Most retailers must be very happy 2017 is over. It has been an extremely tough year for the sector as store closures and even bankruptcies mounted. Fast-food chains, apparel stores, specialty retailer and even grocers felt the pressure of declining mall traffic and changing customer habits. As a result, their stocks sold off, as well. The mainstream media even named it “the retail apocalypse”. The shareholders of Buckle Inc (NYSE:BKE). – a Kearney, Nebraska-headquartered apparel chain, which employs approximately 3200 people – saw the stock price drop from $56.13 to as low as $13.50 for a 76% decline since January, 2015. However, not all retailers were doomed and The Buckle already seems to be recovering.

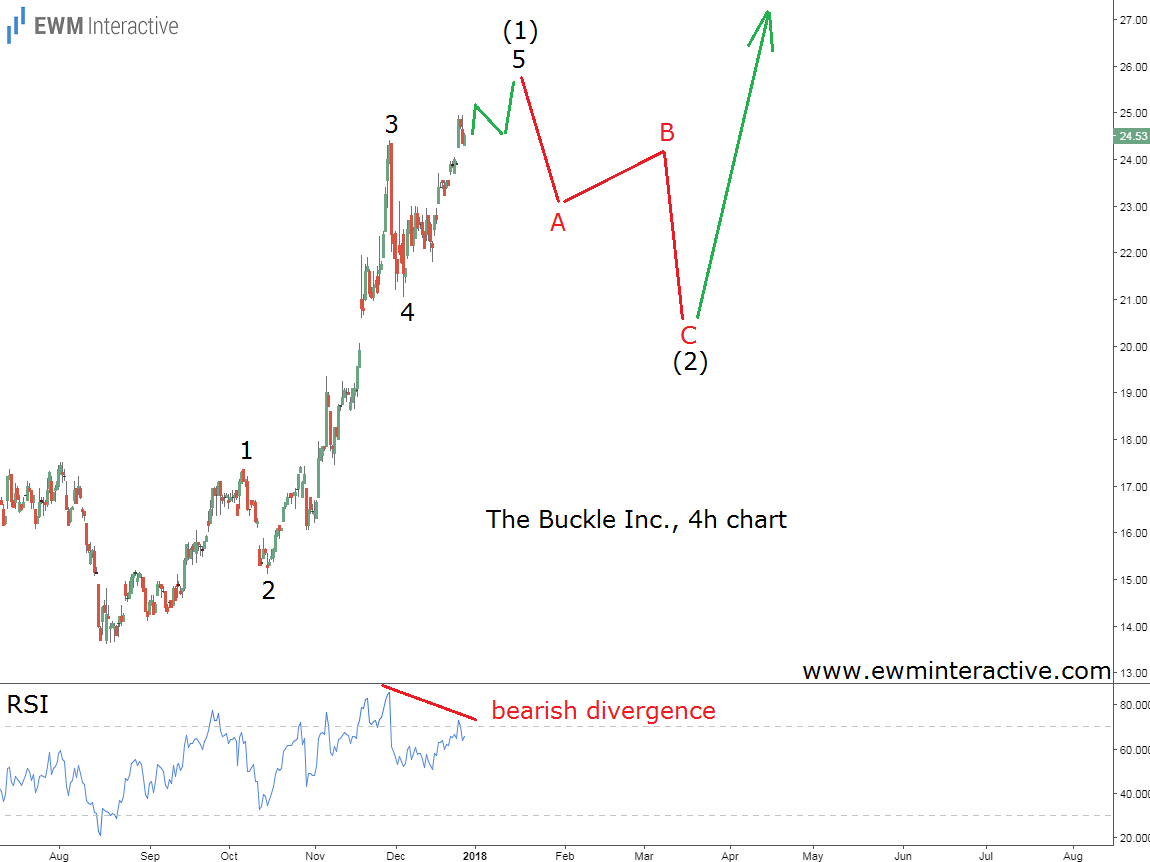

The 4-hour chart of BKE stock visualizes the recovery from $13.50 to $25 so far. As visible, it takes the shape of a textbook impulse, which according to the Elliott Wave Principle means the slump is over and the trend is pointing north again. If this count is correct, The Buckle has turned the corner and the worst of the retail crisis is already behind it.

The stock is up by over 81% from the low, which might make some people feel they have missed the train. We do not think so. First, because every impulse is followed by a three-wave correction before the trend resumes. And second, because the relative strength index further support the short-term negative outlook by revealing a bearish divergence between waves 5 and 3 of (1).

If this count is correct, we should get ready for a three-wave pullback in wave (2), whose targets lie near the support area of wave 4. In terms of price, we should not be surprised to see a dip to $21 or even $20, which would provide us with another chance to board this profitable, debt-free, dividend-paying retailer. In the long-term, future looks bright for The Buckle’s shareholders.