Earlier this month, Warren Buffett's Berkshire Hathaway (NYSE:BRKa) (NYSE: BRK.A) stirred up the market with a big announcement - it's changing its share repurchase policy to be more "flexible."

The framework previously allowed for the buyback of shares at prices "no higher than a 20% premium to book value."

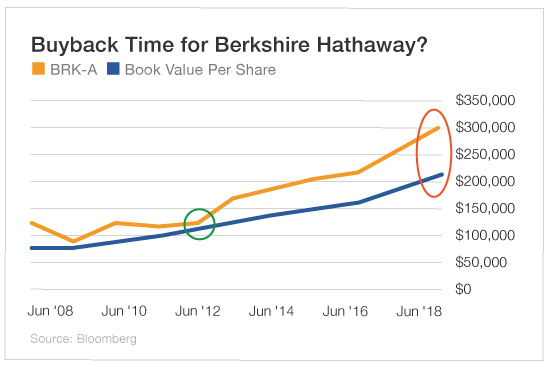

This is not the first time Berkshire has updated this policy. When it announced its first repurchase plan with Buffett at the helm in 2011, the program limited the premium to just 10% over book value. With the current price hovering around a 40% premium to book value, a buyback now would be double the previous policy's limit.

Investors saw shares rise more than 8% with that announcement seven years ago, and it seems like they're setting up for a repeat in 2018. Since this most recent policy change, Berkshire's stock is up 5% on the news.

What does this mean for Berkshire?

Announcing a willingness to buy back company stock at more than a 20% premium to book value is a stimulus for investors to get in beforehand... and see the value per share go up when the buyback takes place.

We saw this in 2011 when Berkshire announced its first repurchase program change:

| In the opinion of our board and management, the underlying businesses of Berkshire are worth considerably more than this amount, though any such estimate is necessarily imprecise. If we are correct in our opinion, repurchases will enhance the per-share intrinsic value of Berkshire shares, benefiting shareholders who retain their interest. |

This time, it's not all good news, though. Berkshire built its empire through acquisitions. But now, that model is slowing down. It's currently sitting on more than $100 billion dollars in cash. Buffett and his group have been looking to pick up something new but have not found anything large enough to spend money on.

When the main business strategy is to buy companies and improve their value, not executing on that strategy slows growth and chills investor sentiment. This new buyback plan may just be a short-term fix for a longer-term problem with Berkshire.

In the meantime, you may want take advantage of the unique opportunity to buy Berkshire before the buyback boosts its stock performance.