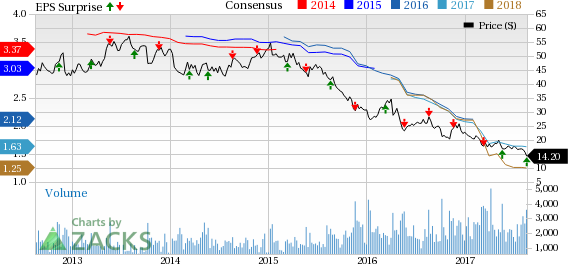

The Buckle, Inc. (NYSE:BKE) reported better-than-expected earnings for the second straight quarter in second-quarter fiscal 2017. This also marked its second earnings beat after four consecutive misses. Moreover, the company’s top line met estimates for the 12th straight quarter.

However, shares of Buckle dropped 0.7% following the earnings release as its dismal comparable store sales (comps) trend continued in the quarter. The company’s comps have been strained for quite some time now with the advent of digital transformation in shopping and consumers splurging online. This has considerably hit store and mall traffic trends across the United States.

Moreover, the stock has plunged nearly 31.9% in the last six months, wider than the industry’s decline of 26.9%. Currently, the industry is placed at the bottom 39% of the Zacks classified industries (157 out of 256). On the contrary, the broader Retail-Wholesale sector gained 8.7%.

Q2 Highlights

The company reported earnings per share of 24 cents that surpassed the Zacks Consensus Estimate of 22 cents but declined 25% from 32 cents delivered in the year-ago quarter. Its net sales of $195.7 million were in line with the Zacks Consensus Estimate but dropped 7.8% year over year.

Women’s merchandise sales declined 13.5%, while Men’s merchandise sales dropped nearly 5.5%. Women’s merchandise contributed 49.5% to total sales, while the Men’s business input was pegged at 50.5%.

Combined accessory sales fell nearly 8.5%, while footwear sales inched up 1%. These two categories contributed roughly 10.5% and 6.5%, respectively, to second-quarter net sales.

Comps decreased 7.7% from the prior-year quarter. Moreover, online sales (not included in comparable-store sales) declined 4.5% year over year to $19.5 million.

We observed that Buckle’s net sales decreased 9%, 5.9%, 8.8%, in July, June and May, respectively. Meanwhile, comparable sales declined a respective 8.4%, 5.8% and 9% in July, June and May.

The company’s gross profit declined 7.3% to $74.1 million. However, gross margin expanded nearly 20 basis points (bps) to 37.9%. The upside was driven by higher merchandise margin and gains from higher cost of sales in fiscal 2016 related to the redemption of rewards under the sunset of old Primo card loyalty program. This was partly negated by higher occupancy, buying and distribution expenses due to lower comps.

Operating income fell 27.8% to $17.4 million in the quarter. Also, operating margin came in at 8.9%, down from 11.4% recorded in the prior-year quarter.

Other Financial Aspects

Buckle ended the quarter with cash and cash equivalents of $195.6 million, receivables of $14.7 million and total shareholders’ equity of $437.1 million.

Moreover, the company had accounts payable of $39.9 million. As of Jul 29, 2017, it incurred capital expenditures of $7.2 million. Management now anticipates capital expenditures in the range of $15–$20 million for fiscal 2017.

As of Jul 29, 2017, Buckle operated 463 retail stores across 44 states.

Zacks Rank & Stocks to Consider

Buckle currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the same industry include The Children's Place, Inc. (NASDAQ:PLCE) , Canada Goose Holdings Inc. (NYSE:GOOS) and The Gap, Inc. (NYSE:GPS) , all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Children's Place delivered an average positive earnings surprise of 16.3% in the trailing four quarters and has a long-term earnings growth rate of 9%.

Canada Goose Holdings came up with positive earnings surprise of 33.3% in the last reported quarter and has a long-term earnings growth rate of 34.1%.

Gap, Inc. pulled off an average positive earnings surprise of 6.5% in the trailing four quarters and has a long-term earnings growth rate of 8%.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Buckle, Inc. (The) (BKE): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS): Free Stock Analysis Report

Original post

Zacks Investment Research