Bruker Corporation (NASDAQ:BRKR) reported adjusted earnings per share (EPS) of 23 cents in the second quarter of 2017, up 15% from the year-ago figure. Adjusted EPS also beat the Zacks Consensus Estimate of 20 cents.

Excluding one-time adjustments, Bruker reported net income of $23.4 million or 15 cents per share in the second quarter, reflecting a 61.4% or 66.7% increase, respectively, from the year-ago quarter.

Revenues in Detail

Bruker reported revenues of $414.9 million in the second quarter, up 11.6% year over year. The top line surpassed the Zacks Consensus Estimate of $381 million. Excluding a 5.8% positive effect from acquisitions and a 1.8% negative effect from changes in foreign currency rates, Bruker reported a year-over-year organic revenue growth of 7.6% in the second quarter of 2017.

Geographically and currency adjusted, European revenues increased in the high single digits in the second quarter, backed by encouraging impacts of acquisitions. North America revenues increased in the low-single digits, led by growth in BEST along with the OST acquisition. In Asia Pacific, organic revenues rose by roughly 20%, driven by continued strong performance in China.

Per management, the company registered organic revenue growth based on mid-teens growth in CALID Group and strength in BEST.

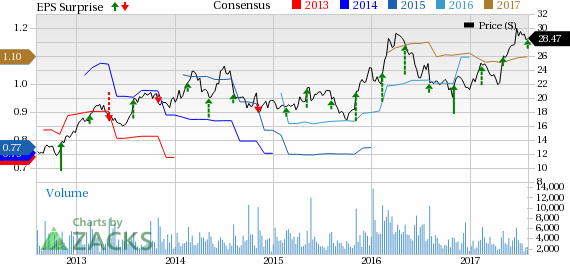

Bruker Corporation Price, Consensus and EPS Surprise

The Bruker BioSpin Group reported mid single-digit revenue growth, led by growing uptake of lower-field NMR (Nuclear magnetic resonance).

The Bruker NANO reported declining year-over-year organic revenues in the second quarter, mainly due to lower revenues from semiconductor metrology products.

The Bruker CALID Group reported a year-over-year mid-teens revenue growth in second-quarter 2017. The upside was largely driven by increased rapifleX revenue and strong performances in consumables and aftermarket service sales.

BEST revenues rose a substantial 43% organically on a year-over-year basis, backed higher MRI OEM consumer demand and the Bruker-OST acquisition in Nov 2016.

Margin Trend

Gross margin in the reported quarter contracted 150 basis points (bps) to 44.2%. According to the company, adjusted gross margin declined 100 bps to 46.6% led by robust revenue growth in lower margin BEST business further affected by the acquisition of OST which together had an adverse impact of roughly 200 bps. Moreover, the BioSpin business witnessed a drop in margins year over year due to the product mix.

Selling, general & administrative expenses increased 1.9% to $102.8 million and research and development expenses rose 10.06% to $40.7 million from the year-ago period. The other charges declined 46.7% year over year to $6.4 million. Overall, operating margin expanded 260 bps to 8.1%.

Financial Position

Bruker exited second-quarter 2017 with cash and cash equivalents and short-term investments of $44.3 million, down from 464.5 million at the end of the first quarter. Year-to-date net cash provided by operating activities was $15.4 million, compared with $4.1 million in the year-ago period.

2017 Guidance

Bruker provided an update to its guidance for full-year 2017.

Total revenue growth rate expectation for the year has been significantly raised to a new band of 4.5–6.0% from the earlier 2–3.5%. Moreover, organic revenue growth guidance has been raised to 1.5–2% from 1–2% previously with continued acquisition growth expectations at 3.5–4% (unchanged).

Changes in foreign currency rates are expected to have an adverse impact on revenues of approximately 0.5-0% marking an improvement from 2.5% projected previously. The current Zacks Consensus Estimate for 2017 revenues is pegged at $1.67 billion.

The company also expects 2017 adjusted operating margin increase of approximately 40–70 bps year over year, unchanged from the previous guidance. This includes an approximate 40-bps headwind in fiscal 2017 from the recent acquisitions.

On the bottom-line front, Bruker raised adjusted EPS projections to a new range of $1.08--$1.12 from $1.05–$1.09. The current Zacks Consensus Estimate for 2017 EPS is pegged at $1.10.

Our Take

Bruker exited the second quarter on a solid note, with both earnings and revenues beating the Zacks Consensus Estimate. The company also raised the full-year 2017 guidance, which is indicative of brighter prospects. Moving on, the company’s strategic acquisition activity has been encouraging. In this context, the company recently announced completion of acquisition of field-portable platform, a technology platform along with product line acquisition to widen its Bio-Detection offerings which encapsulates a range of bacterial, viral and toxin detection solutions for its homeland security and microbiology applications.

We are also upbeat about the company’s current focus on product development and the latest FDA approval for adding 144 new species to its MALDI Biotyper-CA system for efficient microbial identification.

On the flip side, currency fluctuations, competitive landscape and macroeconomic headwinds continue to pose challenges for the company.

Zacks Rank & Other Key Picks

Bruker currently carries a Zacks Rank #2 (Buy).

A few top-ranked medical stocks are Edwards Lifesciences Corporation (NYSE:EW) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) . Notably, Edwards Lifesciences, INSYS Therapeutics and Align Technology sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

INSYS Therapeutics has a long-term expected earnings growth rate of 20%. The stock posted a stellar four-quarter average earnings surprise of 37.8%.

Align Technology has an expected long-term adjusted earnings growth of almost 26.6%. The stock has added roughly 23.5% over the last three months.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. The stock has gained around 5.3% over the last three months.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Bruker Corporation (BRKR): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post