Street Calls of the Week

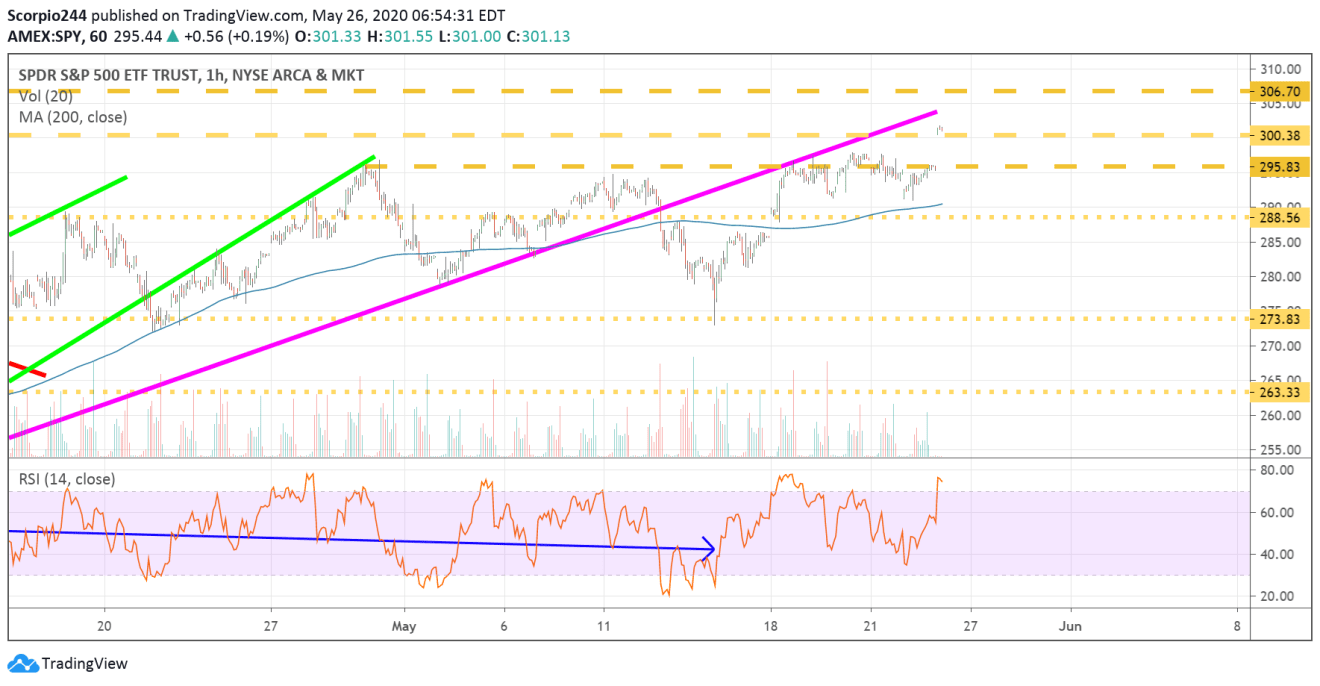

Stocks are rising here in the U.S. on Tuesday, playing a bit of catch up to a rally around the world on Monday. The S&P 500 ETF (NYSE:SPY) was trading just a little bit above the $300 level to start the day, which takes us back to the highest level since March 6. At least at this point, it puts the next significant level of resistance for the ETF around $306. Whether or not the rally can continue from here is anyone’s guess. As I have pointed out, the market doesn’t have a strong economy or robust earnings growth on the table, in 2020 or 2021. So yes, the market is a discounting mechanism towards future growth, but maybe, in this case, it is for 2022.

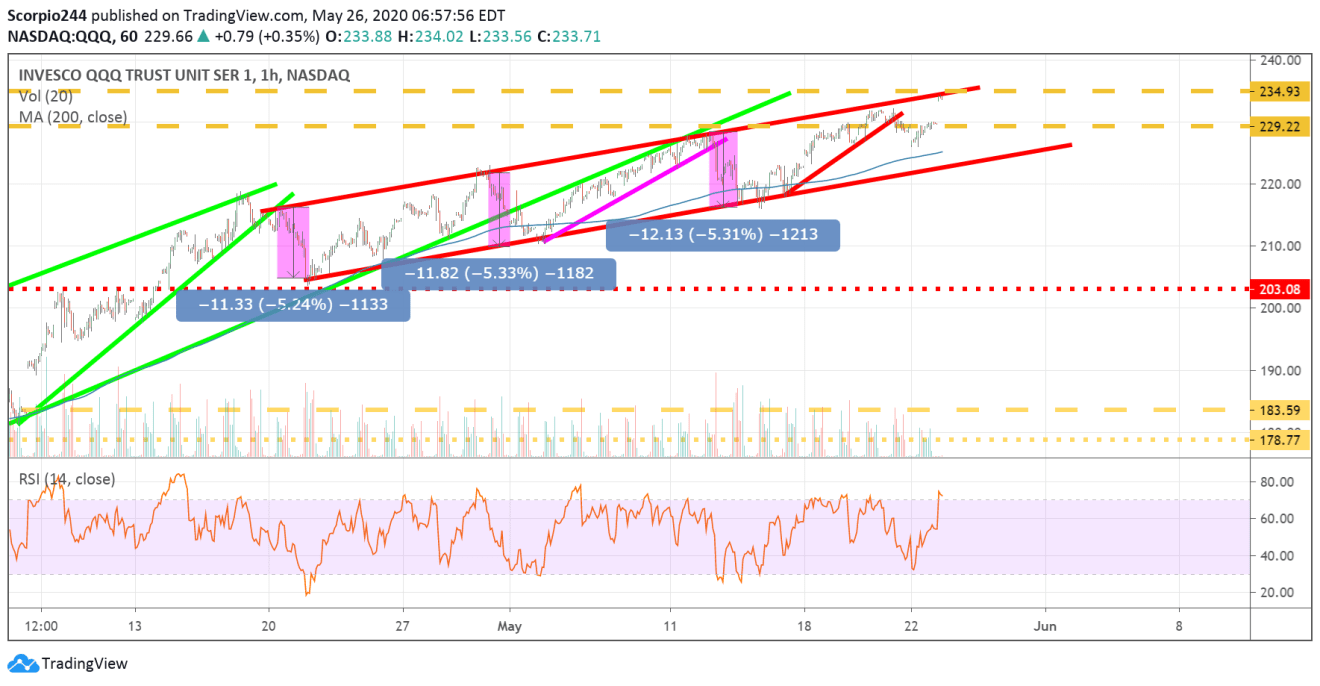

NASDAQ 100 – (NASDAQ:QQQ)

The Qs are butting right up against the upper end of its trading range, with a strong level of resistance around $235.

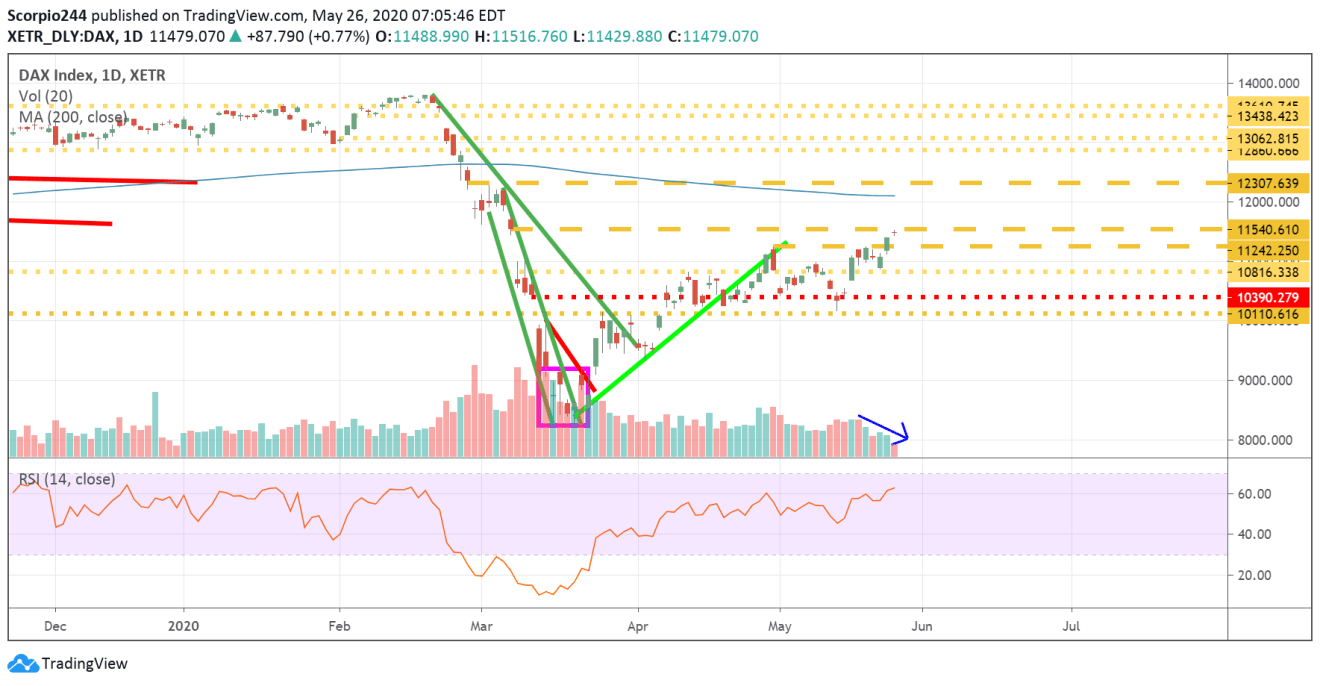

Germany (EWG)

The German DAX had a big day on Monday and has now filled a gap up at 11,570. I guess the one thing that is interesting here is volume levels have been dropping off in this market.

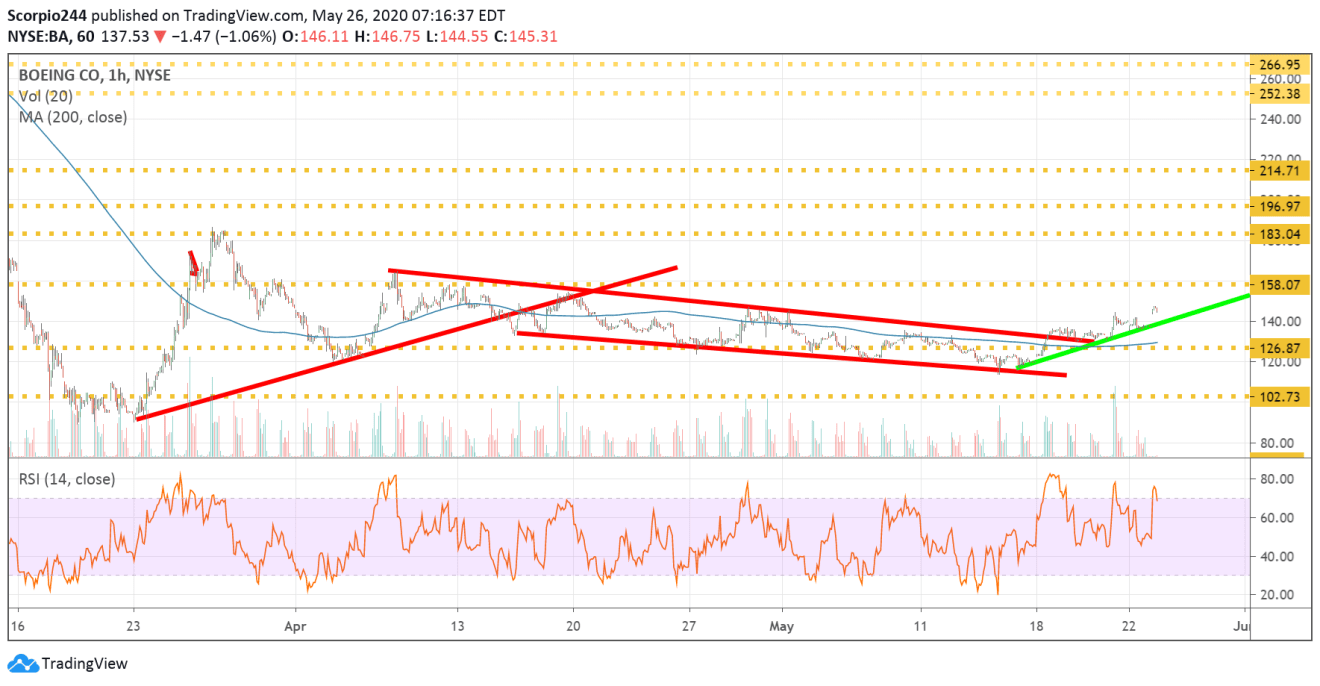

Boeing

Boeing (NYSE:BA) finally broke out of its trading channel to the upside, with its next significant level of resistance not until $158.

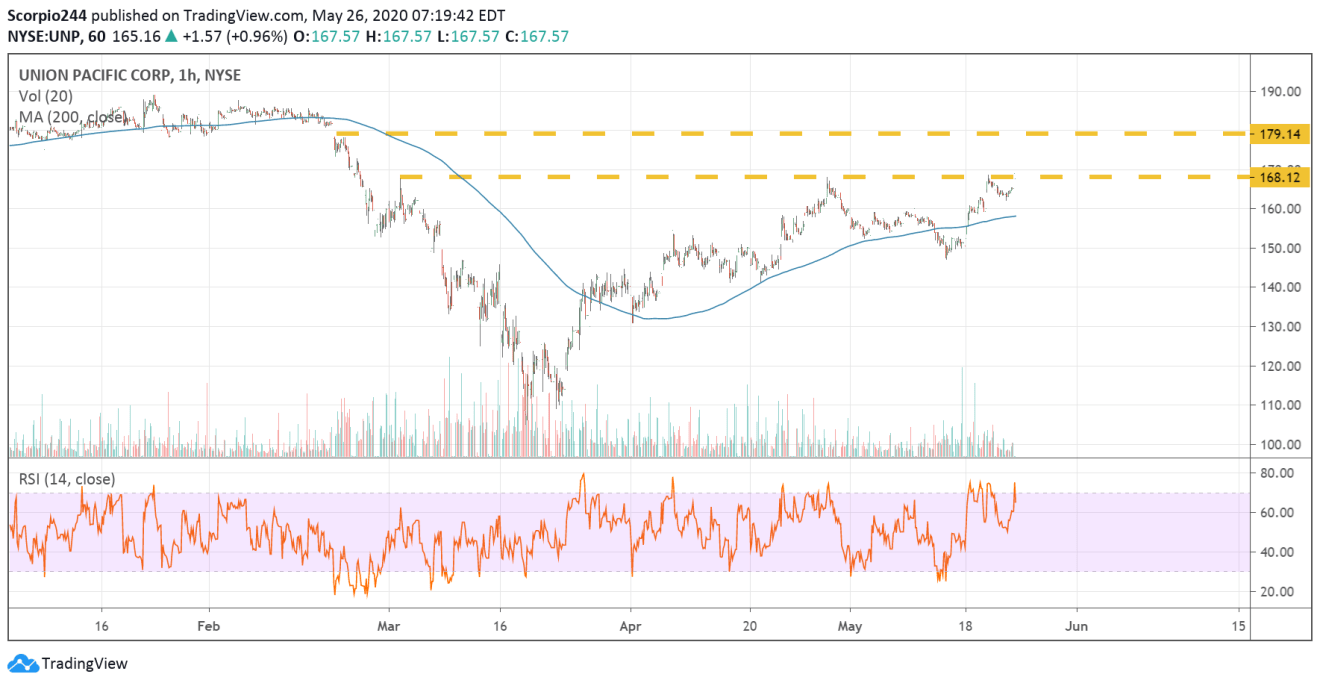

Union Pacific

Union Pacific (NYSE:UNP) is a significant industrial stock and could also help to lead the group along with Boeing. It has a big level of resistance to get through first, which could send it to around $179.

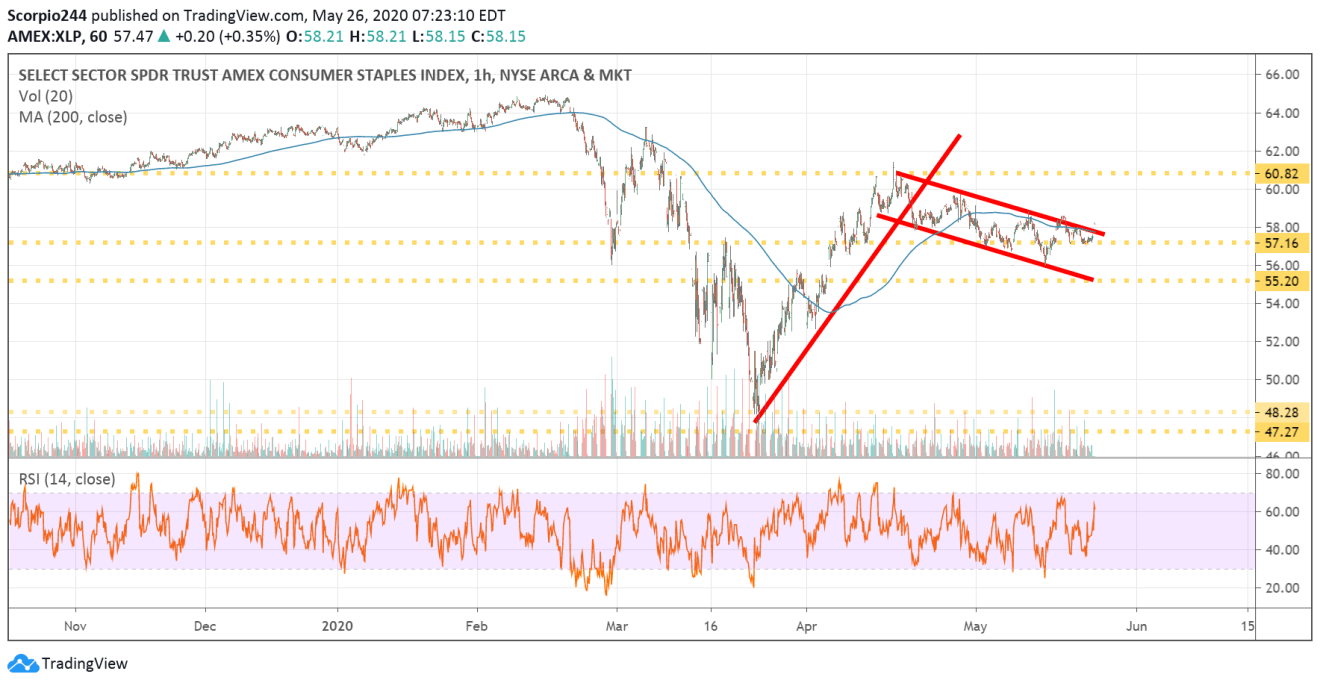

Staples

Consumer Staples (NYSE:XLP) haven’t been a great group, but one has to wonder if the XLP ETF is finally breaking out of a bull flag, with the potential to rise to around $61.

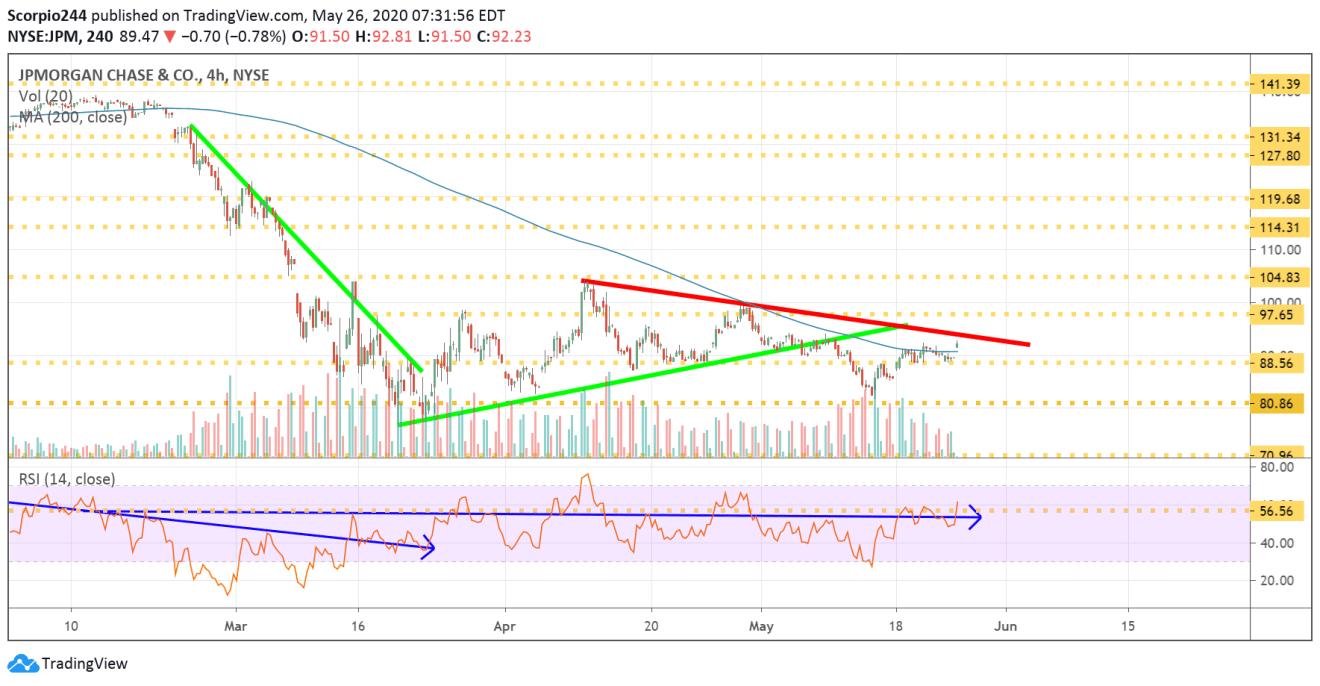

JPMorgan

JPMorgan (NYSE:JPM) is rising some today and has room to rise to a downtrend around $94.25.