Bitcoin (BTC) was first released on Jan 3, 2009. It is the first cryptocurrency—and cryptoasset—to successfully use blockchain technology.

The primary purpose of Bitcoin as a means of exchange as yet to be fully realized. It is still often used for trading, investing, and as a store of value.

Between Mar 9 and 14, 2019 the price of Bitcoin was trading within a downward moving channel. This means that price losses have been gradual but steady during the five-day period. Currently, BTC is trading near the resistance line. moving within a generally upward trend. However, on Mar 12, the price of BTC broke down below the support.

In our Mar 14 price analysis of Bitcoin, we noted that prices may continue falling at a rate determined by this channel. However, with prices trading near the resistance, a breakout is possible. To better understand this, we analyzed BTC price data from Mar 12 to 14.

We found that the support and resistance lines during this period creating a symmetrical triangle rather than a parallel channel:

Based on this we predicted:

The price of BTC is likely to move inside the confines of the symmetrical triangle until a point of convergence occurs. Afterward, it is more likely that a breakout will occur.

Fundamental Analysis

Created by a mysterious figure known only by his pseudonym, Satoshi Nakamoto, Bitcoin (BTC) was designed to allow users to store and transfer value without requiring any intermediaries or centralized institutions such as banks.

Since its inception in 2009, Bitcoin was initially met with much adulation and has been praised for its potential to compete with VISA as a global payment option. However, several years later, Bitcoin was instead the subject of a great deal of scrutiny as its limited network capacity was made glaringly obvious while transaction fees rose to almost $40 during the December bull run.

This scrutiny was met with the Segregated Witness (SegWit) network upgrade, which activated on August 23, 2017, and greatly improved the capacity of the Bitcoin blockchain and improved its position against competing high-throughput blockchain technologies.

During the bear market, Bitcoin (BTC) has fallen less than any other top ten cryptos. Because of this, we at BeInCrypto expect BTC to maintain relative strength in this bear market — reaching a bottom of around $4,000 to close 2018, before seeing a rally back to $6,500 during 2019.

Bitcoin was one of the first blockchains to implement a second layer scaling solution, with the lightning network . The lightning network was widely regarded to be the second half of the solution to Bitcoin’s scaling issues that were first addressed with SegWit.

Being an open source protocol, anybody with the skills is able to contribute to Bitcoin’s development. Currently, over 350 developers have contributed to the development of Bitcoin — which is far lower than the 10,000 working on Ethereum.

Technical Analysis

While 2018 can be considered a bad year for cryptocurrencies, Bitcoin maintained relative strength — despite losing almost 80 percent of its market capitalization.

In the last 12 months, Bitcoin has suffered several blows as several BTC exchange traded fund (ETF) proposals were rejected by the U.S. Securities and Exchange Commission — knocking the BTC value significantly.

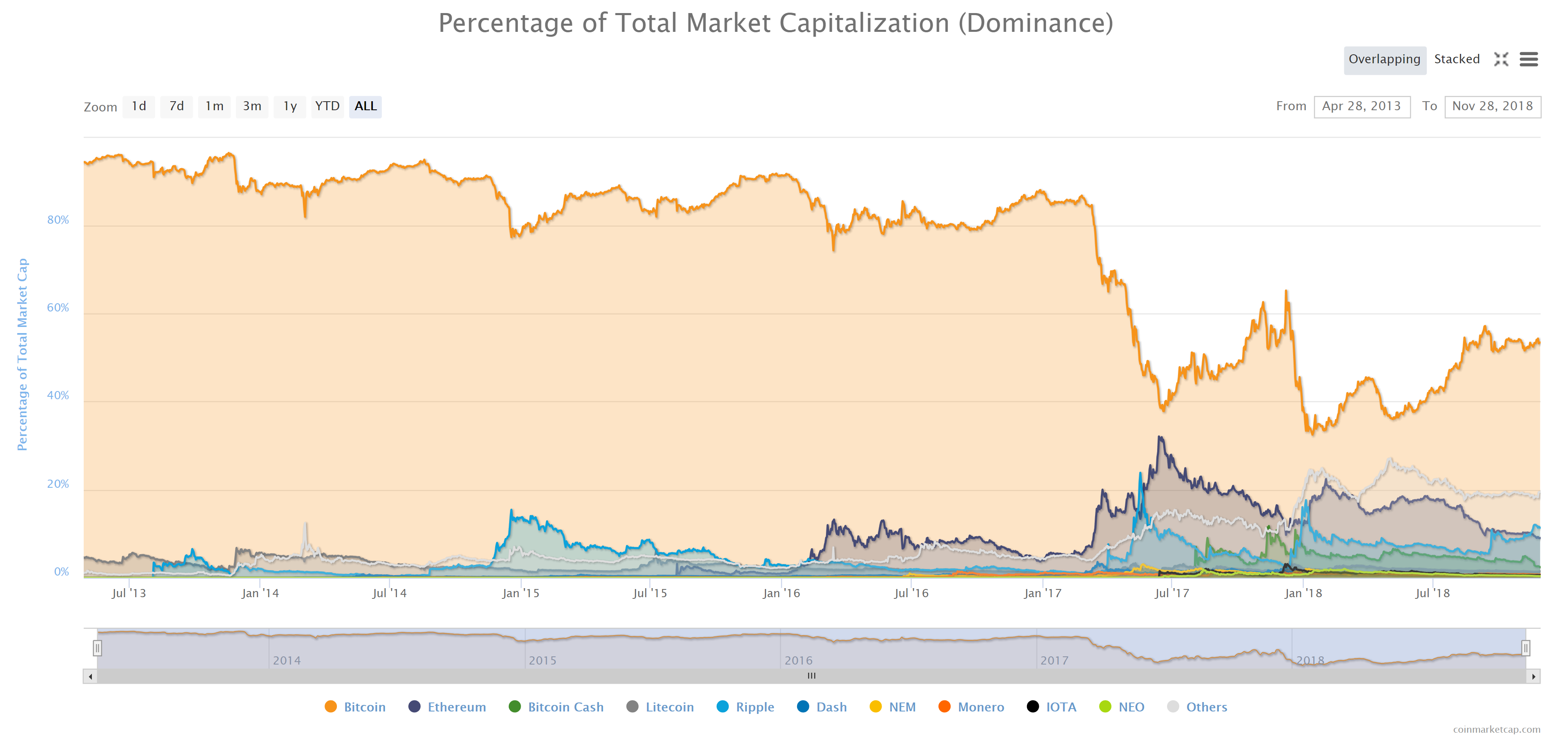

In 2017, the ICO boom saw many ERC20 tokens and new blockchains rapidly grow in value, many of which saw a greater return on investment than Bitcoin during the same period. During that time, Bitcoin’s market dominance gradually fell to as low as 32.5 percent — indicating investor interest favored altcoins.

However, since the beginning of 2018, attention has again switched back to Bitcoin, with its market dominance gradually increase throughout to year, maintaining above 50 percent for the last three months.

Just 21 million bitcoins will ever exist, producing a strong upward pressure on price as demand outstrips supply — particularly during bullish periods.

Specialists’ Perspective

With so much happening in the world of crypto lately, it is no surprise that just about every influencer has their take on the situation.

Last year, practically everybody was bullish — including John McAfee, who predicted that Bitcoin would reach $1,000,000 by 2020 while simultaneously putting himself in a bit of a situation if he is wrong.