Can US fiat queen Kamala beat fiat king Donald in the nation’s next election?

In these trying geopolitical times, citizens are perhaps best served by focusing less on their favourite fiat nation leaders, and more on gold.

For further insight into this key matter, the key daily gold chart. Gold reached my newest buy zone of $2385-$2365 yesterday. Investors who bought modestly can see the price is already up $20/oz from the low.

Back in 2012, the gold price peaked as the government of India began pounding savers with massive taxes on the import of gold. Physical gold demand collapsed, and so the COMEX paper gold market price did too.

For the good news, this morning the government finally cut the onerous tax.

The cut opens the door to a massive surge in long-term physical market demand… and a long-term rise in the price.

Interestingly, this fabulous physical market news occurs at the same time as investment demand in the West may be set to rise significantly. Economic growth is slowing, and the Fed is closer to cutting rates.

If “fiat queen” Kamala wins the US election, government spending and debt will intensify. Sanctions will continue, so global de-dollarization will continue. That’s good news for the price of gold.

If “fiat king” Donald wins? Well, he’s an interest rate dove who is likely to put enormous pressure on the Fed to cut rates. He may even wrench control of some rate setting policy from the Fed… and put it in the hands of the Treasury.

His proposed tariffs could slow global growth quite significantly while raising it domestically. If he forces rates down, growth in America would rise more than most economists are forecasting, but inflation would also surge, and perhaps quite dramatically.

The bottom line: Regardless of who is elected in America, it’s clearly win-win for gold.

The wars in Ukraine and Gaza are having no effect on the oil price. It’s all about fading growth.

The same is true for copper; the sagging price reflects the global economy rolling over.

Copper is arguably oil 2.0, and copper stocks can be bought in the $4/lb zone as a long-term hold or for a quick flip… but that doesn’t change the fact the global debt-themed economy is looking more and more like a ship taking on water.

The stock market? I’ve cautioned gold bugs about being too negative on the stock market, especially with a Fed rate cut (and maybe multiple cuts) ahead.

The Transports are a new bright spot in the market. A fresh closing high would confirm that the bull market is intact.

There’s currently a lot of synergy between the stock market and gold. Can they decouple, with gold rising and stocks taking a hit? That can happen, but it’s unlikely until there’s a resurrection of inflation at the same time as growth fades more aggressively.

That situation would see institutional money managers gravitate away from the bond market, and move towards gold and silver.

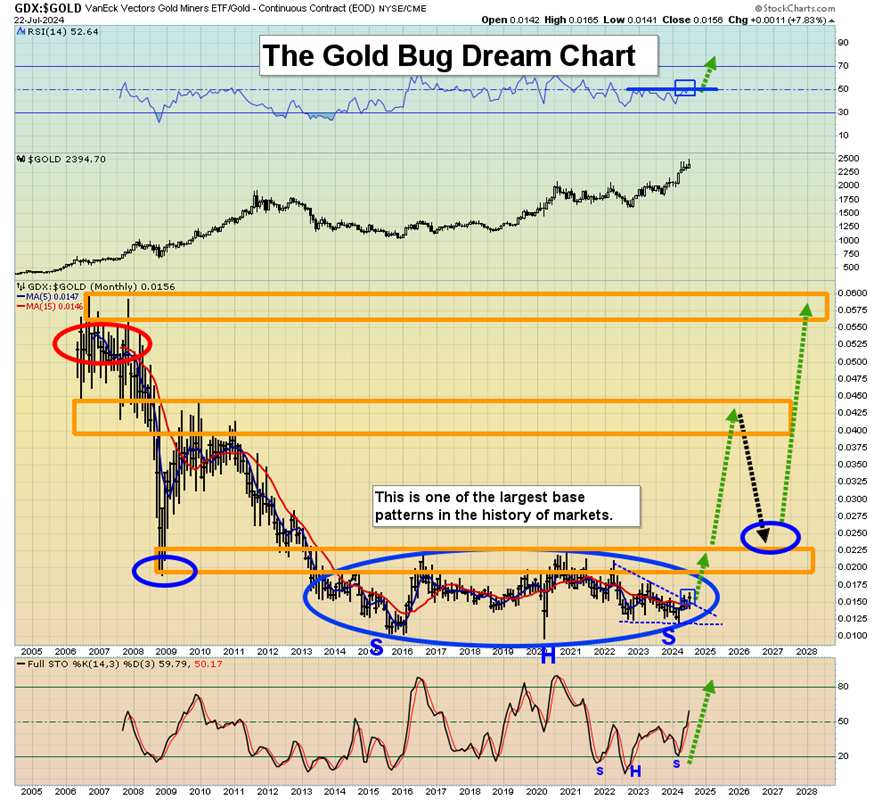

Mining stocks could get a tremendous bid, and on that note, the enticing GDX (NYSE:GDX) versus gold chart. In just the past five months, the miners are up about 25% against gold.

Friday was a particularly interesting day, with GDX rising against gold while both gold and the Dow took a significant hit.

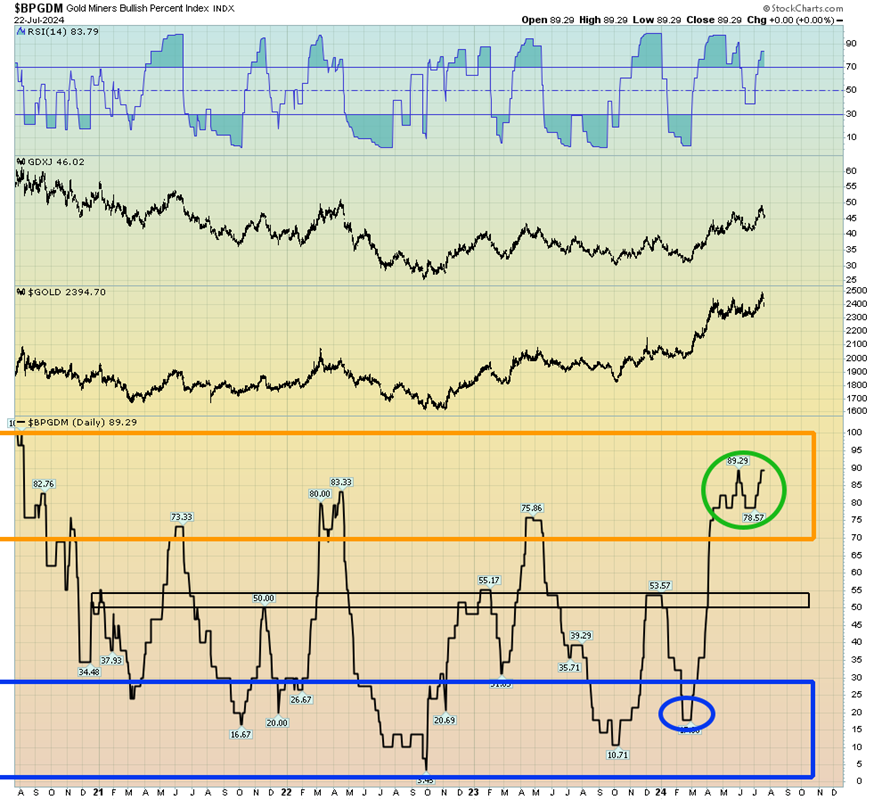

Sentiment indexes like the BPGDM are overbought… but they can stay overbought if physical demand in India begins to surge.

Also, with oil and copper soft, I’m expecting Friday’s PCE inflation report to show another drop. That should be more good news for gold, silver, and the miners.

The gold bug dream chart is the real deal. Price dips for the miners are to be bought. In the months ahead, investors can expect a myriad of outperformance days versus gold.