In the same vein

US approval for Varithena represents another inflection point for BTG's, (BTG) Interventional Medicine (IM) business. Four commercial-stage products, which target the fast-growing interventional oncology and vascular markets, could take IM sales to c £390m by FY20. Our revised valuation of £2.2bn (606p/share) could rise to £2.3bn with pipeline success. Marketed assets plus Varithena are worth up to 564p, implying downside protection.

IM business: Another growth inflection point

FDA approval for Varithena, alongside recent acquisitions, represents yet another growth inflection point for IM. There are now has four commercial-stage products targeting the fast-growing interventional oncology (Beads, TheraSphere) and interventional vascular (Varithena, EkoSonic) markets. We expect the IM segment to deliver revenues of £392m in FY20 and achieve peak sales of £436m by FY24.

SP and LG businesses: Highly cash generative

Specialty Pharma (SP) revenues rose 3% y-o-y in H1, with acceleration in DigiFab (+33%) offsetting weakness in CroFab and Voraxaze. SP margins are strong, the segment is cash generative, and we project high single-digit growth (7% CAGR FY14-20). BTG is seeking new SP products to bolster growth. Licensing (LG) is a highly cash generative division due to growing Zytiga royalties (£42m in fiscal H1) and should receive first Lemtrada royalties in FY14.

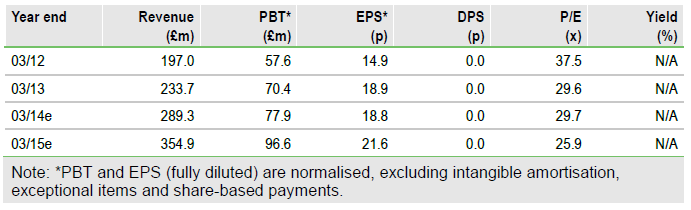

Financials: Increasing operating leverage

Updating our model for the interims and Varithena approval drives a small increase (1-2%) in FY14 and FY15 revenues and a double-digit rise (10-19%) in underlying operating profit. We forecast FY14 revenues of £289m, underlying operating profit (pre-acquisition adjustments, reorganisation costs and share-based payments) of £76m, normalised EPS of 19p, and cash of £31m. We project FY15 revenues of £355m, underlying operating profit of £96m, diluted EPS of 22p and cash of £69m.

Valuation: Fair value rises to £2.2bn (606p/share)

We now value BTG at £2.2bn (606p/share) based on a probability-weighted, sum-of-the-parts DCF analysis. This compares to our previous valuation of £1.9bn or 516p/share. Pipeline successes could see our DCF rise to £2.3bn or 643p/share. Our fair value is underpinned by a valuation of 421p for marketed assets, which rises to 564p following Varithena launch. This implies considerable downside protection if the pipeline fails to achieve key clinical and regulatory milestones.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

BTG: Increasing Operating Leverage

Published 12/13/2013, 03:29 AM

Updated 07/09/2023, 06:31 AM

BTG: Increasing Operating Leverage

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.