal restraint or default sooner than many have planned.

Bond volatility was also on the rise.

In early September 2012, the 10-Year U.S. Treasury Note broke the lower trendline of a Bearish Wedge, signaling the end of the uptrend in notes and bonds. On September 13, the Fed announced QE3, which gave speculators the courage to attempt to front-run the Fed. That is exactly what happened. The speculative long positions in the bond futures market more than doubled, giving the commercial banks the ability to exit their bond carry trades. T-Notes made their final peak on December 7 and have been selling off since then. Just a week later, Treasury Notes crossed below their 50-day moving average, and have been beneath that average since then.

We also warned that “any downgrade of the Federal debt would also have grave consequences for bond and note holders. Recently Standard & Poor's announced that the U.S. credit rating is on hold until an agreement on the debt ceiling is reached at the end of February. S&P issued a reminder on Wednesday to say that nothing had changed. Resolution of the so-called “fiscal cliff” delays the automatic discretionary spending cuts and does nothing to remedy the structural imbalances created by Medicare and Social Security. Standard and Poor's further says that this "doesn't affect our view of the country's credit outlook, given that we believe yesterday's agreement does little to place the U.S.' medium-term public finances on a more sustainable footing."

Technical Breakdown

While the Congress and Senate did not appear to pay any attention to the Standard & Poors’ announcement, the bond market did -- finally breaking down through the September 14, 2012 low of 131.32 and suffering a technical breakdown. The consequences may be severe, since a breakdown from a Bearish Wedge formation implies a full retracement to the beginning of the formation, near 115.00.

Quick Retracement

Likewise, a breakout above a Bullish Wedge formation, as seen in the 10-Year U.S. Treasury Note Yield Index, implies a full retracement to the top of this formation at 40.00, more than doubling the yield on the 10-year note. While it took nearly three years for the 10-Year Treasury Note Yield to reach its low in July, the retracement may be rather quick by comparison.

This has implications, not only for investors and speculators, but also for the Federal Reserve and the national debt. For investors and speculators, the Treasury bond market is no longer a safe haven.

For the Fed, quantitative easing may end sooner than expected. An excerpt from the December FOMC minutes reveals a split in the ranks (emphasis ours):

In considering the outlook for the labor market and the broader economy, a few members expressed the view that ongoing asset purchases would likely be warranted until about the end of 2013, while a few others emphasized the need for considerable policy accommodation but did not state a specific time frame or total for purchases. Several others thought that it would probably be appropriate to slow or to stop purchases well before the end of 2013, citing concerns about financial stability or the size of the balance sheet. One member viewed any additional purchases as unwarranted.

About That Debt

The national debt would also be affected. Using the CBO baseline calculations at a blended 2%, the 2022 national debt will have grown to $31.4 trillion. A simple reversion to the mean historical interest rate of 5% would grow the national debt to $40 trillion by 2022, assuming that spending is frozen at current levels. Moreover, after submitting their baseline projections, the CBO admitted to “finding” an additional $600 billion deficits from the Obama tax cuts.

In summary, investors may be entering a new era of risk in the Treasury markets. The Fed may find itself slowing the QE process and looking for an exit sooner than planned. Finally, our lawmakers may find that low interest rates that enabled them to kick the can down the road are no longer available. Rising interest rates will either force fiscal restraint or default sooner than many have planned.