In last week’s post, we covered why it makes sense to invest in individual bonds versus using a fund. A fund’s “one-size fits-all” approach can be convenient but may not be suitable for an individual who is looking for a tailored solution toward reaching their investment goals. By choosing to own individual bonds, you will have greater control that could lead to better performance. Furthermore, you should have a better grasp of your investments and where you stand today in reaching your goals.

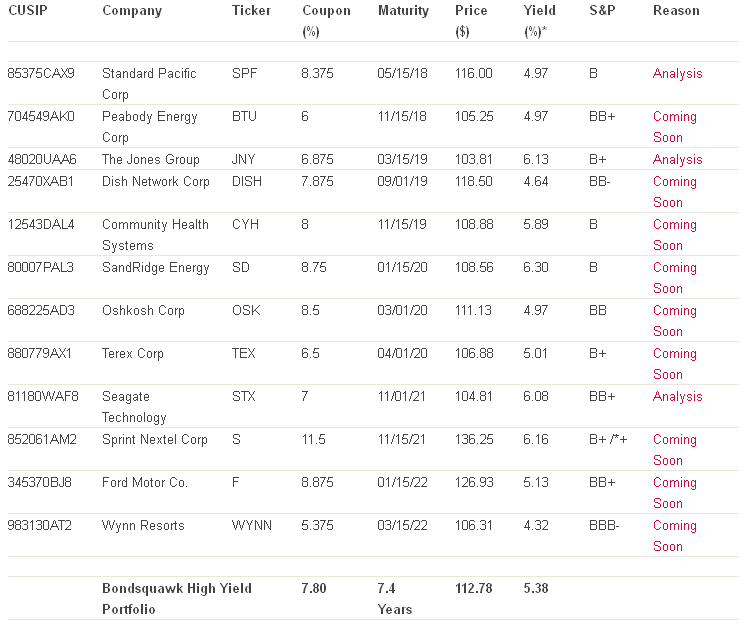

Below is Bondsquawk’s High Yield Bond Portfolio which consists of 12 bonds, one from each diverse sector. The model is used to illustrate an active High Yield portfolio that has bonds rated from BB+ or lower. The goal of this model portfolio is total return so both income and price changes are considered in determining the allocation.

* Yield shown is the Yield to Worst measure which is calculated by using the lower of either the Yield to Maturity or the Yield to Call on every possible call date.

Notes

- CYH 8.0% 11-15-19 is currently callable. The next call date is 11-15-15 at 104.00

- SD 8.75% 1-15-20 is currently callable. The next call date is 1-15-15 at 104.375

- OSK 8.5% 3-1-20 is currently callable. The next call date is 3-1-15 at 104.25

- TEX 6.5% 3-1-20 is currently callable. The next call date is 4-1-16 at 103.25

- STX 7.0% 11-1-21 is currently callable. The next call date is 5-1-16 at 103.50

- WYNN 5.375% 3-15-22 is currently callable. The next call date is 3-15-17 at 102.688

Information and market quotes on the bond investments are provided by Trade Monster’s Bond Trading Center.

The portfolio can change at any time. Bonds can be removed if price targets are achieved or original thesis is no longer valid.

Guidelines

High Yield Ratings (BB+ to C- ratings by Standard & Poor’s Ratings Services at time of inclusion)

1 to 30 Years Maturity

Taxable Bonds

Fixed Rate Coupon

U.S. Dollar Denominated Only

Disclaimer: The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.