The Brunner Investment Trust (BUT) is a global growth investment trust. It was established in 1927 to manage the financial interests of the Brunner family, part founders of ICI. It has been managed by RCM, a company of Allianz Global Investors, and its predecessors since launch. BUT is jointly managed by Lucy Macdonald, who

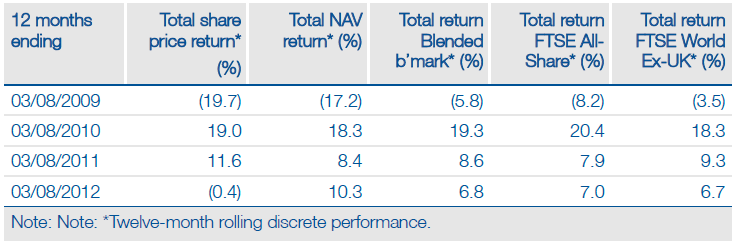

has managed the overseas portfolio since June 2005, and Jeremy Thomas, who has managed the UK portfolio by since July 2010. These managers have been refocusing the portfolio on a smaller number of high-conviction holdings, supported by RCM’s growing research platform. This process was completed in early 2011 and one-year NAV outperformance vs benchmark has also lifted the three-year performance. BUT has a 40-year record of uninterrupted dividend growth.

Investment strategy: Medium-term bottom-up stock picking

In managing the portfolio, the equity assets are split c 50/50 UK to international. Just under 12% of the portfolio is invested in UK government bonds to partially offset the gearing effect of BUT’s debentures. Equities are managed bottom up incorporating extensive fundamental research, with an initial investment horizon of a minimum three years. The trust employs moderate gearing (currently 7.9% net or 24.0% gross). The UK portfolio is further split 80% between large-cap, dividend-paying defensive stocks and 20% domestically oriented special situation investments. Around 4% of the UK portfolio is currently invested outside of the FTSE 350.

Sector outlook: Opportunity in uncertainty

In an uncertain economic environment the portfolio is constructed to be broadly beta neutral on an NAV basis. The managers expect global economic growth will remain positive but with considerable variations across countries and regions. Reflecting this, BUT has holdings in large well-financed businesses with good yields and the portfolio is also tilted towards industries with expected long-term growth potential. The managers are selectively positive on healthcare, technology, global travel and companies exposed to Asian/Emerging market growth. They like companies with a global reach, pricing power and strong corporate liquidity.

Valuation: Discount above long-term averages

The discount based on the fair value NAV, currently at 16.1%, is above its three- and five-year averages of 11.5% and 11.3% respectively. BUT offers the third-highest yield when compared to its peers.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Brunner Investment Trust Investment Trusts Review

Published 08/08/2012, 12:59 AM

Updated 07/09/2023, 06:31 AM

Brunner Investment Trust Investment Trusts Review

Broad global equity exposure

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.