The strong extended bullish rally in the BTC/USD pair has come to an end after the pair hit a record high at 19773.7.From that level, the pair started its bearish correction and found some decent support at 6050.2.Though this level provided some fresh buying power to the BTC/USD bulls, still the recent fall from 19773.7 is not yet completed. Currently, the pair is heading towards the 50% bearish retracement (drawn from the high of 16th December 2017 to the low of 6th February 2018).Most of the professional price action traders will be looking for bearish price action confirmation signal near the critical resistance level at 12892.4 to short this pair.

BTC/USD daily chart analysis

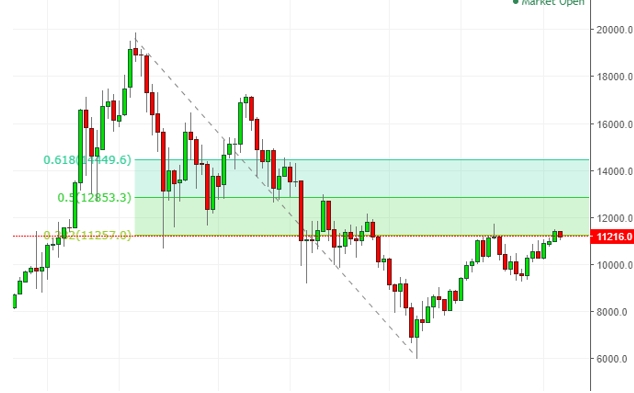

Figure: Price slowly heading towards the 50% retracement level.

From the above figure, we can clearly see the bulls are trying to gain bullish momentum to recover its loss. However, we have plenty of resistance level above the current price level which is definitely a bearish threat to the BTC/USD pair. According to the CEO of iOlite, Alfred Shaffir, after this current fall, the community will have a golden opportunity to join the cryptocurrency industry at a favorable market condition. If the pair manages to break above the critical resistance level at 12853.3, we might see the retest of 61.8% Fibonacci retracement level. Most of the conservative traders will be looking for bearish price action confirmation signal at that level to execute their short orders. On the contrary, a clear break of 61.8% retracement level will confirm the completion of bearish correction in the BTC/USD pair.

A daily closing of the price above the 61.8% retracement level (14456.3) will change the current sentiment of the market from bearish to bullish. Upon the confirmation of the initial bottom formation at 6050.2, the bulls will ultimately target the major resistance level at 17193.2.From that level, we might see some selling pressure but a clear break of that resistance level will lead this pair towards the of 16th December 2017.This level is very crucial for the long-term BTC/USD buyer. A firm break of the price above the critical resistance level at 19773.7 will refuel the BTC/USD bulls in the global market. On the downside, if the pair rejects the 50% retracement level we will see a sharp drop in the price towards the 6050.2 level. This will eventually lead this pair towards the 4838.2.Considering the technical parameters buying the BTC/USD at the current price level will be an immature act. On the contrary in the absence of definite bullish reversal signal, we have no interest in buying this pair.