Facebook’s Mark Zuckerberg testified before Congress on October 23rd about the company’s Libra cryptocurrency project. The hearing didn’t go as smooth as the crypto community hoped, which reflected on the price of digital assets such as Bitcoin. At one point on Wednesday, BTC/USD was down by over $750 for the day.

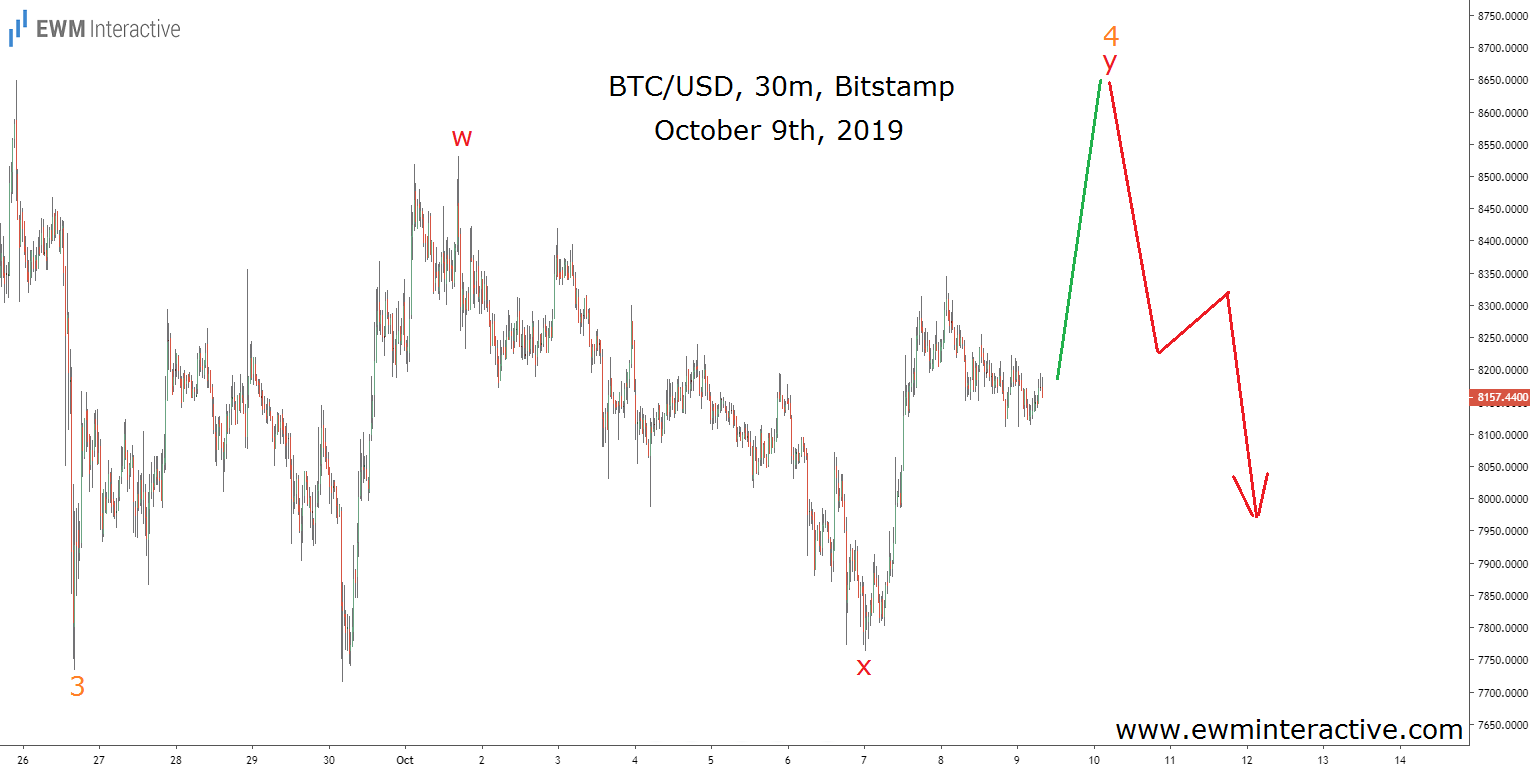

But was Zuckerberg’s Libra testimony the actual reason for Bitcoin’s plunge? As Elliott Wave analysts, we believe the news is startling only to those unaware of the larger trend. In BTC/USD’s case, the larger trend was pointing south when we sent the following chart on October 9th.

Two full weeks before Zuckerberg’s hearing in Congress BTC/USD was hovering around $8150. Since the price has been trading sideways for some time, we thought a correction in wave 4 was in progress. It made sense to expect more strength in wave “y” to a new swing high before the bears return in wave 5.

Libra Testimony Just a Catalyst for BTC/USD Plunge

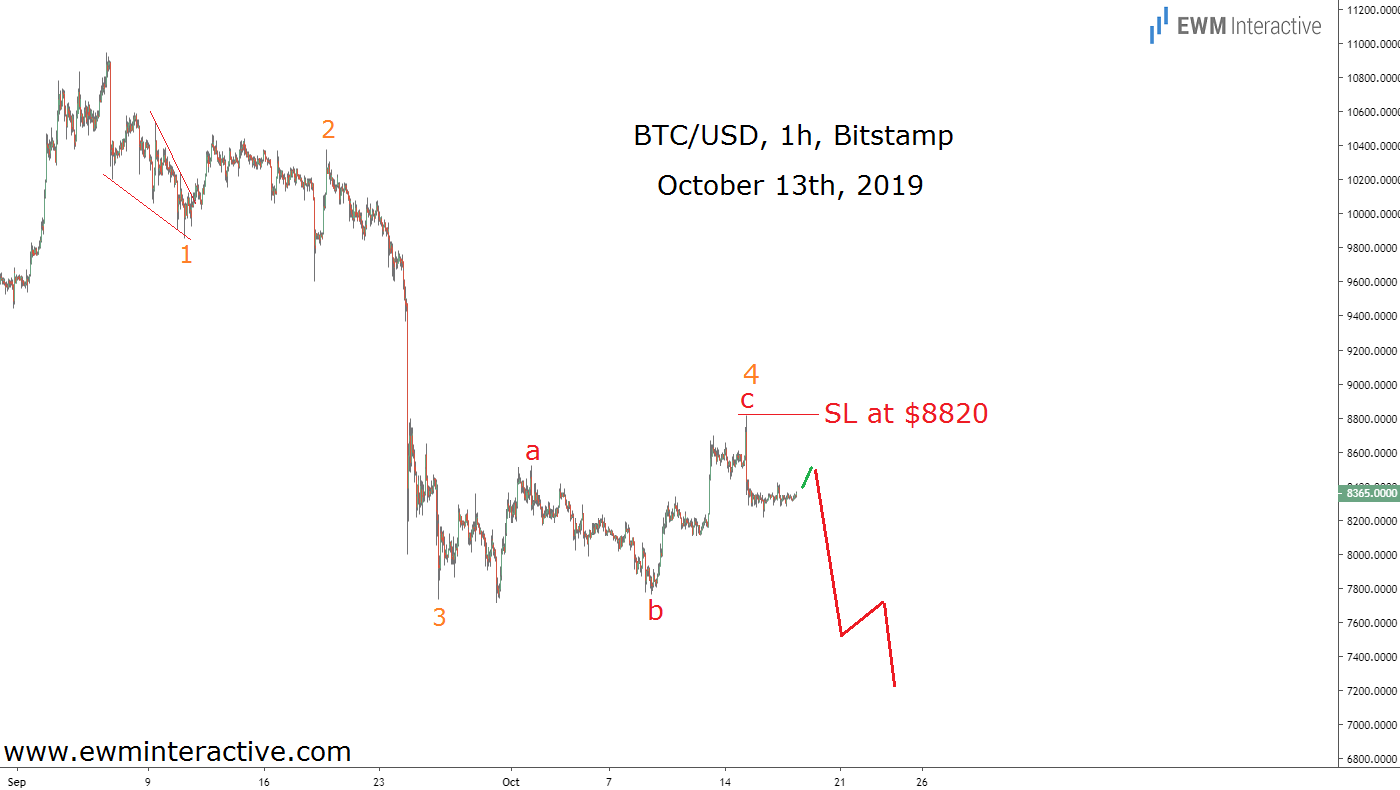

We thought the reversal should occur in the price area between $8500 and $9000. However, the exact level was unknown and picking tops is not worth the risk. Therefore, waiting for the bears to announce their return before going short was a better idea. By the time we sent our next update on October 13th, they were already back.

What we thought was going to be a three-wave sequence in wave “y” turned out to be a five-wave impulse in wave “c”. This, however, didn’t change the overall outlook at all. With a bearish reversal already in place at $8820 it was time for more weakness towards a new low.

Wave 5 was supposed to breach the bottom of wave 3, which meant a decline to at least $7700 could be expected. Full ten days before Mark Zuckerberg headed to Congress to testify about Facebook’s Libra, the Elliott Wave stage was already set for another plunge in BTC/USD.

While Facebook’s CEO was answering lawmakers’ questions, the biggest cryptocurrency fell to an intraday low of $7293. The question is, was BTC/USD going to rise had Congressmen been more receptive to Libra? Hard to say. All we know is there was an incomplete Elliott Wave pattern on the hourly chart of Bitcoin. It looks much closer to completion now.