Modestly geared global equity exposure

The Brunner Investment Trust, (BUT) is a global growth investment trust, managed by Allianz Global Investors (AGI). It aims to provide a cost-effective one-stop shop for investors seeking diversified global equity exposure and a good yield. The trust has a substantial allocation to the UK, which supports a yield (2.9%) above its peer group average (2.0%). The recent interim results suggest that BUT is on track to provide 42 years of uninterrupted dividend growth. As at 31 March 2013, and after payment of the interim dividend, BUT retained about two years of revenue reserves.

Investment strategy: UK and global quoted equities

BUT maintains both a UK and overseas portfolio with the equity assets split c 50/50. The portfolios are then managed bottom-up incorporating extensive fundamental research, with an initial investment horizon of a minimum three years. About 6% of the total portfolio, as at 30 September 2013, was held in UK government bonds to partially offset the gearing effect of BUT’s debentures, providing BUT with gearing of 6.1% net or 20.0% gross. The UK portfolio is further split c 80% between large-cap, dividend-paying defensive stocks and c 20% domestically oriented special situation stocks. Around 9.9% of the UK portfolio is currently invested outside of the FTSE 350.

Outlook: Sentiment improving, valuations average

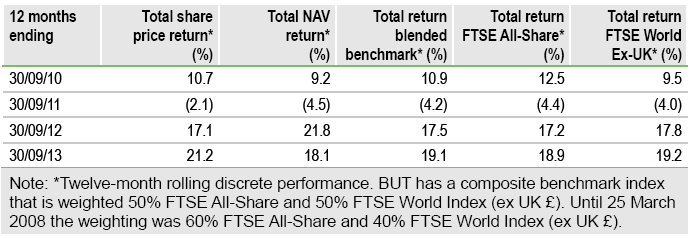

Despite recent market volatility, global equities have provided a very positive performance over the past year. The FTSE World Index has returned 20.1%, in sterling adjusted total return terms, while the MSCI World and FTSE All-Share have returned 21.5% and 18.9% respectively. There are signs that the economic backdrop is improving and, while considerable uncertainty remains, the managers expect global economic growth to remain positive, but with considerable variations across countries and regions. The manager remains focused on companies that are generating strong cash flows. The historic market P/E of the Datastream World Market Index, at 16.1x, is in line with long-run averages (see page 3).

Valuation: Discount in line with long-term averages

The cum-fair discount (currently 14.8%) has averaged 14.0%, 12.6% and 12.6% over one, three and five years respectively, and has traded in a range of between 10.2% and 18.0% during the last 12 months. BUT has the third-highest yield in its peer group (see page 8 for peer group comparison).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Brunner Investment Trust: Sentiment Improving, Valuations Average

Published 10/20/2013, 05:28 AM

Updated 07/09/2023, 06:31 AM

Brunner Investment Trust: Sentiment Improving, Valuations Average

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.