The Fed continues to push the notion that the employment picture is robust. Unfortunately, the reality is a lot less vigorous.

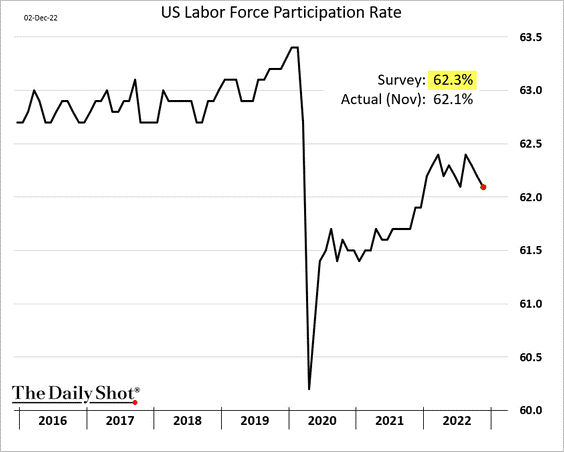

Consider the fact that millions of working-aged Americans never returned to the workforce after the 2020 pandemic. The labor force participation rate (LFPR) remains well below the pre-pandemic peak.

Some have tried to explain the circumstances in terms of new retirees. Yet, the notion does not pass the vision test.

In the chart above, one can see that the labor force participation rate (LFPR) held relatively steady between 2016-2019. It even ticked higher as the employment environment continued to improve.

Is it likely, then, that a tsunami of Baby Boomers suddenly cashed in during the 2020s alone? No it is not.

In truth, the LFPR catapulted higher throughout 2020 and 2021. In 2022, though, deteriorating trends in employment have since emerged.

So why does the official unemployment rate remain remarkably low at a mere 3.7%? Fewer working-aged individuals in the workforce per the LFPR above removes people from being counted as “unemployed.”

It gets worse.

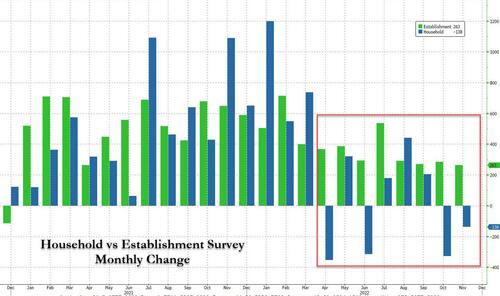

The financial media highlight the Bureau of Labor Statistics (BLS) data — 263,000 jobs were created in November. What’s more the BLS is reporting the creation of 2.7 million jobs over the last eight months.

However, the more venerable Household Survey demonstrates that jobs have been lost in 4 of the last 8 months. (See the blue bars for the Household Survey versus the green bars of the BLS “Establishment” reporting below.)

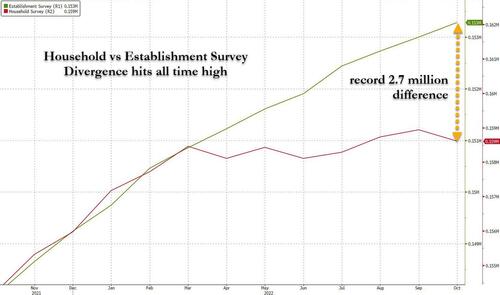

Put another way, the Household Survey explains that there were essentially the same number of employed folks in March of 2022 as there were in November of 2022 (158.5 million). Zero job growth.

In complete contrast, we have the BLS reporting that as many as 2.7 million jobs were added in the same time frame. Talk about a monstrous discrepancy!

In essence, the BLS process counts every part-time job and seasonal acquisition as a pick-up. Multiple job holders with two or three positions will count as two or three jobs. Meanwhile, the Household Survey provides a more genuine picture — a person is working or a person is not.

It does not take a genetics professor to recognize that more and more people are losing their high-paying, full-time jobs. The list of high profile names announcing layoffs is a long one, including, but not limited to:

- DoorDash Inc (NYSE:DASH) layoffs: 6% of workforce laid off (November, 2022)

- Amazon (NASDAQ:AMZN) layoffs: 1% of workforce laid off beginning (November, 2022)

- Meta Platforms (NASDAQ:META) layoffs: 13% of workforce laid off (November, 2022)

- Twitter layoffs: 50% of workforce laid off (November, 2022)

- Zillow Group (NASDAQ:ZG) (NASDAQ:Z) layoffs: 5% of workforce laid off (October, 2022)

- Peloton (NASDAQ:PTON)layoffs: 12% of workforce laid off (October, 2022)

- DocuSign (NASDAQ:DOCU) layoffs: 9% of workforce laid off (September, 2022)

- Taboola (NASDAQ:TBLA) layoffs: 6% of workforce laid off (September, 2022)

- Snap (NYSE:SNAP) layoffs: 20% of workforce laid off (September, 2022)

- Lyft (NASDAQ:LYFT) layoffs: 2% of workforce laid off (July, 2022)

It is not just the tech space either.

The Wall Street Journal reported this week that PepsiCo (NASDAQ:PEP) Inc. is laying off employees at its headquarters. Those are likely to be higher paying roles with managerial responsibilities. Walmart (NYSE:WMT) and Ford are trimming the white-collar base as well.

The implication for investors is reasonably straightforward. A recession is already here.

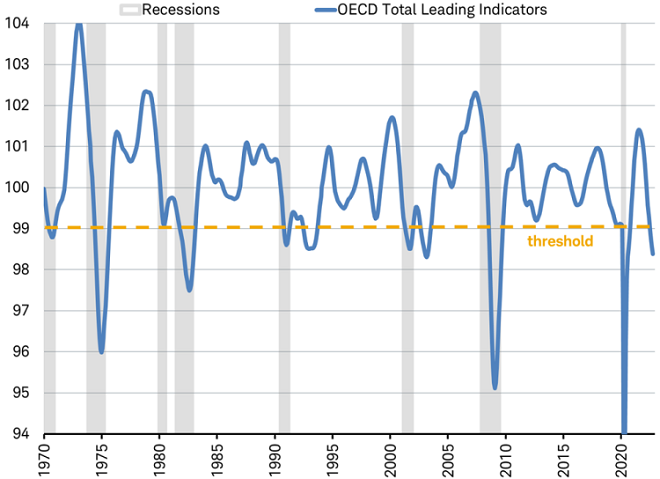

You’re seeing it in leading economic indicators.

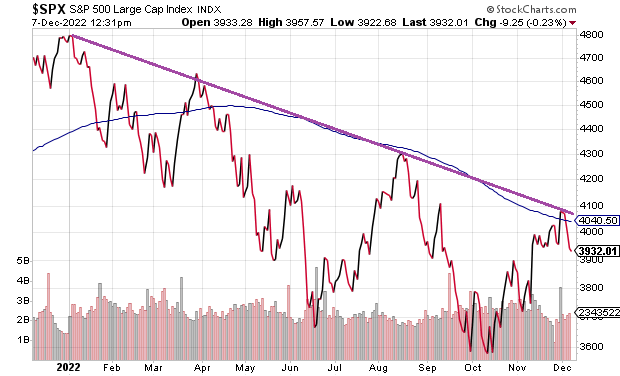

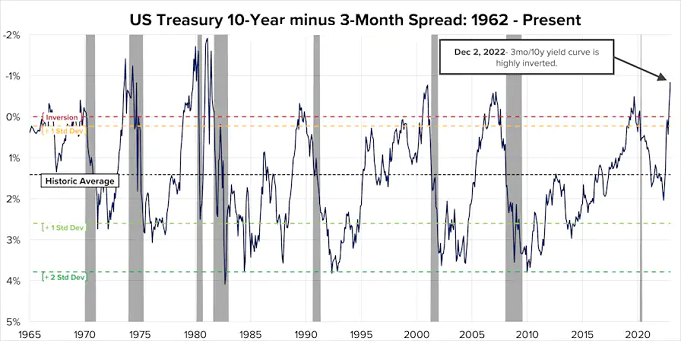

You’re seeing it in the financial markets as the investment community acquires intermediate-maturity Treasuries, even as the Fed continues to manipulate the shortest maturities higher.

And you’re seeing bear market rallies fool investors into believing that this time is different.