Markets were pretty quiet yesterday with the US away for the Martin Luther King holiday. The main news came late from the Eurozone in the form of another downgrade by Standard and Poor's although it was not a country that saw its rating slip. Last night the long-term rating of the European Financial Stability Facility was cut from AAA to AA+ as a direct result of the downgrade of France on Friday. S&P had warned that the EFSF was likely to be downgraded if one of the main AAA funding countries (Germany, France or the Netherlands) had their rating cut. There was no surprise to the announcement and although we saw a short term dip for the euro this has now disappeared.

The main macro data overnight was from China and a better than expected GDP figure has allowed risk to rally in the Asian session. Stock indices are higher by around 1% in the Far East with bourses in Europe expected to open higher as well. China posted a real GDP figure of 8.9% in Q4 although this was the lowest growth figure since 2009 and is still causing commentators to believe that we may need to see some form of monetary policy easing to keep things going. The fall, much like all things at the moment, is being attributed to a lack of export demand as a result of the Eurozone crisis. Even so, the fact that China is not growing at a rate of 11% per year anymore may mean that talk of a speculative bubble blowing up within the economy can be nixed in the short term.

EUR/USD is around 60bps higher on the day with GBP/EUR back into the mid-1.20s as punters are getting long of risk this morning. Cable is also around 30bps higher so far.

UK data comes in the form of CPI this morning with the Bank of England expecting this to be the first month of some fairly chunky falls in inflation in the UK economy. CPI is expected to fall to 4.2% in December from the November number of 4.8% and we expect it to be in the mid-2% range come the end of the year. UK PPI was lower on Friday for the first time in 18 months and, while this takes some time to flow through to the consumer basket, does show that the pressure from commodity markets is starting to ease. The main cause of the lower inflation will be last year’s VAT increase of 2.5 percentage points falling out of the year on year basket. This should allow the Bank of England to keep monetary policy loose and conditions fertile enough for the green shoots of recovery to grow, or so the theory goes. 2012 is still going to be a difficult year.

From Europe we have a mixture of two measures of confidence this morning. Firstly, at 10am, we have the latest German ZEW number that should show that economic sentiment in the German economy has slipped further into the mire and is expected to fall to the lowest level since July 2010. Either side of that announcement we have debt auctions from Spain (9.30am), Belgium (10.30am) and the newly downgraded EFSF at 11am. These are all short term auctions however with the longest being 18 months and as such not much volatility is expected. We would think that these may actually further strengthen the euro slightly as other short-term auctions did last week.

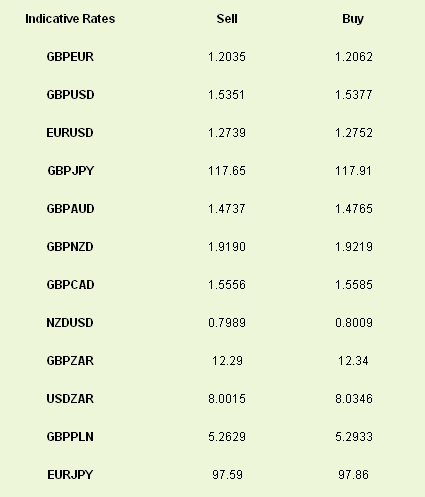

Latest exchange rates at time of writing

The main macro data overnight was from China and a better than expected GDP figure has allowed risk to rally in the Asian session. Stock indices are higher by around 1% in the Far East with bourses in Europe expected to open higher as well. China posted a real GDP figure of 8.9% in Q4 although this was the lowest growth figure since 2009 and is still causing commentators to believe that we may need to see some form of monetary policy easing to keep things going. The fall, much like all things at the moment, is being attributed to a lack of export demand as a result of the Eurozone crisis. Even so, the fact that China is not growing at a rate of 11% per year anymore may mean that talk of a speculative bubble blowing up within the economy can be nixed in the short term.

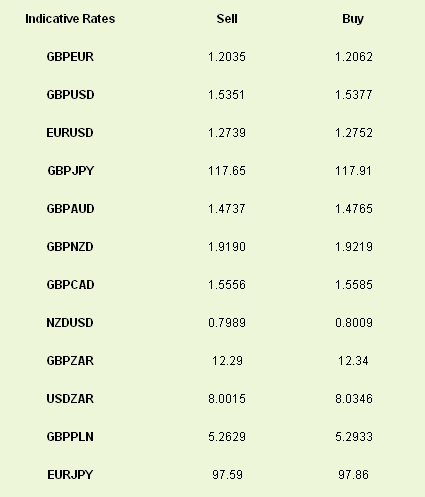

EUR/USD is around 60bps higher on the day with GBP/EUR back into the mid-1.20s as punters are getting long of risk this morning. Cable is also around 30bps higher so far.

UK data comes in the form of CPI this morning with the Bank of England expecting this to be the first month of some fairly chunky falls in inflation in the UK economy. CPI is expected to fall to 4.2% in December from the November number of 4.8% and we expect it to be in the mid-2% range come the end of the year. UK PPI was lower on Friday for the first time in 18 months and, while this takes some time to flow through to the consumer basket, does show that the pressure from commodity markets is starting to ease. The main cause of the lower inflation will be last year’s VAT increase of 2.5 percentage points falling out of the year on year basket. This should allow the Bank of England to keep monetary policy loose and conditions fertile enough for the green shoots of recovery to grow, or so the theory goes. 2012 is still going to be a difficult year.

From Europe we have a mixture of two measures of confidence this morning. Firstly, at 10am, we have the latest German ZEW number that should show that economic sentiment in the German economy has slipped further into the mire and is expected to fall to the lowest level since July 2010. Either side of that announcement we have debt auctions from Spain (9.30am), Belgium (10.30am) and the newly downgraded EFSF at 11am. These are all short term auctions however with the longest being 18 months and as such not much volatility is expected. We would think that these may actually further strengthen the euro slightly as other short-term auctions did last week.

Latest exchange rates at time of writing