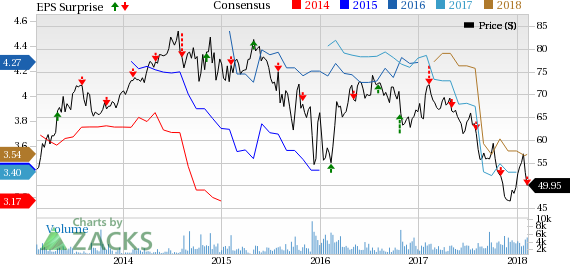

Buckeye Partners, L.P. (NYSE:BPL) reported fourth-quarter 2017 earnings of 85 cents per unit, lagging the Zacks Consensus Estimate of 88 cents by 3.4%. However, earnings was higher than the year-ago figure of 78 cents by nearly 9%.

The year-over-year rise in earnings was due to increased pipeline and terminal throughput volumes during the quarter and improved operating performance from its Buckeye Texas Partners joint venture.

Total Revenues

In the quarter under review, Buckeye Partners’ total revenues came in at $946.1 million, beating the Zacks Consensus Estimate of $923 million by 2.5%.

Total revenues were up 2.4% year over year owing to better performance of Merchant Services and Domestic Pipelines & Terminals segment in fourth-quarter 2017.

Operational Highlights

In the quarter, the partnership’s adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) from continuing operations increased 13.6% year over year to $289.9 million.

Total costs and expenses were $772.7 million, up 0.7%. The partnership’s operating income was up 1.1% to nearly $173.3 million from $156.9 million a year ago.

Interest and debt expenses increased 11.6% year over year to $56.7 million.

Financial Screening

As of Dec 31, 2017, Buckeye Partners had cash and cash equivalents of $2.1 million compared with $640.3 million as of Dec 31, 2016.

Long-term debt as of Dec 31, 2017 was $4,658.3 million, higher than $4,217.7 million as of Dec 31, 2016.

Total capital expenditure in the fourth quarter was $129.7 million, up 22% from $106.2 million a year ago.

Upcoming Release

ONEOK, Inc. (NYSE:OKE) is expected to report fourth-quarter 2017 results on Feb 26. The Zacks Consensus Estimate is pegged at 51 cents.

Chesapeake Utilities Corporation (NYSE:CPK) is expected to report fourth-quarter 2017 results on Feb 26. The Zacks Consensus Estimate is pegged at 85 cents.

EQT Midstream Partners, LP (NYSE:EQM) is expected to report fourth-quarter 2017 results on Feb 15. The Zacks Consensus Estimate is pegged at $1.55.

Zacks Rank

Buckeye Partners carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

ONEOK, Inc. (OKE): Free Stock Analysis Report

Chesapeake Utilities Corporation (CPK): Free Stock Analysis Report

Buckeye Partners L.P. (BPL): Free Stock Analysis Report

EQT Midstream Partners, LP (EQM): Free Stock Analysis Report

Original post