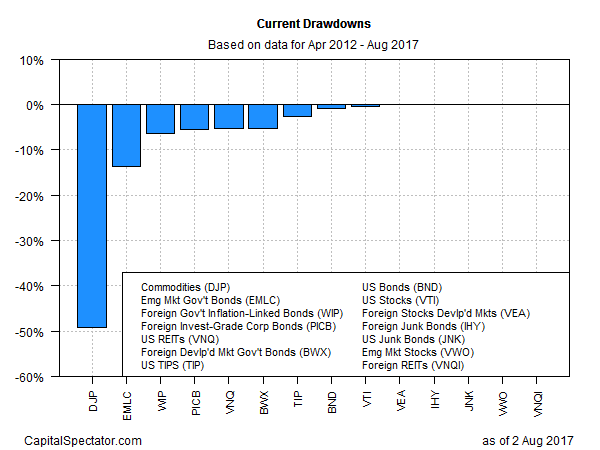

Drawdowns for the majority of the major asset classes remain under 7%, based on a set of representative exchange-traded products through yesterday’s close (Aug. 2). Four of the 14 asset classes are currently posting zero drawdowns and another three are below 3%, based on historical data for the past five years. Only two of the 14 major asset classes have drawdowns that exceed 10% declines. The generally serene risk profile offers another perspective on a simple fact: bull markets are widespread for most of the global markets.

Broadly defined commodities are the outlier at the moment: iPath Bloomberg Commodity Total Return ETN (NYSE:DJP) is deep in the hole with a 49% drawdown, a measure of a price decline from the previous peak. The only other market among the major asset classes with a drawdown below 10%: government bonds in emerging markets. VanEck Vectors JP Morgan Emerging Markets Local Currency Bond (NYSE:EMLC) is sitting on a roughly 14% drawdown.

Otherwise, drawdowns are light, in some cases nonexistent. Drawdown is zero for four markets: foreign junk bonds (NYSE:IHY) (IHY), US junk bonds (NYSE:JNK), equities in emerging markets (NYSE:VWO), and foreign real estate/REITs (NASDAQ:VNQI). Another eight funds are posting drawdowns that are relative light.

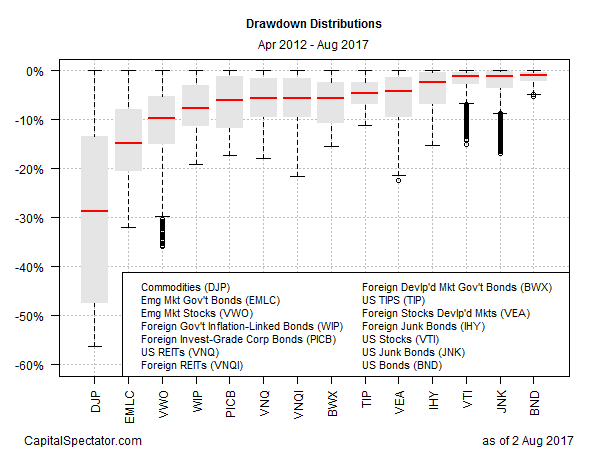

For some perspective on how drawdowns vary for each asset class through time, the next chart shows the distribution for this rick metric over the last five years. The red line marks the median drawdown for the sample period.

The generally benign drawdown profile is a reminder that bull markets prevail around the world for most markets. It may not be financial nirvana for investors, but it’s pretty close. Almost every asset allocation strategy is probably sitting on respectable, perhaps spectacular gains. The main exception: portfolios with a heavy weighting in commodities. Otherwise, bullish tailwinds have left investors flush.

What might end the party? No one really knows, although one analyst warns against thinking that time alone will kill the bull. Referencing the resilience of US stocks, Jefferies Chief Global Equity Strategist Sean Darby wrote last week that “equity bull markets don’t die of old age.” Rather, “they die either from the ill-effects of a credit cycle or from a policy mistake by the central bank tightening inadvertently.”

For the moment, the crowd is discounting both risks, arguably all risks. Meantime, everyone’s a genius in a bull market.