Build up to the RBA:

December the 1st? Wow, somebody tell me where 2015 went?!

With today also the 1st Tuesday of the month, the Reserve Bank of Australia meets today for what is expected to be a fairly uneventful release. After last week’s comments about chilling out (God I love the RBA), the market has all but priced out any chance of another cut before Santa drops down our chimneys.

“I’m more than content to lower it if that actually helps, but is that the best thing to do at a particular time?”

“As for February, that’s three months away, we’ve got Christmas, we should just chill out and see what the data says.”

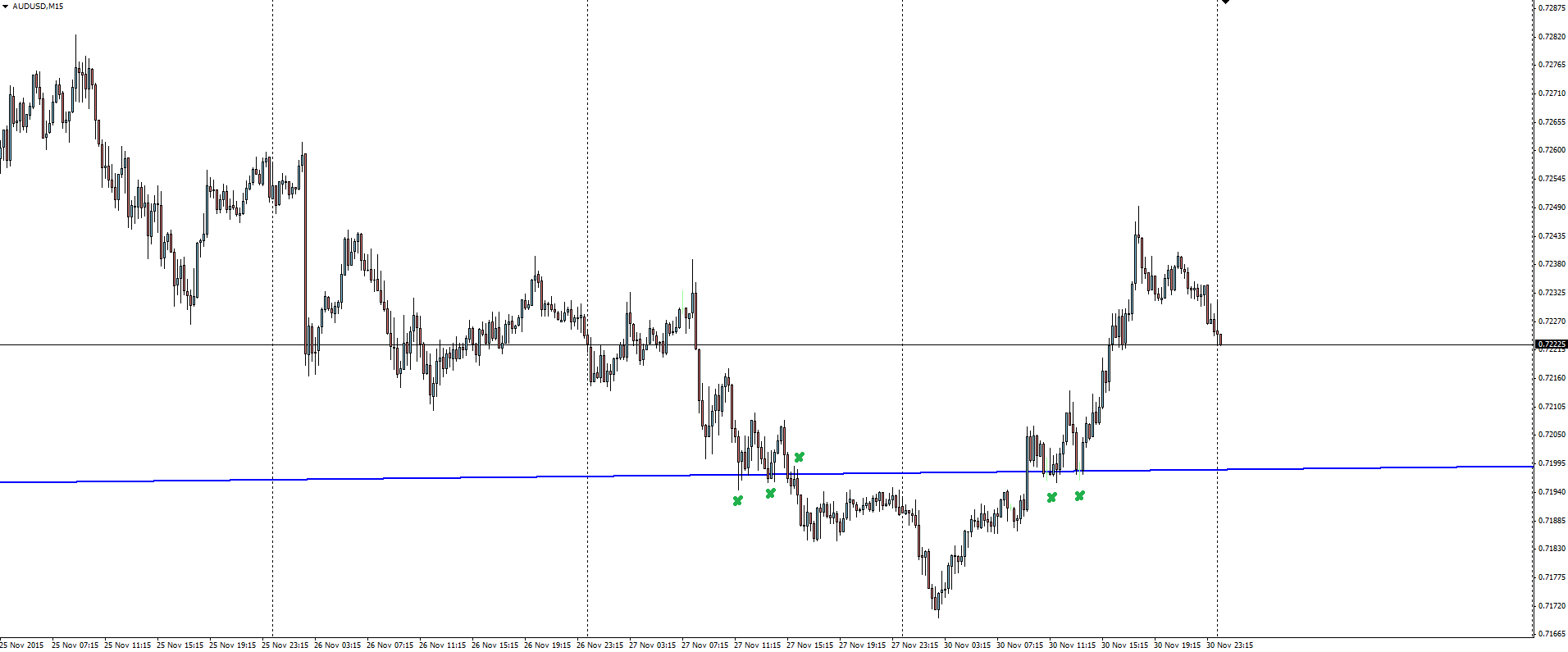

AUD/USD 15 Minute: As you can see from yesterday’s trading session, the Aussie traded higher heading into the release, bucking the trend of USDX strength. There has been slight improvement in the data outlook for the Australian economy lately, but with commodity prices continuing to get hammered far and wide, even from a chilled out Glenn, there is an expectation that we could see some jawboning of the Aussie.

As you can see from yesterday’s trading session, the Aussie traded higher heading into the release, bucking the trend of USDX strength. There has been slight improvement in the data outlook for the Australian economy lately, but with commodity prices continuing to get hammered far and wide, even from a chilled out Glenn, there is an expectation that we could see some jawboning of the Aussie.

I just love this AUD/USD weekly trend line. Even though the line is subjective and has been chopped through up and down multiple times even before yesterday, look at those clean touches on the 15 minute chart. Beautiful.

China Bonus:

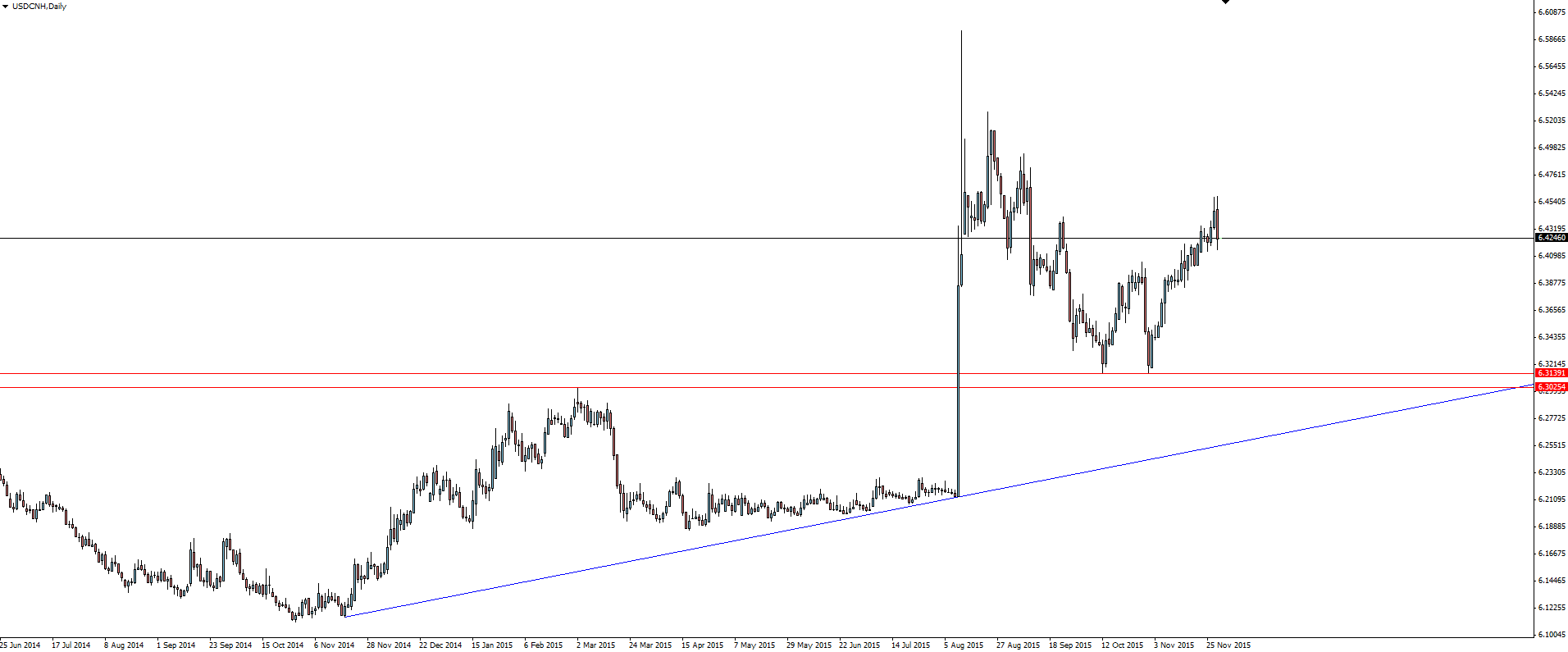

The International Monetary Fund yesterday approved China’s yuan to join its benchmark currency basket.

As we spoke about yesterday, this move was widely expected and there was no real shock in the 10.9% weighting that it was given. The move won’t come into effect until October next year, so there hasn’t been and won’t be much of a near term USD/CNH re-rating. It is, however, a huge political win for the Chinese government.

USD/CNH Daily:

On the Calendar Tuesday:

CNY Manufacturing PMI

CNY Caixin Manufacturing PMI

AUD Cash Rate

AUD RBA Rate Statement

GBP Bank Stress Test Results

EUR PMIs

GBP BOE Gov Carney Speaks

GBP Manufacturing PMI

CAD GDP m/m

USD ISM Manufacturing PMI

Chart of the Day:

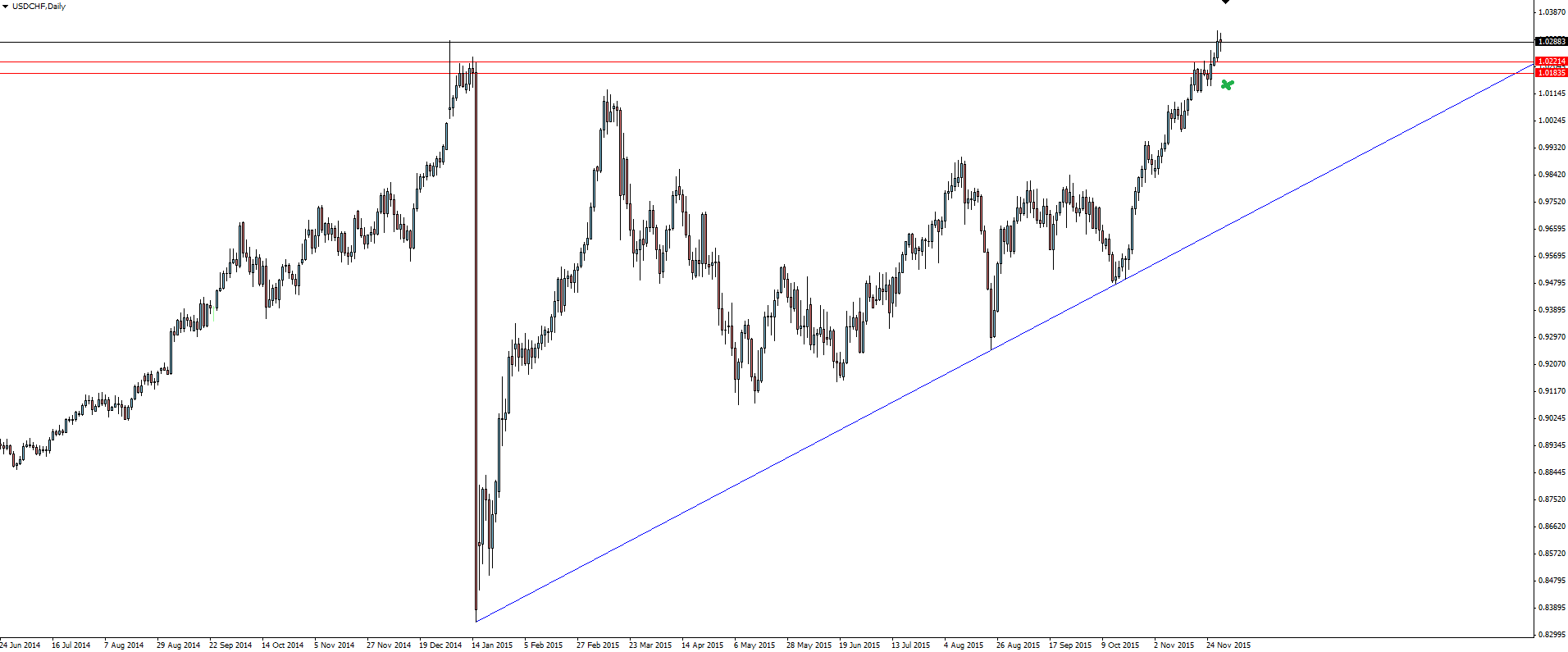

Let the bells ring out, the Swissy is once again ABOVE the SNB Floor Level!

USD/CHF Daily:

The daily chart shows that both the initial floor level has been cleared, as well as the highs of the candle that spiked in the week before the rug was pulled out from under us. Price is now flirting with this high.

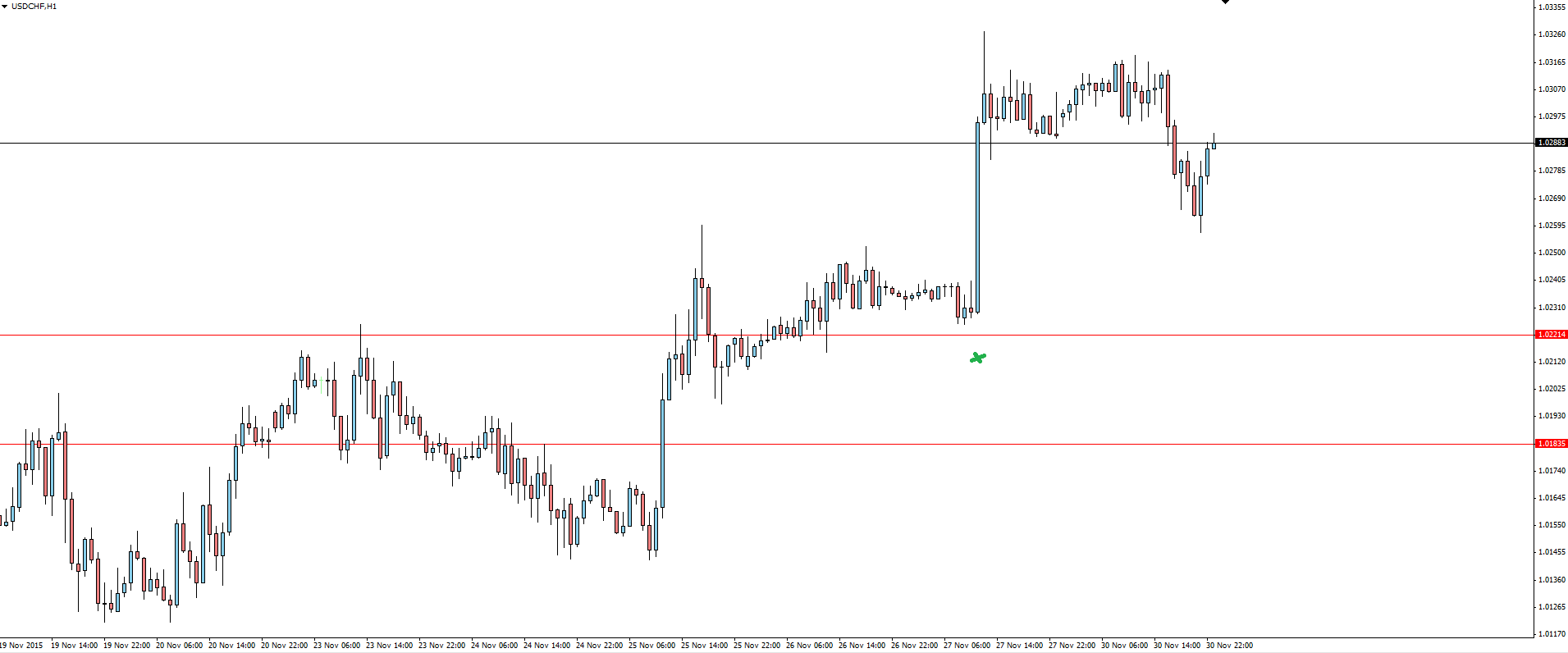

USD/CHF Hourly:

Click on chart to see a larger view.

On the hourly chart, we can see the bullish price action where price ripped out of the zone basically without a single pull back. A picture of strength, but the pull-back will come.

Do you see opportunity trading USD/CHF?

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex broker Vantage FX Pty Ltd does not contain a record of our prices, or an offer of, or solicitation for a transaction. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Australian FX Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.