Bitcoin analytics and the most likely scenario for the BTC/USD price movements in the near future. In this post I applied the following tools: fundamental analysis, all-round market view, market balance level, volume profile, graphic analysis, trendline analysis, Tic-Tac-Toe chart.

The new week has come. As it is usual on Mondays, I offer you my forecast for the cryptocurrency king, Bitcoin, and the corresponding trading instrument, BTC/USD.

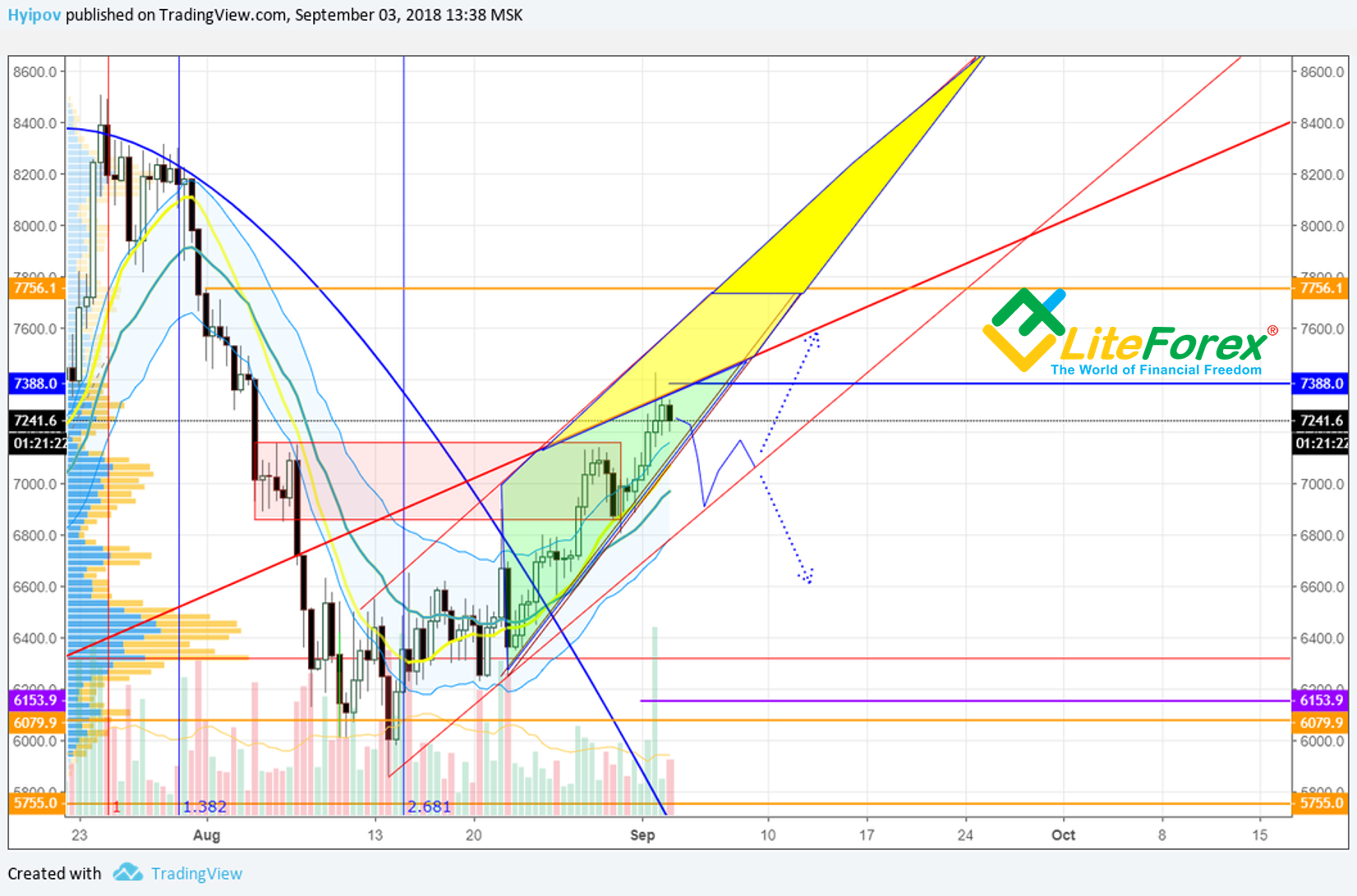

The recent week was rich in surprises. Nobody had expected Bitcoin to drop so deep. Let’s see how BTC/USD actual price moves have matched to my projections.

In my previous forecast, I suggested that the market is obviously overbought and heavy to move. I expected BTC to move down and break through the first trend; however, I didn’t think it would be falling so fast. As it is clear from Bitcoin price chart above, there was an enormous price dump, touching the low at 6119.50 USD.

40 million of the cryptocurrency market participants witnessed how Bitcoin’s drop covered its entire rise, which was developing during almost a whole month, just in a couple of hours.

BTC/USD fundamental analysis

It is remarkable that there were hardly any fundamental reasons for such a deep dive. There wasn’t any negative news at that time, and those stories that later were being linked to the crash, seem to be a nonsense.

I mean, the manipulators have the impertinence to skip preparing the needed news background and they are just pressing the market down by means of their big positions. This strong drawdown has changed the fundamental situation.

BTC/USD technical analysis

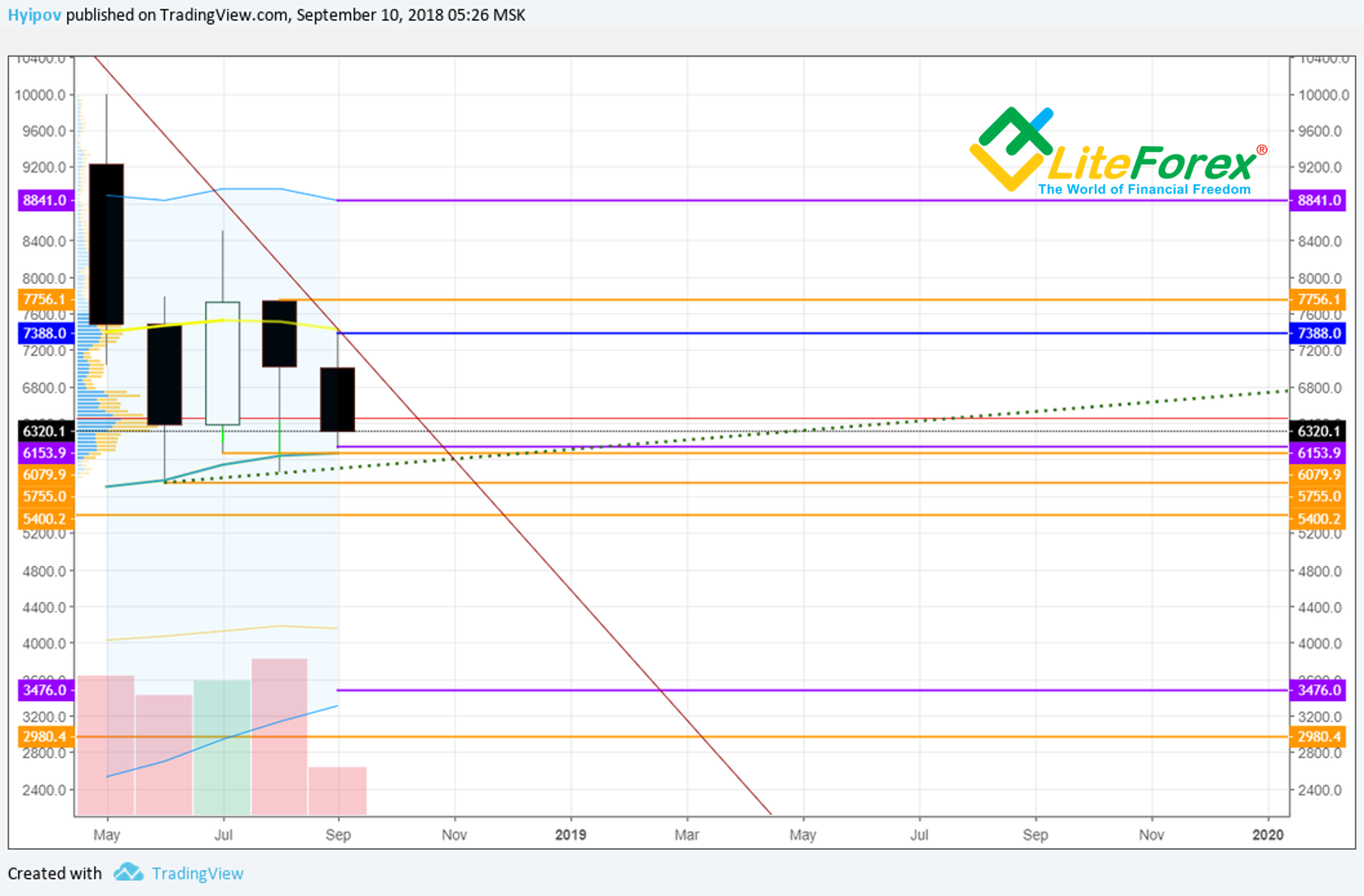

As you see in the BTC/USD monthly chart above, September candlestick has painted black, completely destroying the emerging candlestick pattern, Hammer.

However, nothing disastrous has happened, as the low didn’t reach the new upward channel that has just started emerging (I marked it with green dots).

Moreover, BTC/USD ticker hasn’t broken through Keltner channel’s centre line, which was at 6153.9 USD, or the July’s low at 6079 USD.

Until the above levels are broken out, the scenario of the price moving inside the triangle is still likely and relevant.

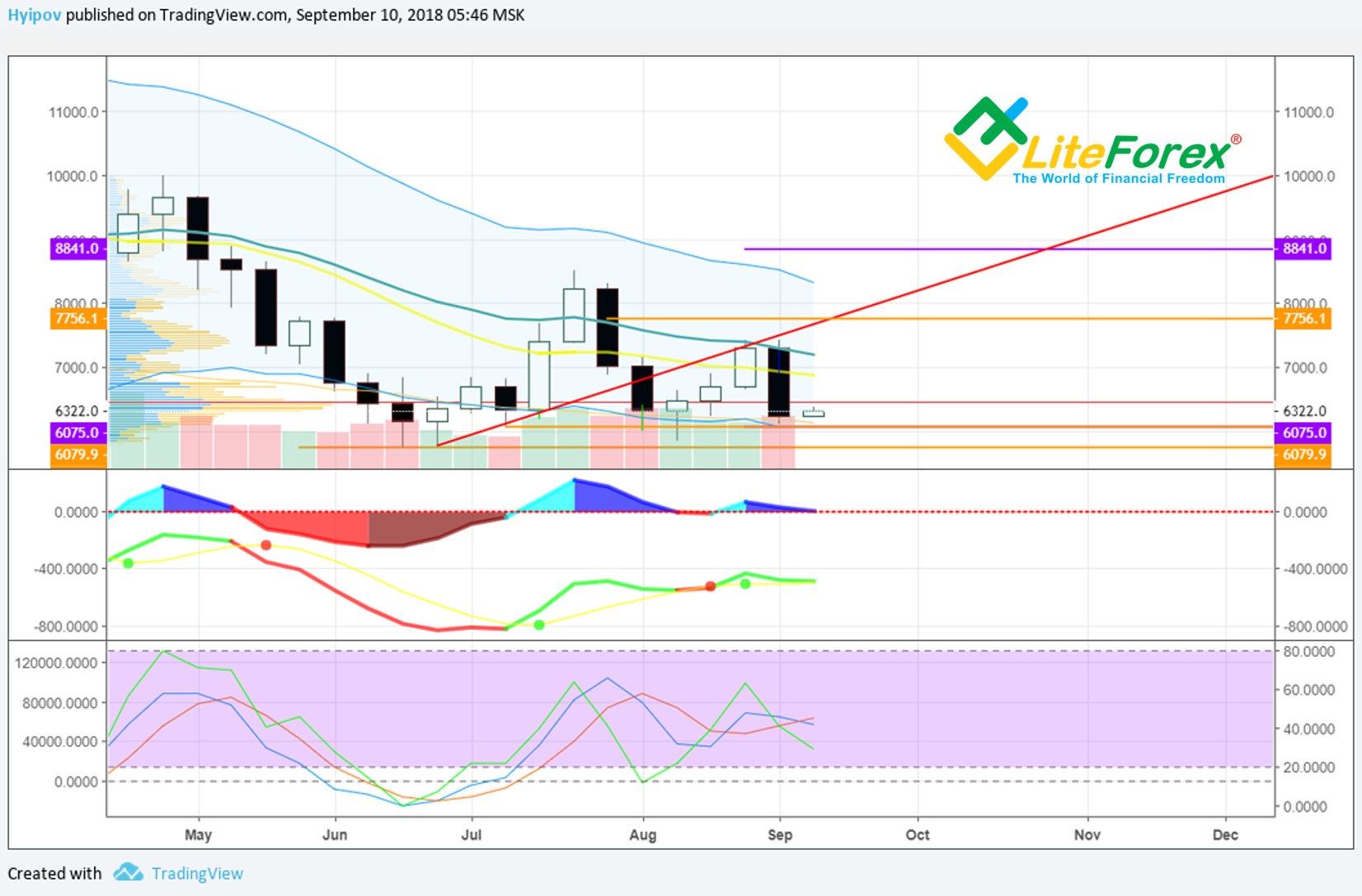

In BTC/USD weekly chart, you see that, despite the black engulfing candle of the previous week, oscillators are still sending no bearish signals.

MACD graphs are above zero level, MACD moving averages are still green.

RSI stochastic suggests uncertainty, even despite such a dramatic crash, occurred last week.

In Bitcoin daily chart above, it is clear that there is developing one of the suggested scenarios for the ticker’s movements within the month. A trend was going on during the shift from July to August. If the ticker consolidates and doesn’t go lower than the key level of 6075 USD, the market is likely to move in a slightly rising sideways trend.

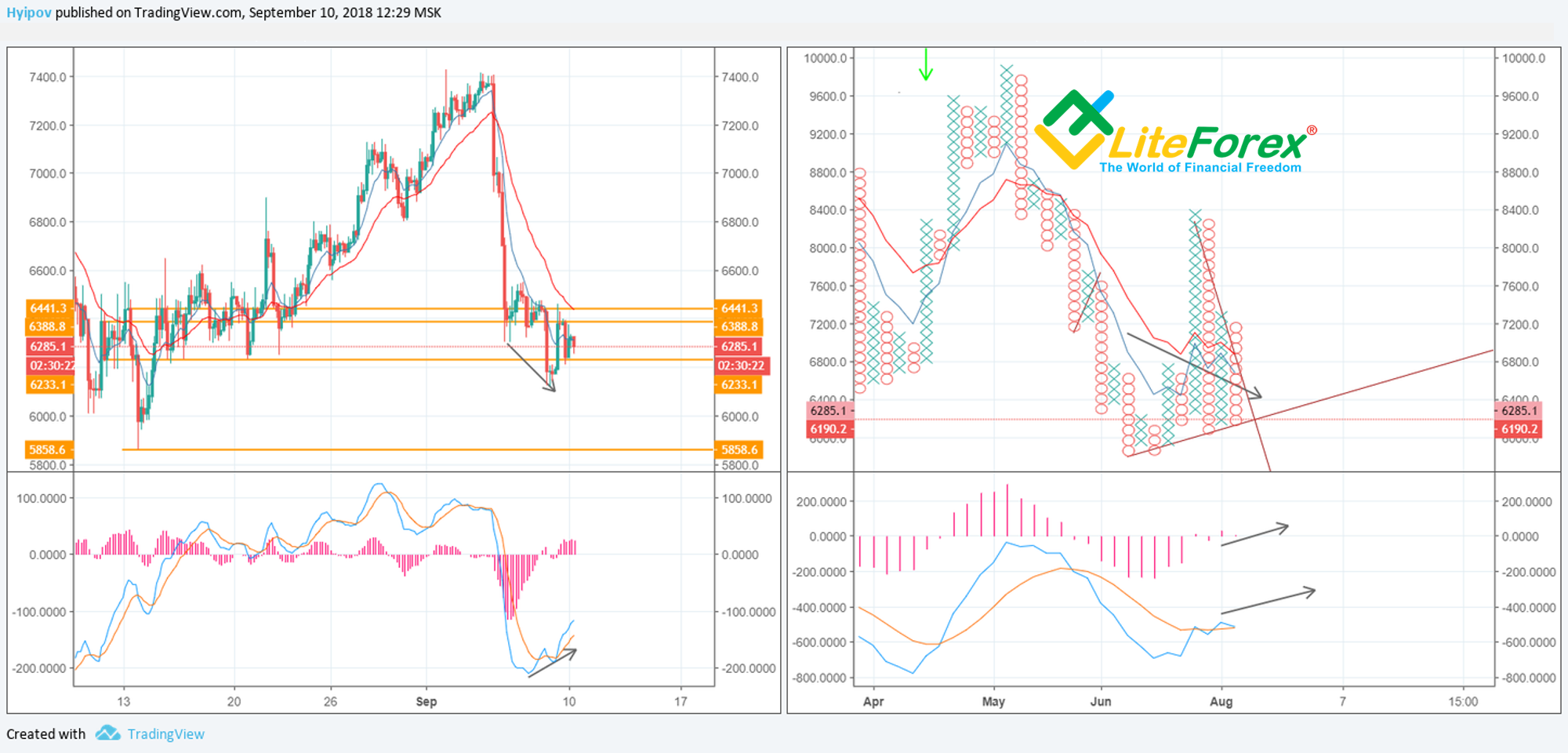

I’ll analyze BTC 4H timeframe as a part of my experiment with unusual charts. Today, I’m using the Tic-Tac-Toe chart.

As it is clear from the chart above, the BTC/USD four-hour chart shows quite a long period of the history, including the price movements over about six months; and the unit size is not more than 108 USD.

Nevertheless, this broad view suggests that the market has met a support from the upward trend, and the symmetric triangle pattern is now emerging.

I think that oppositely-directed signals, sent by MACD and the moving averages in the indicator window, are the features of the sideways trend.

The Japanese candlestick chart on the left proves the idea of the sideways trend development.

First of all, it is proved by MACD bullish convergence, and the fact that, despite such a dump, the ticker hasn’t broken through the key support levels.

As you see from Bitcoin price chart above, the last series of cycles created multiple support levels. Combined, they create a wide zone that sets bears back; it is between the levels of 6440 and 5755.

I’m sure manipulators will hardly break through this zone, unless there is any strongly negative fundamental news.

To sum up BTC/USD analysis:

This drawdown is obviously nothing else but an audacious manipulation, a try to shake all hamsters out and strengthen their positions. The plan has definitely failed; BTC/USD ticker stopped where it had been expected to. They couldn’t’t create a panic.

There are likely to be a few more tries to press Bitcoin price lower, but the multiple support levels won’t let them do it as easily as previously. Currently, I suggest that BTC/USD should move inside the symmetric triangle, supported by the triangle’s bottom leg at about 5935 USD (I marked it with green dots in the chart above).

I don’t think the ticker will move outside the formation even as a spike, at least during the next two weeks.

Unfortunately, above the ticker, there are also rather numerous resistance levels, like at 6400 and at 6700, and the triangle’s top leg, in the form of the downtrend.

Therefore, there is growing tension in the BTC/USD market, and so, in the entire cryptocurrency market; it will result in strong volatility and single price jumps for some altcoins.

That is my BTC/USD trading scenario for the next two weeks.